The Federal Reserve’s final meeting of 2025 commenced on Tuesday, December 9th. The central bank is widely expected to announce its last monetary policy decision of the year at 2:00 p.m. ET on Wednesday.

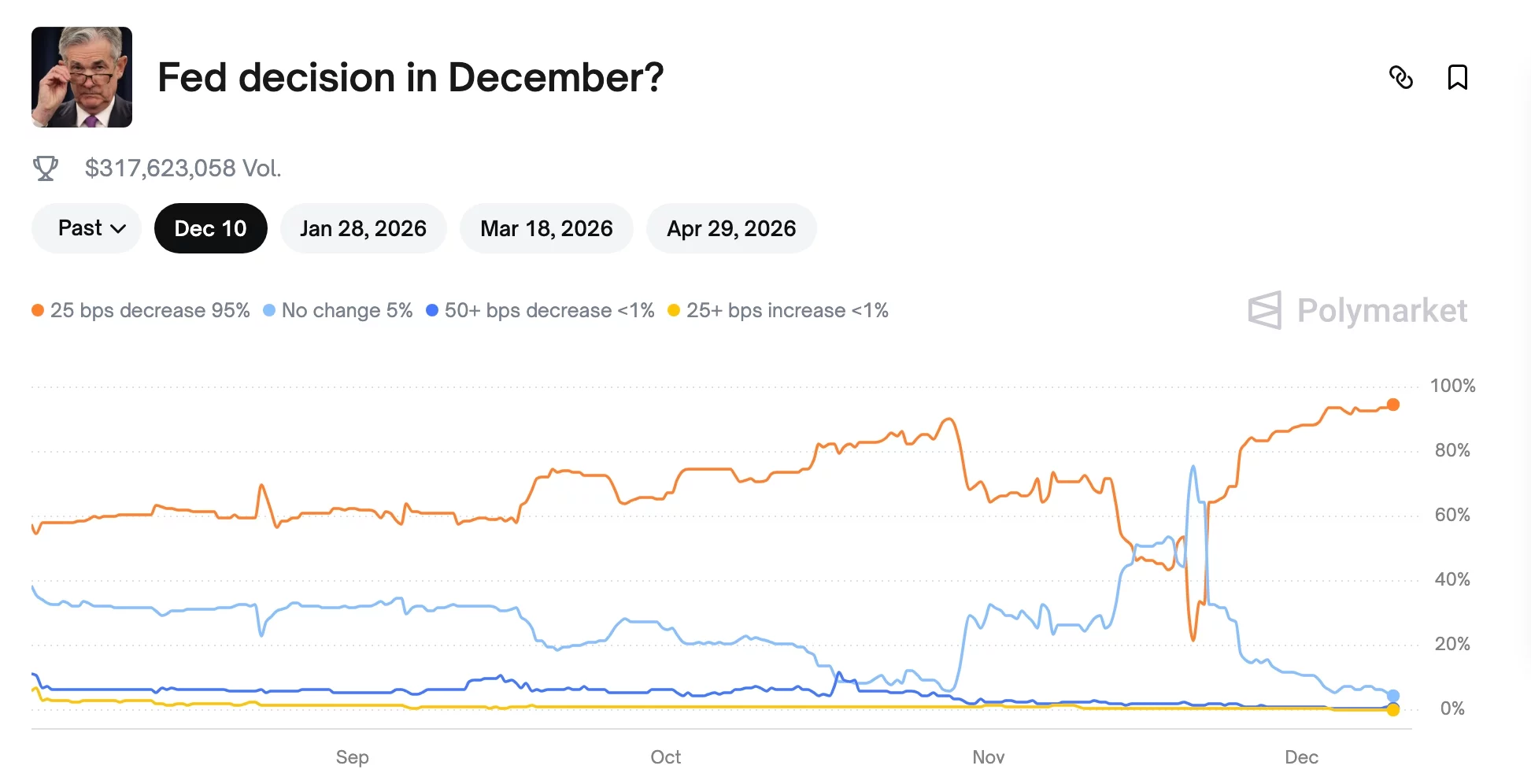

Investors are anticipating a 0.25% rate cut, which would mark the third reduction of 2025. Data from the CME Group indicates a 90% probability of this outcome. Market participants on Polymarket also lean towards a 0.25% rate reduction, with ongoing concerns about the labor market contributing to this expectation.

Historically, Bitcoin has tended to react positively to rate cuts. Lower interest rates make non-yielding assets like cryptocurrencies more attractive and can often weaken the U.S. dollar.

