Bitcoin's recent slide to $86,700 has ignited a wave of crowd reactions, and the latest Santiment data reveals a market deeply divided emotionally.

While social volume surrounding the price drop is surging, retail traders are not converging on a single narrative. Instead, they are broadcasting completely opposite expectations, oscillating between extreme doom and extreme optimism with very little in between.

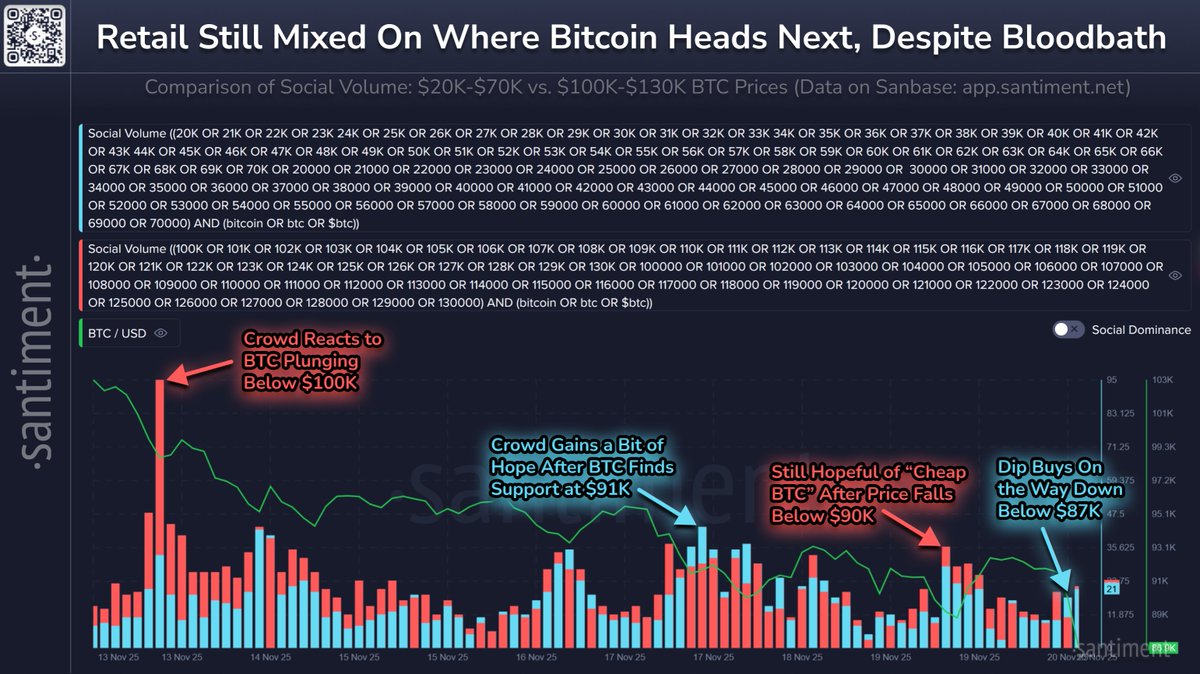

According to Santiment data, discussions around ultra-bearish price ranges, specifically between $20,000 and $70,000, have seen a sharp increase. Concurrently, chatter about bullish six-figure targets, ranging from $100,000 to $130,000, has also spiked. This significant imbalance in conversation reflects market uncertainty rather than widespread confidence. Historically, Bitcoin has a tendency to move against the prevailing majority view of retail traders, making the current sentiment a potentially meaningful signal for future price movements.

The accompanying chart illustrates that each major price leg down has triggered predictable crowd behavior. Panic spikes are typically observed when Bitcoin breaks key support levels, followed by short-lived bursts of hope whenever the price experiences a bounce. Retail traders were observed buying dips around the $91,000 mark, then again below $90,000. A final cluster of optimistic calls appears to have emerged after the plunge under $87,000, a point where fear would typically be expected to peak.

Analysts have noted that a true market bottom usually forms when social sentiment becomes overwhelmingly bearish, particularly with widespread predictions of prices falling below $70,000. This moment of capitulation has not yet fully materialized. However, the emotional whiplash observed in recent trading activity suggests the market may be approaching such a turning point.

For the time being, Bitcoin's price action remains highly reactive to crowd psychology. If retail sentiment eventually shifts to a uniformly pessimistic outlook, it could serve as the clearest indicator that a medium-term reversal is imminent.