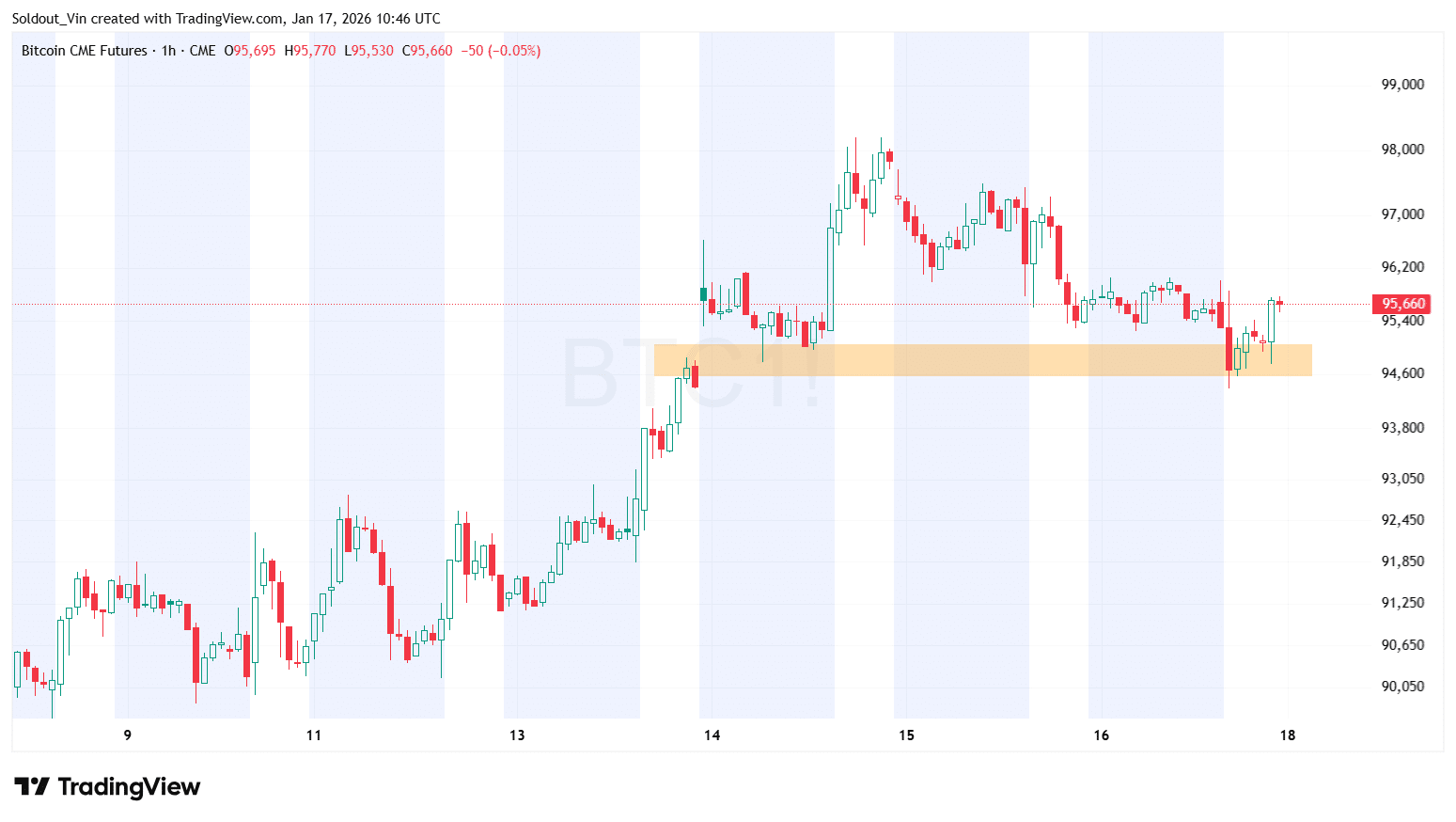

Bitcoin has successfully closed the CME futures gap near the $94,800 level. This technical milestone is being viewed by analysts as a positive indicator for further price appreciation.

CME gaps are created when Bitcoin's price movements on 24/7 spot markets during the weekend result in unfilled price ranges on the CME futures chart, which does not operate over weekends. Historically, these gaps often serve as focal points for technical traders and tend to be revisited and filled by subsequent market activity.

With the BTC CME futures chart now showing the gap near $94,800 has been filled, this condition supports the potential for continued upside. Analysts suggest that a weekly close above the $94,000 mark could pave the way for Bitcoin to extend its rally towards the significant $100,000 threshold.

The filling of the CME gap is a notable development, occurring amidst recent price resilience above the $90,000 level. During this period, bulls have successfully defended support areas, leading to subsequent rebounds. Bitcoin experienced a dip below $94,000 before moving back towards $95,000, thereby closing the gap.

Bitcoin Poised for Weekly Gain Following Muted New Year Start

Bitcoin has experienced a notable rebound this week, registering a gain of 5%. This positive movement follows a relatively subdued start to the new year for the cryptocurrency.

A significant portion of Bitcoin's gains this week can be attributed to a substantial purchase disclosed by Strategy, a major corporate holder. Strategy announced the acquisition of over $1 billion worth of Bitcoin, which has reignited hopes for improving corporate demand for the leading cryptocurrency.

Strategy has acquired 13,627 BTC for ~$1.25 billion at ~$91,519 per bitcoin. As of 1/11/2026, we hodl 687,410 $BTC acquired for ~$51.80 billion at ~$75,353 per bitcoin. $MSTR$STRC$STRK$STRF$STRD$STREhttps://t.co/bIbPbFAbTa

— Strategy (@Strategy) January 12, 2026

Despite this corporate activity, retail demand for Bitcoin has remained under pressure. Broader sentiment within the cryptocurrency space continues to be cautious, contributing to Bitcoin trading at a discount and indicating persistent weakness in retail sentiment.

This sentiment is further influenced by recent developments in the United States, where lawmakers delayed a key discussion on a planned crypto regulatory framework. This delay occurred after Coinbase expressed opposition to the bill in its current form.

As of 6:26 a.m. EST, Bitcoin is trading at $95,100, representing a fractional decrease of less than a percentage point, according to data from Coingecko.