Key Insights

- •The US Spot Bitcoin ETF has recorded an outflow of over $903 million on Thursday.

- •BlackRock Bitcoin ETF has recorded its highest weekly outflow over the past four sessions.

- •Bitcoin price slipped 10% to $82k, with analysts highlighting a key support level to watch ahead.

US Spot Bitcoin ETF Sees Significant Outflow

The US Spot Bitcoin ETF experienced a substantial outflow on November 20, marking its second-highest outflow since its launch. This selloff occurred as Bitcoin price faced considerable selling pressure, declining by approximately 10% in value over the past 24 hours. The recent drop in BTC's price may be attributed to ongoing selling pressure from institutional investors. Additionally, reports indicate that large holders, often referred to as whales, are aggressively selling their holdings, further dampening broader market sentiment.

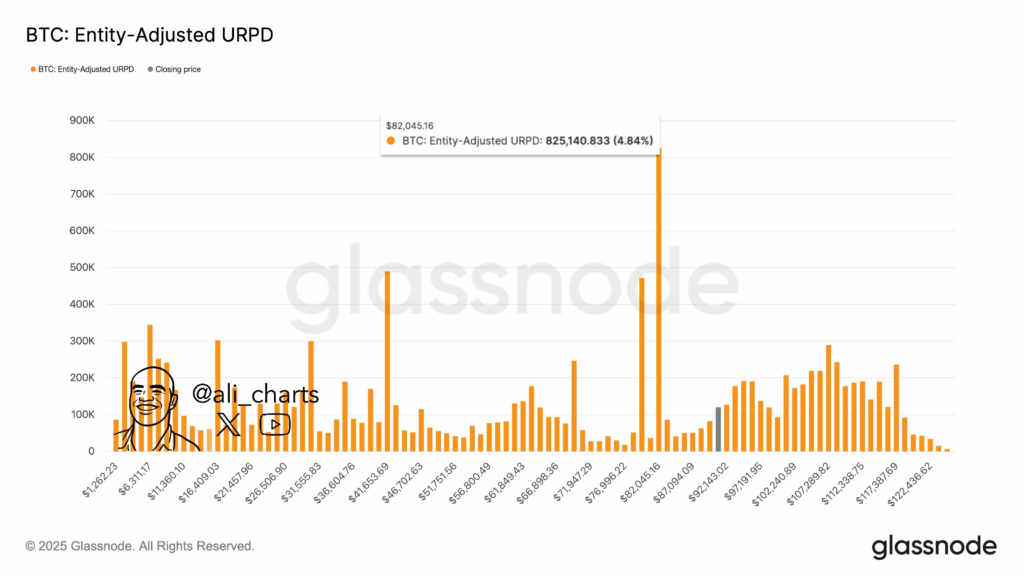

It is noteworthy that the BlackRock Bitcoin ETF has recorded its highest weekly outflow across the first four days of the current week. This trend suggests a significant selling spree among institutions, reflecting a waning appetite for risk among major market players. As the Bitcoin USD price fell below the $82,000 mark today, projections of a further decline are gaining momentum. The $82,000 level represents a critical support for BTC, and a breach of this level could intensify selling pressure in the market.

US Spot Bitcoin ETF Experiences Record Outflow

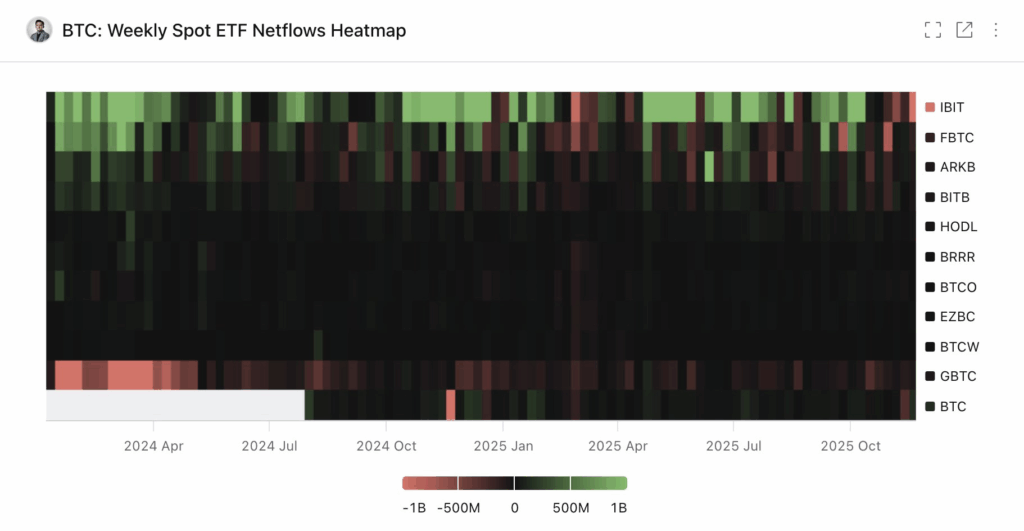

According to data from Farside Investors, the US Spot Bitcoin ETF recorded an outflow of $903.2 million on Thursday, November 20. This figure represents the second-highest single-day outflow for the investment instrument, surpassed only by the $1.11 billion outflow recorded on February 25, 2025. BlackRock's Bitcoin ETF (IBIT) was the largest contributor to the negative fund flow on Thursday, with an outflow of $355.5 million. Following closely were Grayscale's GBTC and Fidelity's FBTC, with outflows of $199.4 million and $190.4 million, respectively.

Over the past four days of the week, the US Spot Bitcoin ETF has collectively seen an outflow of $1.45 billion. A slight inflow of $75.4 million was observed only on November 19. CryptoQuant CEO Ki Young Ju also highlighted the declining institutional interest. He further noted that the BlackRock Bitcoin ETF has experienced its highest weekly outflow over the last four trading sessions. From November 17 to 20, the combined outflow for IBIT amounted to $1.02 billion. These negative fund flow trends have contributed to dampened broader market sentiment and the recent losses in the cryptocurrency market.

What's Next for Bitcoin Price?

In recent Bitcoin news, the BTC price has declined by nearly 10% of its value, dropping to as low as $81,653 in the last 24 hours. At the time of writing, it had experienced a slight recovery and was trading near $83,000. Bitcoin's trading volume increased by 50% yesterday, reaching $121 billion, which suggests heightened selling pressure in the market. Furthermore, the Bitcoin price has decreased by approximately 14% over the past week and around 23% on the monthly chart. This decline aligns with the waning institutional interest, as evidenced by the significant outflow from the US Spot Bitcoin ETF.

The broader cryptocurrency market sentiment is currently in the "extreme fear" zone, with the fear and greed index reading at 11. Amid this environment, analyst Ali Martinez has indicated that Bitcoin price has a major support level at $82,000. If the BTC price falls below this support, it could experience another correction, potentially driving its price down to the next significant support level at $77,000. Considering these factors and the heightened volatility in the market, investors are advised to exercise due diligence when making investment decisions.