Bitcoin is trading in a narrow range after a volatile week, sitting around $89,400 on Saturday morning.

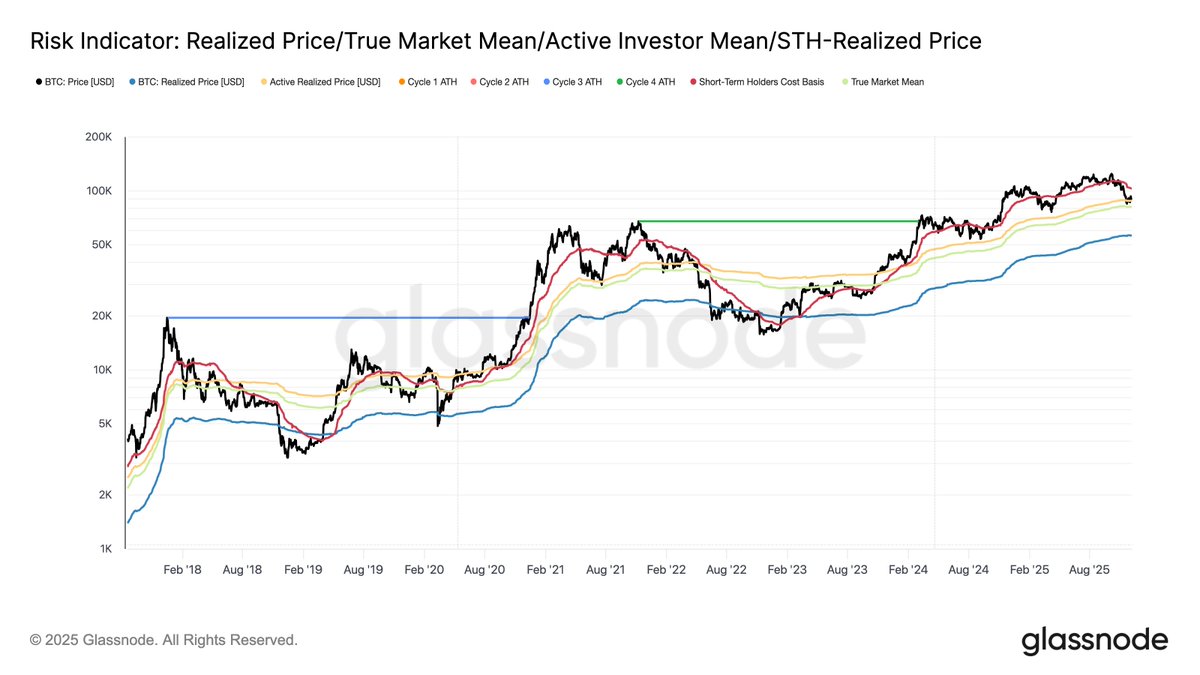

The latest data from Glassnode provides a sharp update on several market-defining cost basis levels, giving traders a clearer sense of where risk begins to build and where long-term conviction currently sits.

Glassnode Updates Key BTC Cost Basis Levels

Glassnode reports that several major valuation metrics have shifted as Bitcoin’s spot price hovers near $89.3K:

- •Short-Term Holder (STH) Cost Basis: $103.1K

- •Spot Price: $89.3K

- •Active Investors Mean: $88.0K

- •True Market Mean: $81.4K

- •Realized Price: $56.4K

The most important takeaway is that Bitcoin is currently trading below the STH cost basis, historically a zone where short-term holders are underwater and market volatility tends to increase. At the same time, price is holding above the Active Investor Mean, suggesting deep-pocketed, active market participants still have a cost basis beneath current levels.

What the Chart Suggests

The TradingView 2-hour chart shows Bitcoin consolidating tightly after a sharp pullback from the mid-$92K region. Buyers stepped in aggressively near $89K, stopping the decline and stabilizing price into a sideways range.

Volume has compressed significantly, which often precedes a larger move. For now, Bitcoin remains pinned between $89K support and light resistance just above $90K, waiting for a catalyst.

Why These Levels Matter

Cost-basis models historically act as psychological and structural thresholds:

- •Trading below STH cost basis often means short-term holders feel pressure, which can contribute to sharper moves if panic selling begins.

- •Trading above the Active Investor Mean suggests long-term confidence remains intact.

- •True Market Mean ($81.4K) is the deeper, cycle-level line to watch – a level Bitcoin has bounced from repeatedly throughout 2025.

As long as Bitcoin stays above this $81–82K region, Glassnode’s risk indicators point to a market still comfortably above deep-value territory.

What Comes Next

With volatility fading and price compressing below $90K, the market is approaching a decision point. A clean reclaim of $92K would flip momentum back to the upside, while a breakdown below $88K opens the door toward the mid-$80K area, where several long-term cost basis levels converge.

For now, Bitcoin remains steady, balanced between short-term stress signals and long-term structural strength.