Bitcoin price, after encountering resistance above $97,000, has seen a slight pullback, now trading just above $95,500. As of 2:01 a.m. EST, BTC is valued at $95,699. Trading volume has decreased by 16% to $55.8 billion, indicating a slowdown in market activity following the price correction.

This dip occurs as the overall market capitalization has fallen to $3.3 trillion. Notably, BNB is the only asset among the top-five cryptocurrencies to register a positive gain on the day.

The price movement unfolds even as the US Senate prepares to resume hearings on Bitcoin and crypto market structure. Concurrently, data suggests an increase in Bitcoin withdrawals by Iranians amidst their ongoing political crisis, highlighting diverse market influences.

Senate Banking Committee Lawmakers Express Optimism on Crypto Legislation

Despite previous postponements, US lawmakers have conveyed an optimistic outlook regarding crypto legislation, citing progress in ongoing discussions. Communications on the social media platform X indicate that negotiations are moving towards a consensus on market structure rules, fostering confidence that bipartisan legislation to support the digital asset industry is achievable.

Senator Cynthia Lummis shared her perspective, stating, "Thanks to Chairman Scott’s leadership, we are closer than ever to giving the digital asset industry the clarity it deserves. Everyone is still at the negotiating table, & I look forward to partnering with him to deliver a bipartisan bill the industry & America can be proud of."

I’ve spoken with leaders across the crypto industry, the financial sector, and my Democratic and Republican colleagues, and everyone remains at the table working in good faith.

As we take a brief pause before moving to a markup, this market structure bill reflects months of…

— Senator Tim Scott (@SenatorTimScott) January 15, 2026

In parallel, Senator Bill Hagerty expressed confidence that a consensus on the legislation would be reached promptly. He stated, "I applaud Chairman @SenatorTimScott for his leadership, as well as @SenLummis and the White House, for working day and night with all the members of the Banking Committee on the crypto market structure legislation. I am confident we will get to a consensus product in short order.… https://t.co/YJshwUjnd1"

I’ve spoken with leaders across the crypto industry, the financial sector, and my Democratic and Republican colleagues, and everyone remains at the table working in good faith.

As we take a brief pause before moving to a markup, this market structure bill reflects months of…

— Senator Tim Scott (@SenatorTimScott) January 15, 2026

The successful passage of this bill would represent a significant regulatory overhaul of US financial markets, aiming to retain innovation within the country and bolster long-term economic leadership.

Iran Increases Bitcoin Usage Amidst Economic and Political Unrest

Concurrently, Chainalysis data reveals a surge in cryptocurrency usage within Iran, particularly Bitcoin withdrawals, as citizens seek to preserve value amidst the nation's ongoing protests and economic instability.

A report published by Chainalysis on Thursday indicated that Iran's cryptocurrency ecosystem reached $7.78 billion in 2025, with activity accelerating during the period of unrest and a substantial increase in daily crypto transfers.

🚨 IRAN: $7.8B CRYPTO SURGE!

According to a Chainalysis report, crypto activity in Iran has reached $7.8 Billion amid an economic crisis and protests.

• People are using Bitcoin to hedge against 40-50% inflation.

• The IRGC controls 50% of inflows to bypass international… pic.twitter.com/fJ7bNQIIcX

— Crypto Aman (@cryptoamanclub) January 16, 2026

The report further elaborates that Bitcoin's role extends beyond capital preservation; it has become an instrument of resistance, offering liquidity and flexibility in an increasingly constrained economic landscape.

