In its latest market note, 10x Research is sounding the alarm that smart money may have already sold the top of this Bitcoin cycle, and is urging traders to closely examine on-chain signals before the next move unfolds.

The firm, led by former Credit Suisse strategist Markus Thielen, has built a reputation for calling major market turning points. Back in late 2022, 10x Research correctly identified the Bitcoin bear market bottom during a regional tour across Hong Kong, Singapore, Vietnam, and Thailand, while most Wall Street economists were still forecasting persistent inflation and a looming U.S. recession.

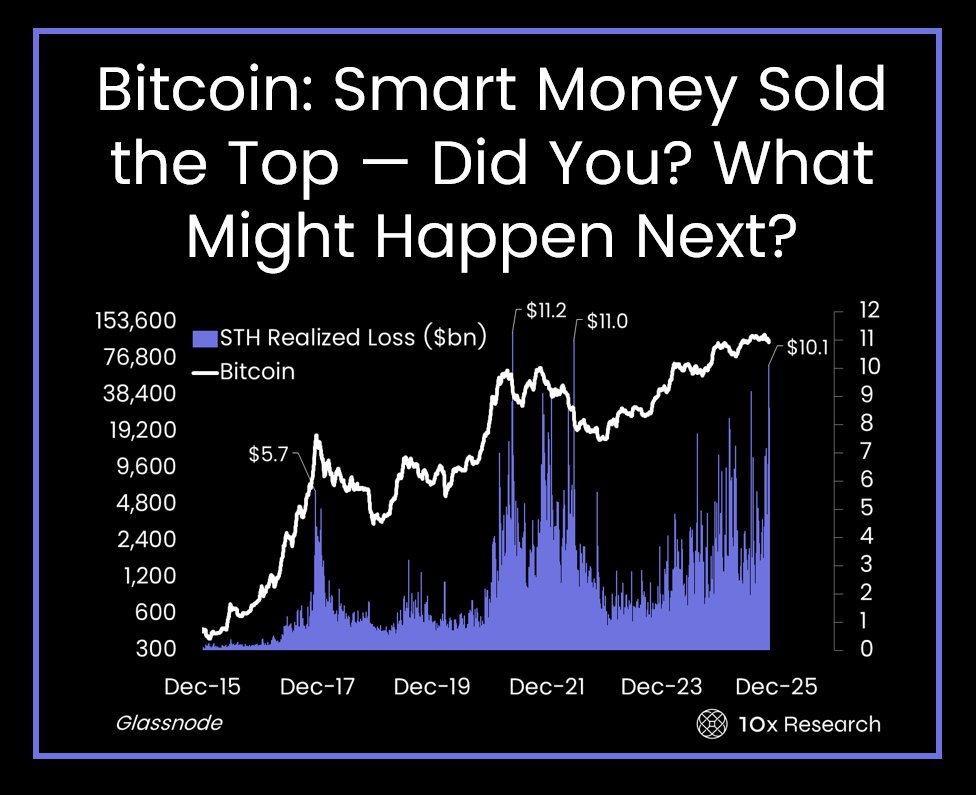

Now, nearly three years later, the firm is once again pointing to what it calls a “subtle but significant shift” in market structure, one that could mark a potential macro top in the current cycle.

Spotting a Top Is Harder Than Finding a Bottom

In the note, 10x Research emphasizes that market tops rarely announce themselves. While fear defines bottoms, euphoria defines peaks. “Calling tops is far more difficult,” the firm wrote, noting that these moments are often “crowded with noise” as sentiment turns overwhelmingly bullish.

Still, the firm says clear indicators do exist. Using on-chain data and technical triggers, 10x Research tracks how Bitcoin historically behaves when key price thresholds are breached. Several of those “trigger zones,” the firm explained, have recently been hit, a pattern that historically precedes larger corrections.

A Call to Data-Driven Discipline

The firm stopped short of giving a direct forecast, instead encouraging readers to analyze the data themselves. “Want to know what might happen next? See the data, judge for yourself, our charts and analytics give you the clarity the market doesn’t,” the note concluded.

Whether this proves to be another defining moment for 10x Research, or just another pause in Bitcoin’s ongoing cycle, remains to be seen. But for now, their message is clear: the smart money may already be one step ahead.