However, recent market reactions to rate cuts in 2025 have been more varied. Some instances saw initial dips in Bitcoin and other assets following rate changes. This suggests that investors are increasingly focusing on the Federal Reserve's communications, particularly the tone of Chair Jerome Powell's statements, and broader liquidity conditions, rather than solely on the rate change itself.

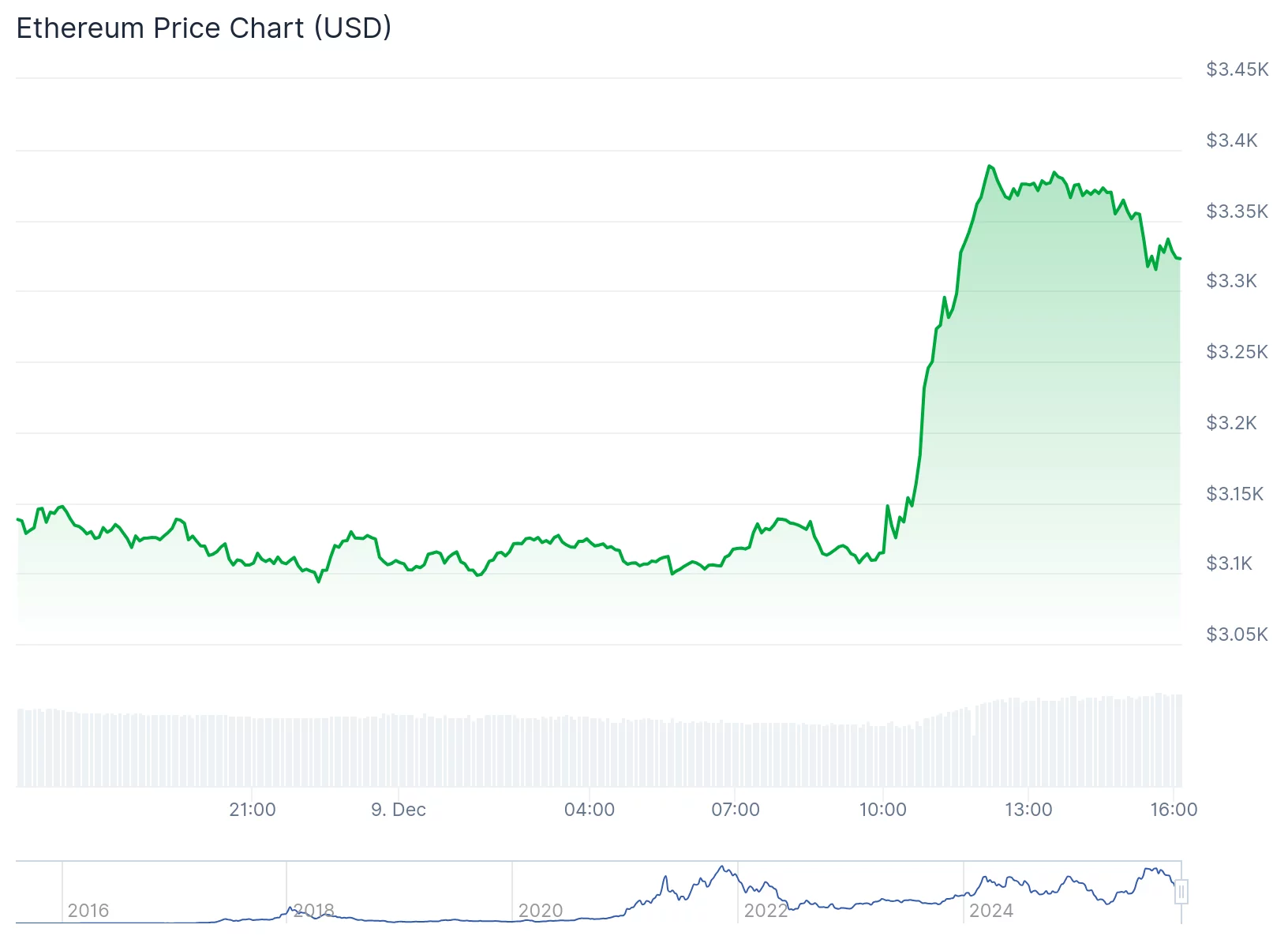

Despite the prevailing volatility, both Bitcoin and Ethereum were showing positive movement at the last check. Analysts predict that further rate cuts anticipated in late 2025 or early 2026 could potentially lead to market rallies, even amidst current turbulence.

