A new analysis circulating across the crypto community warns that 30% of all Bitcoin sits in old, inactive addresses, many of which predate modern security standards. According to data, these dormant coins, accumulated over the last 10+ years, form a massive layer of the network’s long-term supply.

The chart shows how Bitcoin’s holder waves have grown increasingly top-heavy, with aging supply dominating the long-term landscape. The concern now: when quantum-resistant wallet upgrades become necessary, migrating this old supply could trigger intense chain congestion, political disputes, or even a network-wide coordination fight.

Most of these coins belong to early miners, OG holders, and long-term custodians. Moving them would require private keys that may be lost, compromised, or held by individuals no longer involved in the ecosystem. That creates a potential governance challenge no cycle has tested before.

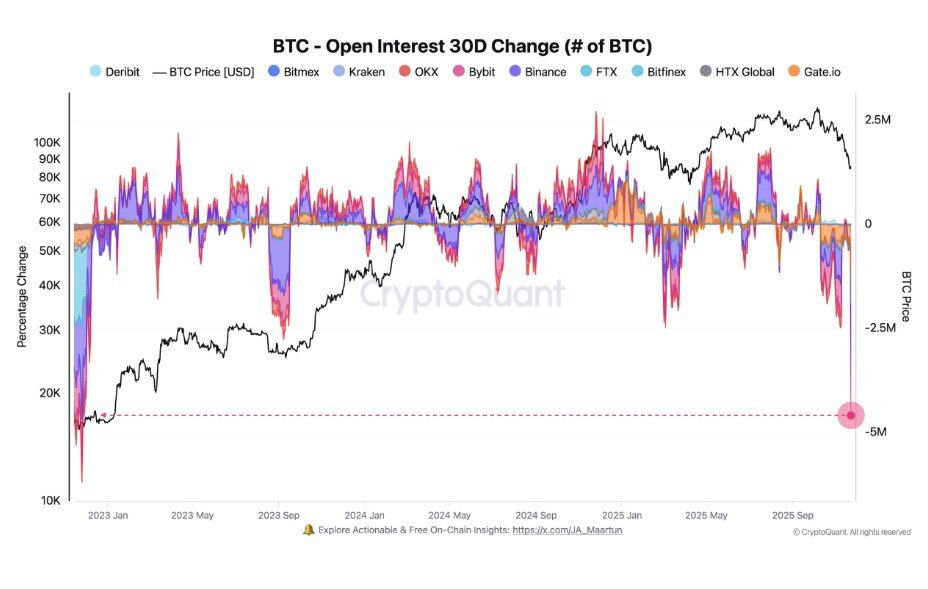

Open Interest Suffers the Largest 30-Day Collapse Since 2022

Overlaying this structural issue is a more immediate market shock. New CryptoQuant data shows Bitcoin open interest has just seen its steepest 30-day decline since 2022, wiping out more than 5 million BTC in aggregated futures positioning across major exchanges.

The chart illustrates a violent flush-out across Binance, Bybit, OKX, Deribit, Bitmex, Kraken, Gate.io, and others. This type of market-wide positioning reset often occurs:

- •at major macro pivot points

- •following events where excessive leverage unwinds

- •near cycle bottoms or accumulation zones

During past cycles, similar crashes in open interest marked the final stages of capitulation before a recovery phase. The current drop aligns with a period of macro uncertainty, tightening liquidity, and profit-taking after Bitcoin failed to hold key levels near its recent highs.

What This Means for Bitcoin’s Next Moves

The combination of historic long-term supply immobility and short-term speculative unwinding paints an unusual picture:

- •Bitcoin’s structural base is extremely strong, with old holders firmly parked.

- •But derivatives markets are undergoing a deep cleansing that typically reshapes short-term price trajectories.

If history repeats, the wipeout in open interest could lay the groundwork for a stabilization phase, but the unresolved issue of upgrading decades-old addresses looms in the background as a future flashpoint for the network.

The Bigger Narrative

On one side, Bitcoin’s oldest coins represent its strongest believers.

On the other, the most aggressive traders are exiting positions at the fastest pace in years.

The result:

A market divided between unshakable long-term conviction and short-term uncertainty, with both dynamics likely to shape volatility as Bitcoin approaches its next macro catalyst window.