Despite dipping below $100,000 multiple times this week, Bitcoin (BTC) once again closed above the six-figure mark, extending its streak to six consecutive months of daily closes over $100K. While volatility has spiked, analysts say key on-chain signals now suggest the market may be entering a stabilization phase rather than a full-scale breakdown.

Key Takeaways

- •Bitcoin has held above $100K for six months straight, despite repeated intraday dips.

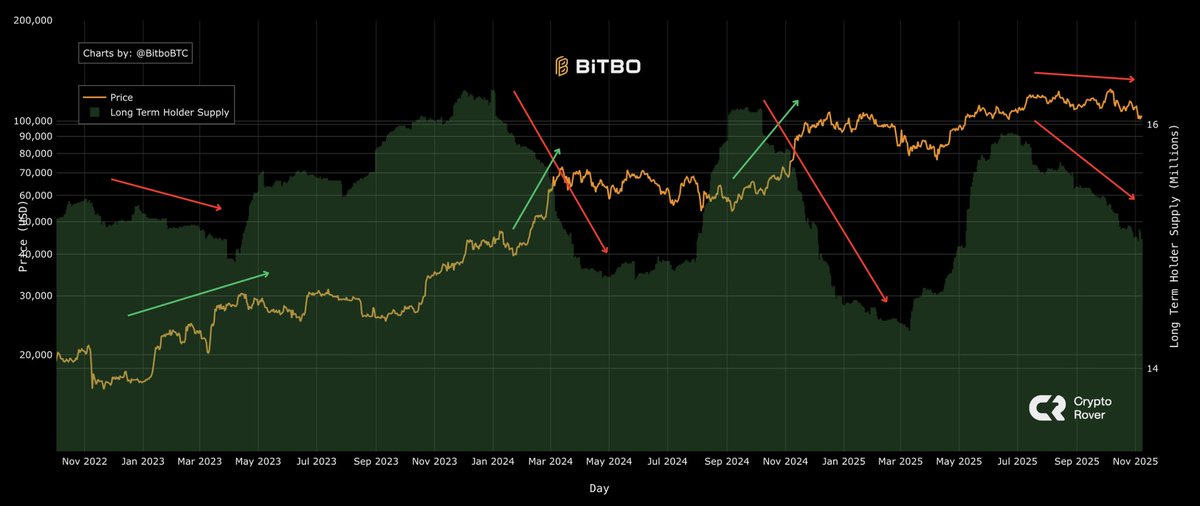

- •Long-term holders are distributing coins during price stagnation – a rare cycle behavior.

- •Selling pressure is fading, with leverage flushed and stablecoin buying power building.

BTC Price Resilience and Whale Behavior

Bitcoin has repeatedly tested the $100,000 support zone this week but consistently closed each day above the key psychological threshold. The resilience at this level underscores strong spot demand and potential accumulation by larger holders defending the range.

🔥 UPDATE: $BTC dipped below $100K multiple times this week.

But it always closed the day above $100K.

Today makes it 6 months of closing above $100K. pic.twitter.com/uH6pXsb8gJ

— Cointelegraph (@Cointelegraph) November 8, 2025

However, a notable shift in long-term holder (LTH) behavior has been observed. Historically, LTHs tend to distribute their coins during sharp rallies and near market tops, but this time, they are selling during sideways price movement, not during a breakout. This behavior could suggest that these holders are positioning ahead of a potential four-year cycle transition, hinting that the next major move might not be far away.

On-Chain Data Points to a Potential Market Bottom

Multiple on-chain indicators reflect easing sell pressure across futures and spot markets:

- •Futures CVD (90-day) shows aggressive sell-side pressure subsiding.

- •Spot CVD remains slightly negative, but selling momentum has slowed.

- •Stablecoin Supply Ratio has returned to zones seen at previous cycle bottoms.

- •aSOPR near 1.0 indicates most coins are being sold at cost, not in panic.

Together, these metrics suggest that leverage has been flushed, retail traders remain cautious, and stablecoin liquidity is quietly building up, which often precedes upward reversals.

BITCOIN SELLING PRESSURE IS STARTING TO FADE

The latest on-chain data looks more like a market bottoming out than breaking down:

Futures CVD (90-day) shows that aggressive taker-sell pressure is easing. The heavy shorting and forced selling that drove the recent drop is… pic.twitter.com/BJ0sBfZDe1

— CryptosRus (@CryptosR_Us) November 8, 2025

Outlook: A Cycle Reset or a Higher Base?

Analysts remain divided on whether Bitcoin’s six-month consolidation above $100K marks a cycle plateau or a launchpad for the next leg higher. Data hints at long-term repositioning, while on-chain flows show fading sell-pressure, a combination that often aligns with early bottom formation.

If positive macro catalysts emerge, such as ETF inflows, lower inflation prints, or renewed institutional demand, the next directional move could arrive quickly.

For now, Bitcoin’s ability to hold the $100K level amid mounting market fatigue may be the most telling signal yet that the bull cycle’s next phase is quietly taking shape.