Analysis of Bitcoin Price Potential to Reach $100,000 in 2026

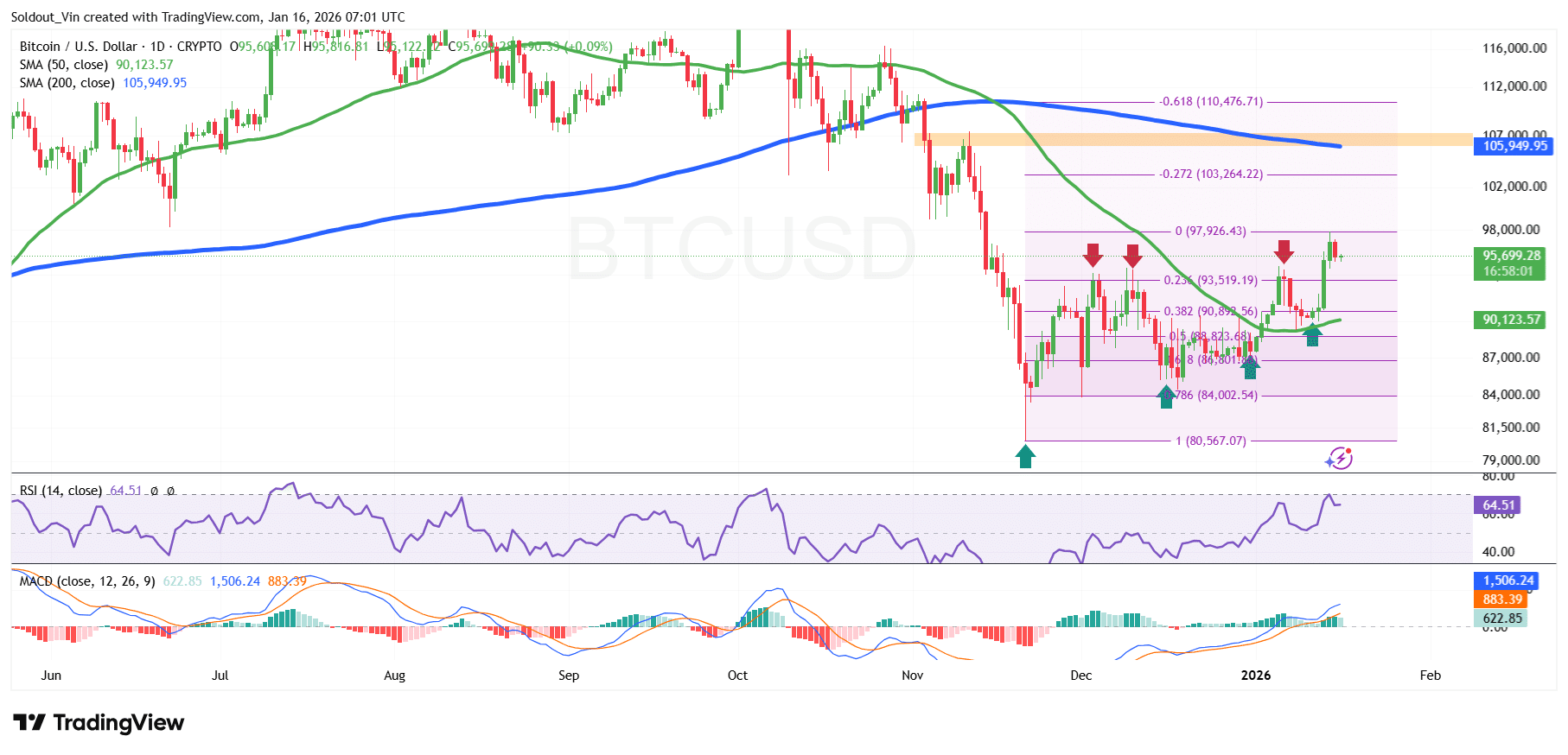

Bitcoin's price is currently maintaining a position above the $93,500 support level and the 0.236 Fibonacci Retracement level. The recent upward movement was supported by the supply zone identified around $89,000.

This surge has propelled BTC above the 50-day Simple Moving Average (SMA) at $90,123, reinforcing the overall bullish sentiment. The 200-day SMA is currently acting as overhead resistance at $105,949.

Bitcoin's Relative Strength Index (RSI) is approaching the overbought territory, standing at 64.51. This reading suggests that buyers are in control, but the price has not yet reached an overbought condition, indicating potential for further upward movement.

Additionally, the Moving Average Convergence Divergence (MACD) indicator has turned positive, with the blue MACD line crossing above the orange signal line, signaling a bullish trend.

The 1-day BTC/USD chart analysis indicates that the Bitcoin price could potentially break above the 0 Fibonacci level at $97,926. The next significant resistance and target are projected within the -0.271 Fib zone, around $103,264.

Further supporting the bullish outlook, exchange-traded funds (ETFs) have accumulated over 17,700 BTC tokens this week, signaling sustained investor interest and trading activity.

17,700 Bitcoin $BTC.

That’s roughly $1.68 billion accumulated by ETFs so far this week! pic.twitter.com/Hs5E9feATg

— Ali Charts (@alicharts) January 16, 2026

Conversely, following a 5.4% surge in the past week, short-term investors might engage in profit-taking, potentially leading to a price decline towards the $89,000 support level.