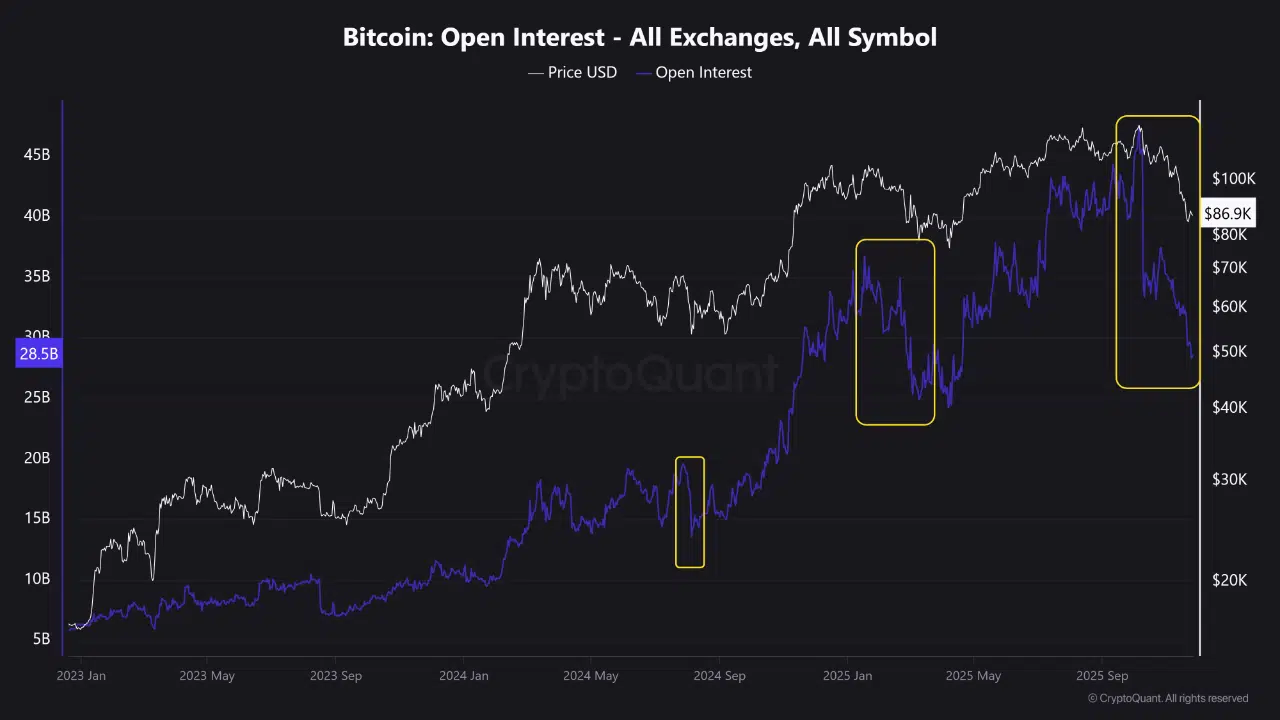

Bitcoin’s market structure just experienced its sharpest Open Interest reset of the current cycle, according to new analysis shared by CryptoQuant. Total Open Interest fell dramatically from around $45 billion to $28 billion within days, marking one of the most abrupt leverage unwinds since late 2023. Analysts stress that the drop does not indicate the start of a bear market. Instead, it reflects a classic long-squeeze event that flushed out overly extended positions and reset risk across derivatives markets.

Despite the volatility, Bitcoin continues to trade above the ETF average cost basis of $79,000.

CryptoQuant notes that institutional funds have not shown any meaningful signs of selling during this correction, suggesting the drawdown is leverage-driven rather than fundamentally driven. The analysis highlights $74,000 as the key structural level to monitor. A weekly close below this threshold would be the first technical signal of broader macro weakness emerging across the market.

Macro Outlook Turns Optimistic Ahead of Fed Shift

CryptoQuant’s macro section points to an improving backdrop as the Federal Reserve approaches a major liquidity inflection point. December 10th is expected to be the final day of Fed liquidity withdrawal, after which the tightening pauses. More cash flowing back into the system typically increases risk appetite, and the report emphasizes that this shift could be supportive for both equities and digital assets.

The stock market has already shown signs of stabilizing, rebounding after a sharp correction earlier in the week. Analysts see a high probability that the Fed will continue its rate-cutting cycle into 2026, building a favorable environment for growth-oriented assets, including Bitcoin.

Geopolitical developments may also play a role. The ongoing situation in Ukraine is highlighted as a potential catalyst, with any progress toward a peace deal likely to improve global risk sentiment and provide additional confidence to crypto markets.

ETF Inflows and Whale Activity Remain Key Drivers

The report underscores the importance of continued Bitcoin ETF inflows in determining short-term and medium-term market direction. Recent netflow trends have shown a mixture of outflows and inflows across major issuers, but the most recent bars in the CryptoQuant chart highlight renewed positive flows. Sustained inflows into spot ETFs, combined with persistent whale accumulation, are viewed as the essential conditions for Bitcoin to resume its upward trajectory.

In contrast, prolonged periods of ETF outflows typically correlate with market hesitation and liquidity tightening, factors that contributed to the recent volatility. With Open Interest reset and futures markets cleansed of excessive leverage, analysts argue that Bitcoin is positioned more cleanly for trend continuation if institutional demand strengthens.

Structural Reset, Clear Levels, and a Market Waiting for Confirmation

CryptoQuant’s analysis paints a picture of a market undergoing a necessary structural reset rather than a trend reversal. The rapid Open Interest collapse mirrors prior periods, highlighted in the chart, where leverage washouts preceded renewed upside. As long as Bitcoin holds above the $74,000 structural line, the broader bullish thesis remains intact.

With the Fed stepping back from liquidity withdrawal, ETF flows stabilizing, and risk conditions improving, the next phase depends on whether capital rotates back into Bitcoin at scale. A strong inflow rebound would confirm the reset as a healthy mid-cycle event, setting the stage for renewed price discovery.