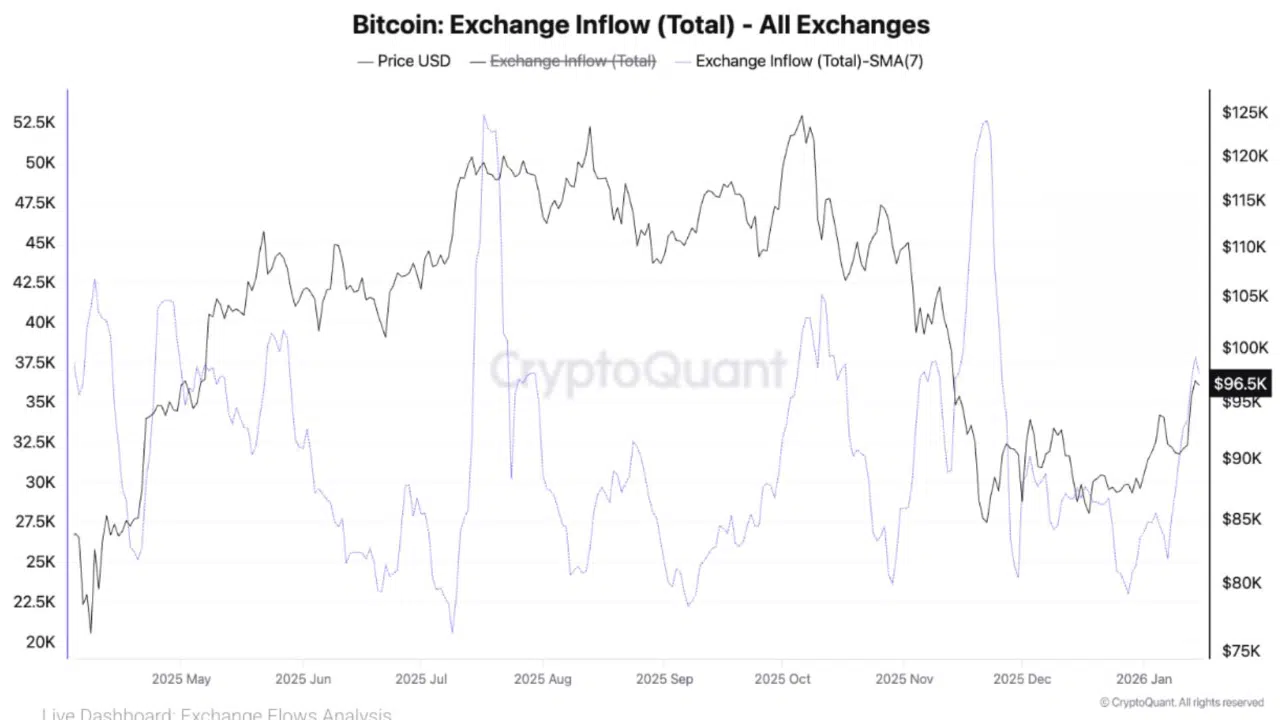

Bitcoin’s recent price recovery is unfolding alongside a notable shift in on-chain behavior, with exchange inflows climbing to levels not seen in months.

Data cited in a CryptoQuant report shows the 7-day moving average of total Bitcoin exchange inflows rising to approximately 39,000 BTC, the highest reading recorded since late November 2025.

The increase is occurring as Bitcoin trades back near the $95,000–$96,500 zone, following a rebound from lower levels earlier in the cycle. The chart tracking total exchange inflows across all platforms shows inflow spikes re-emerging while price attempts to stabilize, a combination that has historically drawn close scrutiny from market participants.

Exchange Inflows Pick Up During Price Recovery

According to the CryptoQuant data, the current rebound is being accompanied by a clear rise in BTC moving onto exchanges. The total exchange inflow line and its 7-day average have both trended higher in recent sessions, contrasting with the lower inflow levels seen during parts of December.

Historically, periods where exchange inflows increase after a price rebound tend to reflect a growing intent to distribute rather than accumulate. While inflows alone do not guarantee immediate selling, they do increase the amount of readily available supply that can be sold into the market if conditions shift.

The chart shows similar inflow expansions during previous phases in 2025, some of which coincided with local tops or periods of heightened volatility, rather than sustained upside continuation.

Supply-Side Risk Re-Emerges

In commentary accompanying the data, XWIN Research Japan described the trend as a renewed supply-side risk developing beneath Bitcoin’s rebound. The research note emphasized that while rising inflows do not automatically translate into selling pressure, they suggest that holders may be preparing for distribution rather than long-term accumulation.

The report noted that the durability of the current price recovery will likely depend on how effectively the market absorbs this potential increase in sell-side liquidity. If demand remains strong enough to offset incoming supply, price may remain supported. If not, the elevated inflows could act as a headwind.

Market at a Test Point

The CryptoQuant chart places the current inflow levels well above those seen during quieter accumulation phases, highlighting a shift in on-chain behavior as price rebounds. With Bitcoin now trading higher while exchange inflows expand, the market is entering a phase where supply dynamics are becoming increasingly relevant again.

Rather than signaling an immediate reversal, the data frames the rebound as one that is being tested by rising available supply. How Bitcoin trades from here will hinge on whether buyers can continue to absorb the inflows without triggering broader distribution pressure.