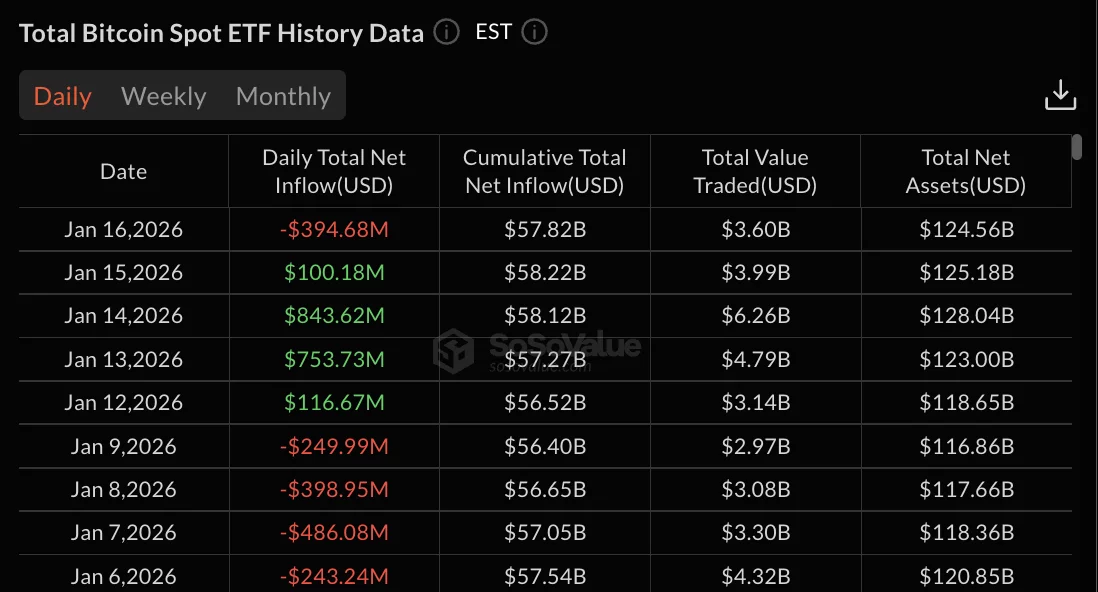

Bitcoin ETFs recorded $394.68 million in net outflows on January 16, marking the end of a four-day inflow streak that had brought $1.81 billion into the funds.

Ethereum spot ETFs attracted $4.64 million in net inflows on January 16, extending a streak of positive flows to five consecutive trading days. This recent streak, beginning January 12, has collectively brought $478.04 million into Ethereum products.

Total net assets under management for Bitcoin ETFs decreased to $124.56 billion from $125.18 billion on the previous day. In contrast, Ethereum ETF assets saw an increase, climbing to $20.42 billion.

BlackRock’s IBIT was the only Bitcoin ETF to record inflows on January 16, with $15.09 million. Fidelity’s FBTC led the redemptions, experiencing $205.22 million in withdrawals.

Bitcoin ETFs Experience Reversal After Strong Inflow Period

Bitcoin ETFs initially faced selling pressure at the start of January, with outflows totaling $1.38 billion from January 6 through January 9. This trend reversed on January 12 with $116.67 million in inflows, initiating the strongest week of inflows for 2026.

On January 13, net inflows reached $753.73 million. The following day, January 14, recorded the largest single-day inflow total at $843.62 million. January 15 added another $100.18 million in inflows before the reversal observed on January 16. This four-day period of positive inflows had largely offset the redemption wave experienced in early January.

Fidelity’s FBTC was responsible for 52% of the January 16 outflows, amounting to $205.22 million. Bitwise’s BITB saw withdrawals of $90.38 million, while Ark & 21Shares’ ARKB experienced $69.42 million in redemptions. Grayscale’s GBTC recorded outflows of $44.76 million.

Several other Bitcoin ETFs, including Grayscale’s mini BTC trust, VanEck’s HODL, Invesco’s BTCO, Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI, reported zero flows on January 16.

The total value traded on January 16 reached $3.60 billion, a decrease from $3.99 billion the previous day. The cumulative total net inflow for Bitcoin ETFs dropped to $57.82 billion from $58.22 billion, as the single-day outflows counteracted recent gains.

Ethereum ETFs Maintain Momentum with Five Consecutive Days of Inflows

Ethereum ETF inflows commenced on January 12 with $5.04 million, and this positive trend accelerated through the middle of the week. January 13 saw inflows of $129.99 million, followed by $175.00 million on January 14 and $164.37 million on January 15.

The net inflows on January 16, totaling $4.64 million, represented the weakest day within this streak but maintained the positive momentum. Total net assets for Ethereum ETFs increased from $18.88 billion on January 12 to $20.42 billion on January 16.

The cumulative total net inflow for Ethereum ETFs reached $12.91 billion, recovering from outflow pressures experienced in December. The total value traded for Ethereum ETFs on January 16 was $1.19 billion.

The contrasting performance between Bitcoin and Ethereum ETF flows suggests a pattern of selective institutional buying rather than a broad-based redemption across all crypto-related products. XRP spot ETFs recorded $1.12 million in net inflows on January 16, while Solana spot ETFs experienced $2.22 million in outflows.