Key Insights

- •The US Spot Bitcoin ETF experienced an outflow of $88 million this week, with BlackRock's IBIT being a significant contributor.

- •Analysts suggest that the BTC USD price could fall to $80,000 if it drops below the $87,000 level.

- •Bitcoin miners have realized profits following the BTC price recovery to $94,000 earlier this week.

Bitcoin ETF Outflow Sparks Trader Concern

The US Spot Bitcoin ETF has captured the attention of traders with its latest fund flows, indicating a potential shift in investor sentiment. Despite an inflow recorded on December 5th, the weekly fund flow for the investment instrument remained negative. This comes as the BTC price experienced a notable slump to $84,000 this week, following a prior recovery to $94,000. This volatile price action has caused unease among traders, prompting evaluations of the underlying reasons for the dip in BTC USD price.

While the negative fund flow into the US Spot Bitcoin ETF could be a contributing factor, the magnitude of the outflow is not considered exceptionally large. However, continuous selling pressure from BlackRock's IBIT may have fueled concerns among market participants. Additionally, recent reports indicate that Bitcoin miners have been booking profits as the BTC USD price recovered earlier in the week. This profit-taking activity might have also contributed to selling pressure in the market, influencing the Bitcoin price to trade in negative territory.

The surge in BTC USD price to $126,000 in early October had previously boosted broader market sentiment, with expectations of a continued rally towards $200,000 by year-end. However, a subsequent crash from October 10th, reportedly triggered by tariff concerns, has ignited intense debate regarding the asset's future potential. Amidst these developments, institutions appear to be diversifying their focus from Bitcoin to the altcoin segment. A number of altcoin ETFs have received approval from US regulators and have consistently witnessed significant inflows since their launch.

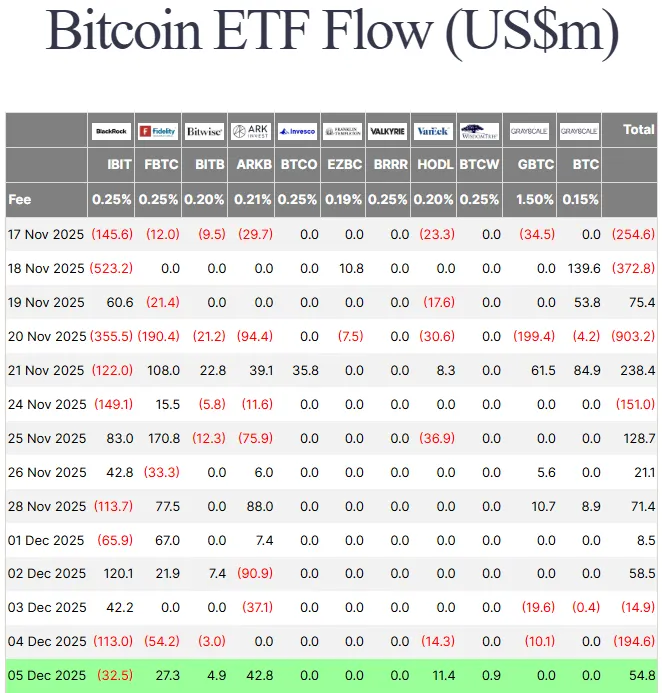

Conversely, data from Farside Investors suggests a potential waning of sentiment for the flagship cryptocurrency. The US Spot Bitcoin ETF has recorded a weekly outflow totaling $87.7 million, despite experiencing inflows on three out of the five trading sessions. On December 5th, the investment instrument saw an inflow of $54.8 million, with Ark Invest's ARKB contributing significantly with a $42.8 million influx. However, BlackRock's Bitcoin ETF (IBIT) experienced outflows of $113 million and $32.5 million in the preceding two sessions, respectively.

These outflows have intensified discussions regarding their potential impact on the BTC USD price. Furthermore, numerous experts have issued warnings about a possible continuing decline, prompting renewed speculation about Bitcoin's price trajectory by the end of 2025.

Analyst Forecasts Potential Drop to $79K Amidst Miner Profit-Taking

In light of the ongoing outflows from the US Spot Bitcoin ETF, market analysts have shared crucial insights concerning the future potential of Bitcoin. In a recent post on X, analyst Michael van de Poppe indicated that the BTC USD price needs to reclaim the $92,000 mark to sustain its upward momentum. He also highlighted $88,000 as a critical level to monitor for the asset. At the time of reporting, Bitcoin was trading approximately 2% lower, changing hands at $89,600.

Van de Poppe's analysis, presented in a BTC price chart, suggests that $87,000 represents the final significant support level for Bitcoin. According to the chart, failure to maintain this $87,000 support could lead to a sharp decline, potentially reaching $80,000 or even lower.

Concurrently, analyst Ali Martinez noted that the recovery to $94,000 earlier this week enabled Bitcoin miners to realize profits. His data indicates that BTC miners have cashed out approximately $4.3 million in profits following the recent BTC USD price rebound.

Considering these developments, investors are closely observing the fund flows of the Bitcoin ETF. Market participants are also monitoring whether the cryptocurrency can maintain its hold above the $87,000 support level to avert a further significant price crash in the immediate future.