Bitcoin exchange-traded funds (ETFs) have experienced consistent outflows for six consecutive days, with approximately $137 million withdrawn on November 5, 2025. This ongoing trend has brought the total outflows during this period to over $2.05 billion, as Bitcoin (BTC) struggles to maintain its position above the $103,000 level.

The period of withdrawals commenced on October 29, shortly after Bitcoin's price declined below $110,000. Selling pressure has been building across the market, contributing to this sustained downtrend. At the time of this report, the cryptocurrency is trading at $102,429, a significant distance from its all-time high (ATH) of $126,198, which was achieved early last month.

Reduced Buyer Interest and Increased Withdrawals

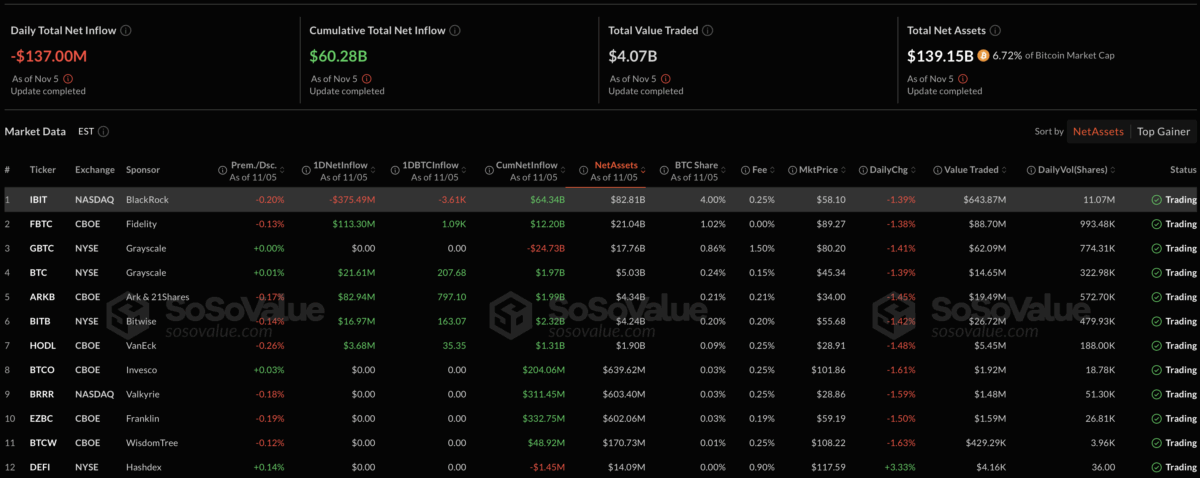

Consequently, trading activity has diminished across the market, with only half of the twelve Bitcoin ETF issuers recording any transactions on the specified day. Among those that did experience inflows, Fidelity’s FBTC led with $113 million, and Ark & 21Shares’ ARKB added $83 million.

Grayscale, Bitwise, and VanEck also reported modest gains. However, these inflows were insufficient to offset the substantial withdrawal from BlackRock’s iShares Bitcoin Trust (IBIT), which saw a decrease of approximately $375 million. This single fund accounted for the majority of the day's total outflows.

Bitcoin Experiences a 5% Weekly Decline

In the past week, BTC has seen a 5% decrease in value. At one point, the cryptocurrency fell to $98,000 before experiencing a slight recovery above the $100,000 mark. Despite this rebound, market participants have not yet shown enough confidence to alter the current market momentum.

Currently, traders are adopting a cautious stance, awaiting confirmation before re-entering the market. Approximately $323 million has been liquidated from the market within the last 24 hours, with $61.26 million of that total originating from traders who had bet on Bitcoin's price increase.

Many traders are closely monitoring the $106,000 level, which has transitioned from a support zone to a significant resistance barrier. There is a sentiment that Bitcoin could fall below $100,000 again if buyer interest does not resurface soon.

Data from the Deribit exchange indicates that some traders are positioning for a potential decline to $80,000. The open interest in Bitcoin options has exceeded $40 billion. Deribit observed a "notable surge in put options positioned near the $80,000 mark," suggesting an increased number of investors are hedging against further losses. The exchange, which handles over 80% of global crypto options trading, reported that the $80,000 and $90,000 put options have open interest exceeding $1 billion and $1.9 billion, respectively.

Macroeconomic Factors Exacerbate Market Pressure

Market observers, including Singapore-based QCP Capital, attribute the current sell-off to macroeconomic pressures and recent statements from Federal Reserve Chair Jerome Powell. These factors have reportedly diminished interest in Bitcoin ETFs.

"Macro pressure filtered directly into crypto via four consecutive sessions of roughly $1.3 billion in net outflows from U.S. spot Bitcoin ETFs," QCP Capital stated in a market update.

According to Ecoinometrics, the risk of a feedback loop is intensifying. This scenario involves ETF outflows driving prices lower, which in turn leads to further outflows. Bitcoin has now experienced a decline of more than 18% since reaching its all-time high, leaving the market in search of stability amidst growing uncertainty.