Key Market Indicators

Bitcoin has stabilized within the $94,000 to $100,000 range, indicating a moderation in sell-side pressure. This price range suggests that potential buyers may begin to assess its value, hinting at a possible period of consolidation for the cryptocurrency.

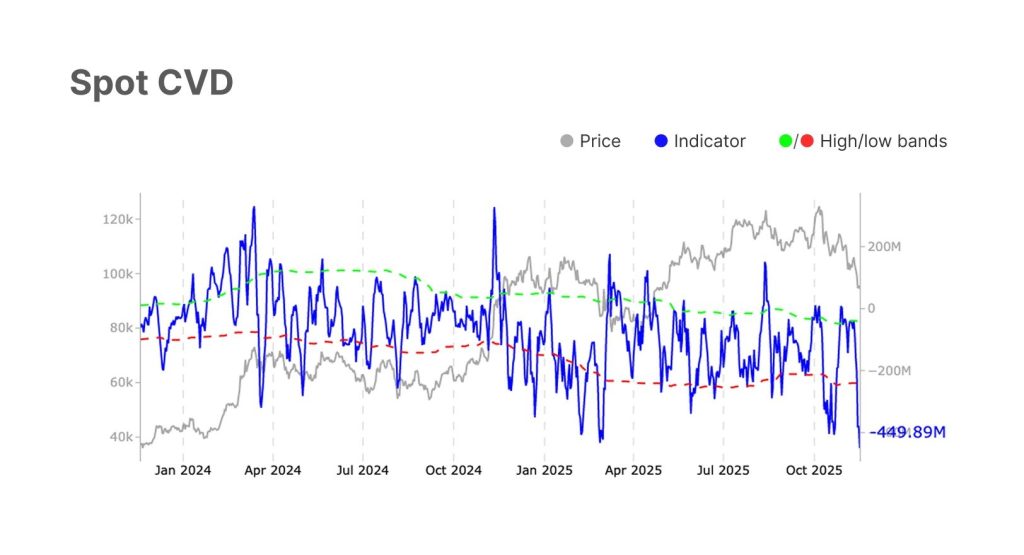

The 14-day Relative Strength Index (RSI) remains in oversold territory, signaling sustained downward pressure on momentum. Concurrently, both Futures CVD (Cumulative Volume Delta) and Perpetual CVD have dropped to extreme negative levels, confirming a strong dominance of selling activity in the market.

In the spot market, trading volumes have seen a decline, and Bitcoin Exchange-Traded Fund (ETF) outflows have moderated. This shift suggests that aggressive selling may be transitioning into a more measured repositioning phase by market participants.

On-Chain Metrics and Whale Activity

On-chain activity has softened, with declines observed in transfer volumes and fee revenues. Profitability metrics have also weakened, signaling increased caution in the market, particularly with a rise in short-term holder losses.

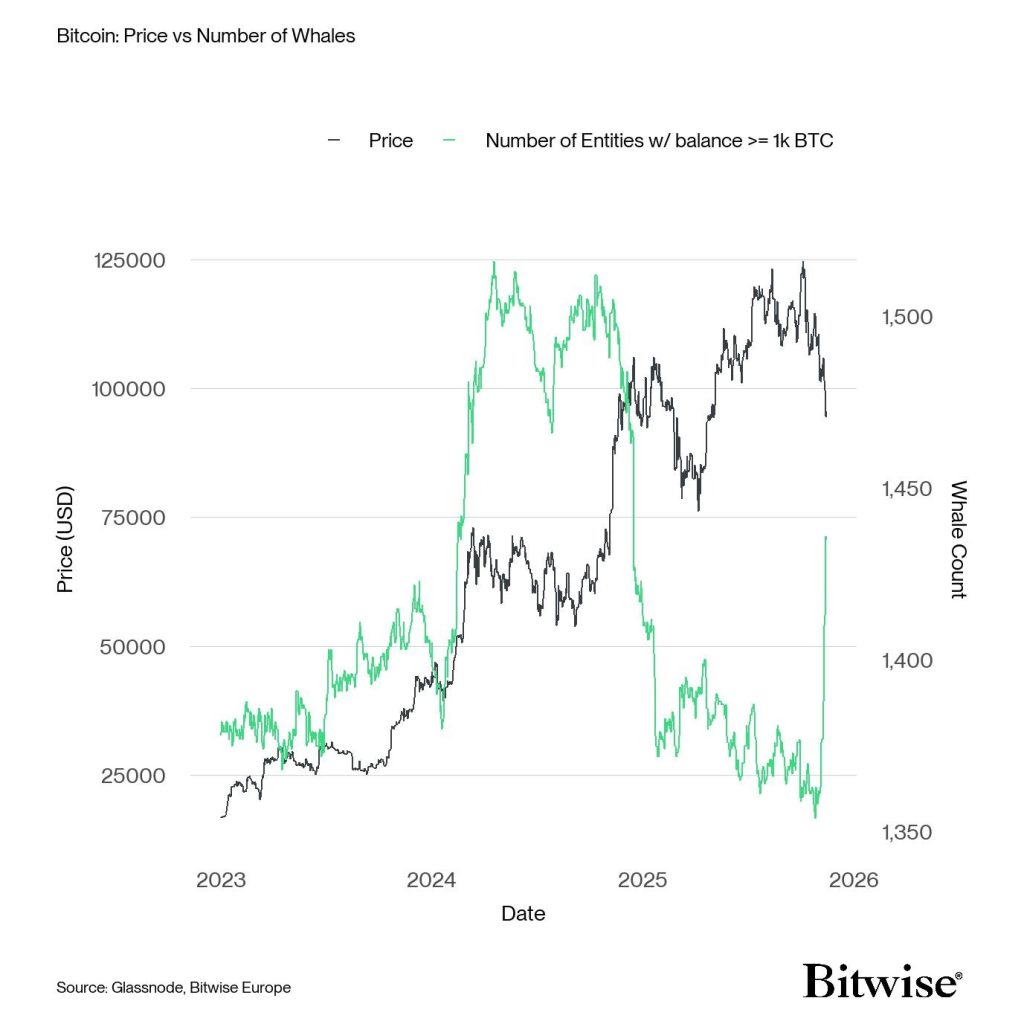

Despite these challenges, the emergence of exhaustion signals could indicate the formation of a local bottom around the $94,000 to $100,000 range. Notably, whale activity has surged, with the number of entities holding over 1,000 Bitcoin reaching a new high since early 2024.

This surge in whale activity suggests that large holders are actively capitalizing on the recent price dips. Historically, such behavior has been interpreted as a signal of bullish sentiment, which aligns with the current period of volatility and the potential for a future price increase.

Bitcoin's recent volatility is underscored by a significant 11.23% drop over the past week. However, despite this decline, market conditions are showing signs of stabilization as sell-side pressure begins to ease.