At last check on Tuesday, around 4 p.m. EST, Bitcoin was up approximately 2.6% for the day, while Ethereum had risen by about 6%. In contrast, many altcoins were trading in the red as of midday Tuesday.

Stablecoin Outflows Indicate Risk-Off Sentiment

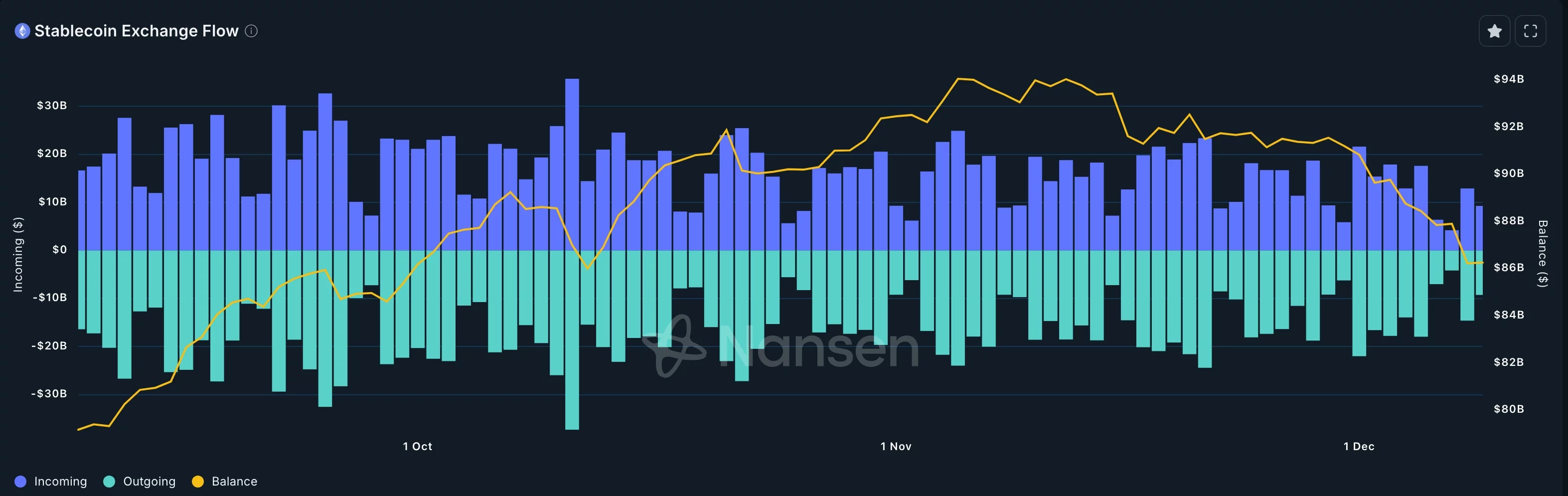

Data compiled by Nansen reveals a significant drop in the balance of stablecoins held on exchanges, now standing at $86 billion. This marks the lowest level since October, following a decline from a peak of $94 billion on November 6th. This trend suggests that investors have adopted a risk-off sentiment.

These stablecoin trends have coincided with a period of market deleveraging. Data from CoinGlass indicates that the futures open interest has decreased by 0.3% in the last 24 hours, settling at $130 billion.

A decline in futures open interest coupled with a flattened funding rate are indicators of weakening demand within the futures market, which has recently been a dominant force in the crypto trading landscape.

Federal Reserve Interest Rate Decision Looms

There is a possibility that Bitcoin and other altcoins could experience a price drop following the rate cut for three primary reasons:

- •First, the anticipated interest rate cut has likely already been priced into market expectations. Consequently, investors may engage in "sell the news" trading, offloading assets after the announcement.

- •Second, the Federal Reserve might deliver a hawkish interest rate cut. This would involve signaling an intention to maintain stable interest rates for an extended period while closely monitoring incoming economic data.

- •Third, a rate cut could potentially contribute to inflation in the United States. This scenario might prompt the Fed to either keep rates steady or even consider hiking them in 2026. Concerns about this possibility are reflected in the recent rise of U.S. bond yields, with the 10-year yield climbing to 4.18%.

The current pullback in the crypto market appears to align with earlier warnings that the recent rally might have been a "dead-cat bounce"—a temporary upward movement in a declining asset before resuming its downtrend.