Market Overview

Bitcoin and Ethereum have continued their downward trend, with selling pressure increasing and buying momentum weakening. This indicates a decline in confidence and a deterioration of near-term market sentiment.

Market leaders are highlighting several key factors contributing to the current situation, including liquidity stress, shifting interest rate expectations, and structural pressure within the market. They suggest that the current market cycle may still be in its mid-phase, rather than nearing a final peak or a sharp collapse.

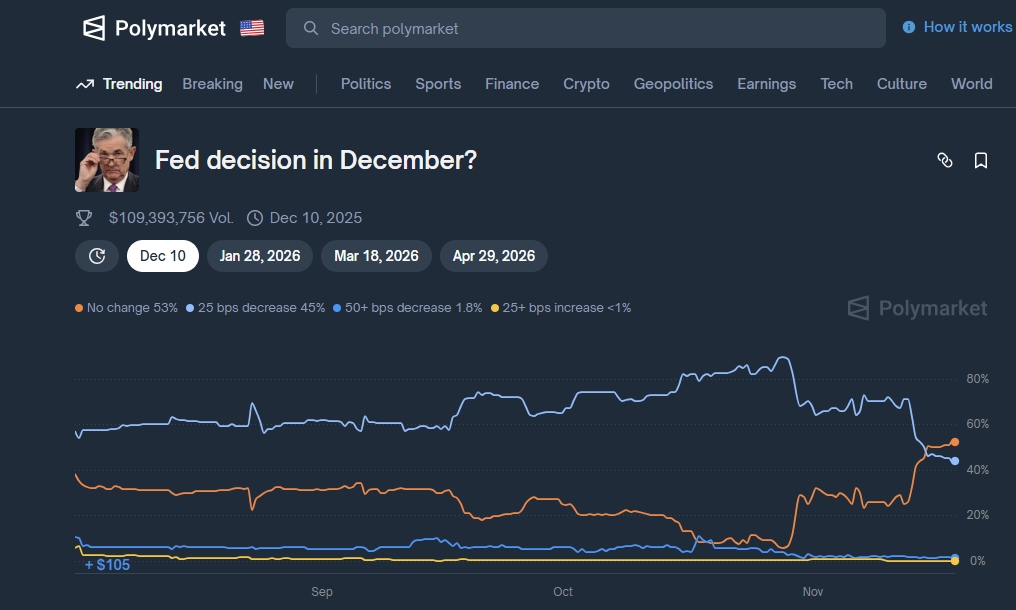

With the Federal Reserve's December decision on interest rates on the horizon, a cautious and controlled approach to positioning may be more prudent than attempting to predict a near-term bottom.

Crypto markets are experiencing continued declines, with Bitcoin and Ethereum showing weakness. Analysts are warning that liquidity remains tight, and sentiment is softening as the market braces for the upcoming December rate decision.

Recent Price Action and Sentiment Shift

Yesterday proved to be another challenging day for the cryptocurrency market, and the overall sentiment has continued to shift towards caution.

Both Bitcoin (BTC) and Ethereum (ETH) extended their losses, reflecting an environment where buyers are hesitant and selling pressure is dominant. The current decline appears to be a steady, controlled unwinding rather than a single sharp collapse, suggesting that leverage is being reduced quietly rather than liquidated aggressively.

Bitcoin's recent price action exemplifies this pattern. After multiple unsuccessful attempts to reclaim higher levels earlier in the week, its momentum has further weakened. At the time of writing, Bitcoin is trading in the range of $89,500–$89,600, marking another decrease from last week's levels. Ethereum has followed a nearly identical trajectory, failing to decouple or establish meaningful support.

The tone across the broader market has changed: dips are no longer being viewed as buying opportunities. Instead, they are met with silence and caution, which is a sign of fragile confidence.

Past 24 Hours: Data Confirms Softening Momentum

Over the past 24 hours, Bitcoin has continued to trade lower.

On the 4-hour chart, the price structure reveals persistent downward pressure coupled with increasing sell volume. Several attempts at short-lived rebounds quickly faded, indicating a lack of conviction on the buy side. Larger sell orders and rising volume suggest that this move is likely driven by more than just retail sentiment.

Since November 14, BTC has exhibited a clear pattern of lower highs, weaker rebounds, and gradually expanding supply. If this trend persists, traders may begin to focus on deeper structural support zones rather than anticipating a rapid recovery.

The decline has not triggered panic, but it has introduced softness into the market. This alone is sufficient to unsettle investors who were expecting a more aggressive year-end rally.

What Market Leaders Are Saying

Several prominent figures have offered their insights on the current market landscape, providing context beyond the technical charts.

Tom Lee of Fundstrat attributes the ongoing weakness to the aftermath of the October 10 deleveraging event. He believes that market makers might still be operating with impaired balance sheets, leading to a temporary liquidity drought that is specific to the crypto market, similar to quantitative tightening. Despite this, Lee maintains that the current cycle has not reached its final peak and suggests that the true top could still be one to three years away.

Arthur Hayes presents a more cautionary outlook. He observes that Bitcoin's decline while equities remain elevated could signal underlying credit stress. His liquidity models indicate weakening U.S. dollar conditions. If liquidity continues to tighten before policymakers intervene, Bitcoin could potentially fall into the high-$80,000s range. Nevertheless, Hayes believes that once liquidity returns, Bitcoin is well-positioned for a strong long-term continuation.

Cathie Wood remains optimistic about the digital asset class. While acknowledging the increasing competition within the ecosystem, particularly from stablecoins, she continues to view Bitcoin as a long-term macro asset rather than a speculative cycle product.

Collectively, these perspectives suggest that the current market weakness may be structural rather than emotional, driven by liquidity mechanics rather than a fading belief in the asset class.

The December Fed Decision Weighs on Sentiment

Uncertainty surrounding the upcoming Federal Reserve decision has become an additional pressure point for the market.

The probability of no rate cut in December has significantly increased and now represents the dominant expectation across both traditional markets and prediction platforms. Despite recent political noise, traders appear to be more focused on economic data and central bank communications.

For an asset class that is deeply connected to liquidity conditions, this shift in expectations is significant. Higher-for-longer interest rates tend to suppress speculative appetite, reduce leverage, and accelerate risk-off behavior, all of which are currently observable across digital asset markets.

Is This the Market Bottom?

Calling a market bottom at this juncture appears premature. The current environment lacks the typical characteristics of a final cycle phase, such as forced liquidations, widespread capitulation, extreme fear, or sharply disconnected valuations. Instead, the market seems to be grinding lower, searching for stability as liquidity continues to contract.

This does not invalidate the long-term investment thesis. However, it emphasizes the importance of timing, and rushing into exposure based on assumptions rather than clear signals increases risk.

Looking Ahead

For the time being, a cautious approach may be more suitable than aggressive accumulation. Building positions gradually, maintaining flexibility, and avoiding leverage could prove beneficial in the coming weeks.

The next expansion phase in the market will eventually occur, but the market may need to complete its current winter cycle before momentum returns. Until then, patience should not be mistaken for weakness.

It is a matter of discipline.