Bitcoin Dominance Weakens as Altcoin Season Nears, Analyst Warns

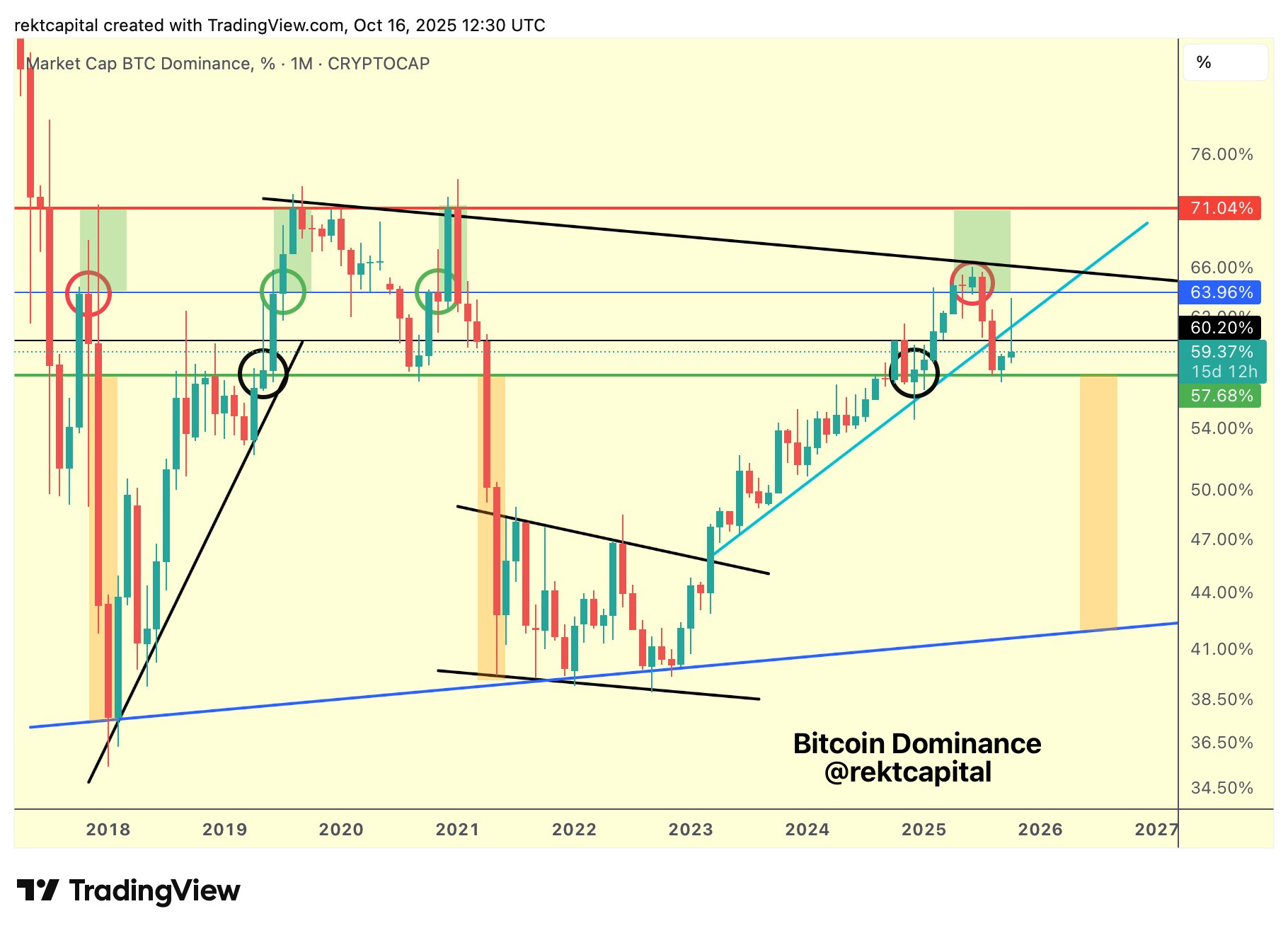

According to technical analyst Rekt Capital, Bitcoin Dominance has officially lost its long-term uptrend, turning key support levels into new resistance zones. The breakdown, highlighted on his latest TradingView chart, shows that both the former uptrend and the 60% dominance level have now flipped into resistance.

Even the 64% area, which previously supported Bitcoin’s dominance during its bull phase, is now acting as an upper ceiling.

This shift, Rekt Capital suggests, validates the start of a broader downtrend in Bitcoin’s market share. The analyst notes that if Bitcoin Dominance continues to struggle below these resistance zones, the market could see a strong rotation toward altcoins.

“The 57.68% level remains the key line in the sand,” Rekt Capital wrote on X. “Losing that green support could be the trigger for a major Altseason.”

Recent market data appears to align with this outlook. Bitcoin is trading around $111,300 after recovering slightly from last week’s sell-off, but momentum indicators show waning strength. The daily Relative Strength Index (RSI) sits near 40, reflecting neutral-to-weak momentum, while the MACD is showing early signs of bearish crossover. These technical signals suggest that Bitcoin might face difficulty reclaiming higher levels in the short term.

If dominance continues to slide, capital could flow into altcoins like Ethereum, Solana, and BNB, which historically outperform during Bitcoin consolidation phases. Analysts often associate such shifts with renewed speculative interest and higher trading activity in the broader market.

While Bitcoin remains near the $110,000 mark, the dominance chart’s behavior implies that investors may soon begin diversifying away from BTC, seeking higher returns in smaller-cap assets. Historically, such periods have led to explosive rallies across the altcoin market.