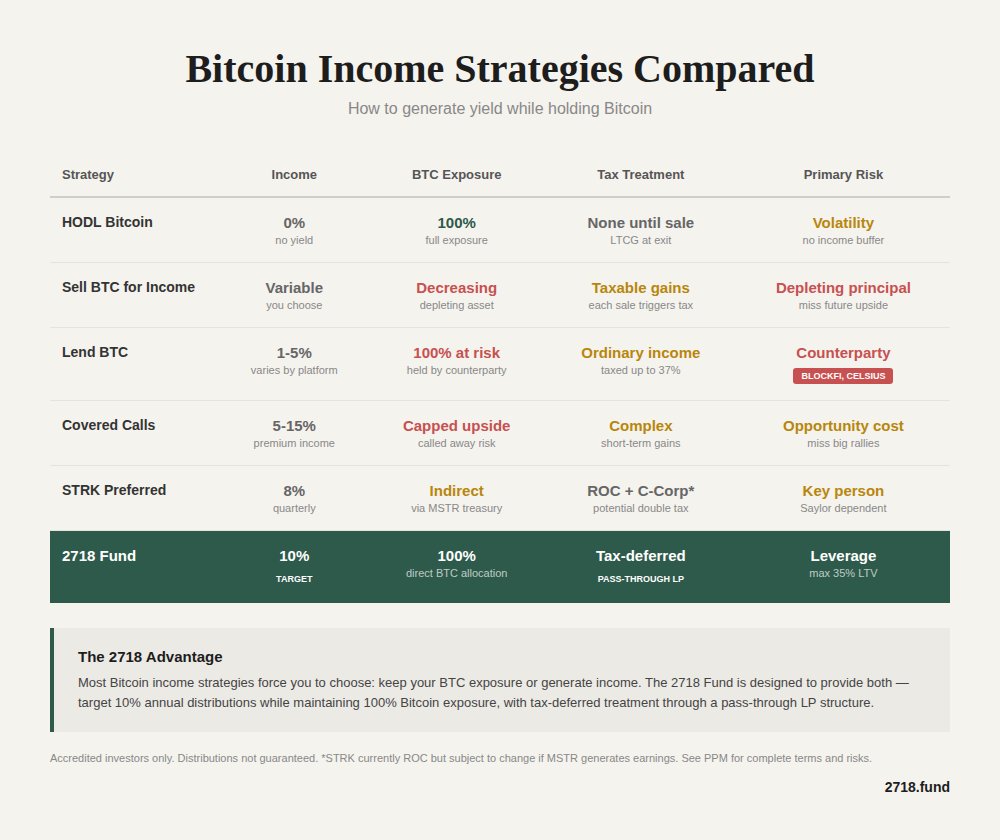

A growing number of investors are exploring ways to generate income from Bitcoin without fully giving up long-term exposure. A comparison of common Bitcoin income strategies highlights a clear trade-off between yield, risk, tax treatment, and upside participation.

Holding vs. Monetizing Bitcoin Exposure

The most straightforward approach, simply holding Bitcoin, offers full exposure to price appreciation but generates no income. Volatility remains the primary risk, with no cash flow to offset drawdowns.

Selling Bitcoin to generate income introduces flexibility but steadily reduces exposure. Each sale triggers taxable gains and risks depleting principal if prices rise later.

Lending Bitcoin can offer modest yields, typically in the low single digits, but introduces counterparty risk. Funds are held by third parties, leaving capital exposed if the lender fails.

Structured Income Strategies and Their Limits

Covered call strategies can boost income through option premiums, often in the mid-to-high single digits or more. However, upside becomes capped, meaning large rallies may be missed if Bitcoin is called away. Tax treatment can also become complex due to short-term gains.

Equity-linked approaches, such as preferred structures tied indirectly to Bitcoin treasuries, provide income with partial exposure. These strategies introduce reliance on management decisions and corporate execution rather than direct Bitcoin ownership.

The 2718 Fund Model

The comparison highlights the 2718 Fund as a distinct structure aiming to maintain full Bitcoin exposure while targeting a 10% annual distribution. Unlike selling or option-based strategies, it emphasizes direct Bitcoin allocation with tax-deferred treatment through a pass-through limited partnership.

The primary risk shifts toward leverage, with loan-to-value constraints defining downside exposure rather than counterparty custody or capped upside.

Key Takeaway

The chart makes one theme clear: most Bitcoin income strategies force investors to sacrifice either exposure, simplicity, or control. Higher yield often comes with leverage, capped upside, or structural complexity. For long-term holders, the decision ultimately hinges on whether income today outweighs the cost of reduced flexibility or increased risk tomorrow.