The market has undergone a significant reset following October’s substantial crash, creating fertile ground for new recovery plays. Bitcoin is spearheading this rebound, with several altcoins, including XRP, Cardano (ADA), and Chainlink (LINK), showing positive momentum. Notably, MAGACOIN FINANCE is also attracting considerable attention from whales as investors prepare for a significant rally in the fourth quarter.

Bitcoin Bounces Back After $19B Crash

Following a record liquidation event of $19 billion on October 10, Bitcoin experienced a sharp decline to $104,000, a move that caught many market participants by surprise. However, Geoff Kendrick of Standard Chartered suggests that this market shakeout may have paved the way for a substantial rally.

Kendrick anticipates that Bitcoin could potentially reach $200,000 by the end of the year, contingent on sustained ETF inflows and continued easing of interest rates by the U.S. Federal Reserve.

In a more conservative scenario, Kendrick indicated to Cointelegraph that Bitcoin could still close the year "well north of $150,000." He further noted that ETF inflows are showing signs of recovery, with net positive inflows of $477 million recorded this past week, suggesting a resurgence in demand from institutional investors.

This rebound is being interpreted by many traders as the commencement of a second accumulation phase. With gold also reaching new all-time highs, Bitcoin is regaining its status as a safe-haven asset. Consequently, many analysts are identifying Bitcoin as one of the best cryptocurrencies to invest in for November, particularly for those looking for recovery opportunities after the recent market downturn.

XRP Price Outlook Turns Up After Sharp Drop

XRP's recent price correction was more pronounced than that of many other cryptocurrencies. During the flash crash on October 10, XRP fell to a low of $0.77 on Binance, representing a significant 72% decline within a single day. Despite this sharp drop, some analysts now believe that this correction could be setting the stage for a strong recovery.

Crypto analyst Crypto Kaleo shared with his substantial following on X that XRP's current market setup bears a resemblance to the conditions seen in late 2017. During that period, a flash crash on Binance preceded XRP's historic surge to $3.3. Kaleo suggests that XRP "could send from here," highlighting the coin's recent bounce from a long-standing descending trendline.

Although XRP is currently trading below $2.5, it continues to attract interest from both retail buyers and whales who are anticipating a clear breakout. With renewed buying pressure and historical patterns aligning, many are considering XRP among the best cryptocurrencies to buy for November, expecting it to replicate its past recovery cycles.

Cardano Shows Signs of a 333% Rebound

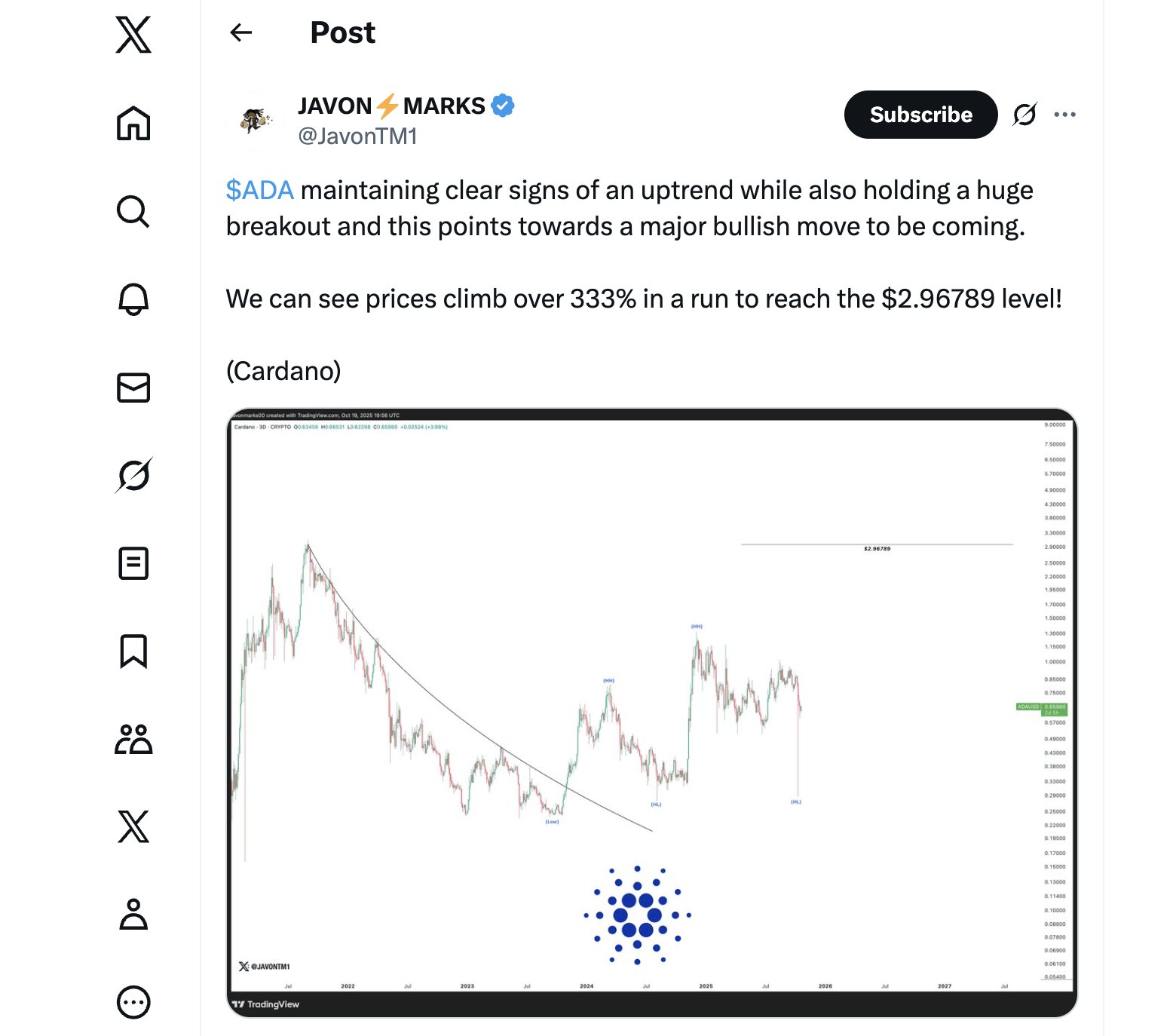

Cardano (ADA) remains a cryptocurrency of significant interest to long-term investors. Despite experiencing price declines since early October, analysts are observing the formation of a clear uptrend. Market watcher Javon Marks indicated that ADA has maintained its breakout structure, a development that could potentially lead to another substantial rally.

Marks projects a potential 333% rally for ADA, targeting a price of $2.96. He pointed out that ADA has consistently achieved higher highs and higher lows since 2023, and its recent dip to $0.279 did not breach key support levels. Other analysts, such as Chris O, forecast a potential run to $5–$8 within this cycle, provided market sentiment continues to strengthen.

Cardano's resilience amidst market volatility positions it favorably for recovery portfolios. Its ongoing development efforts and a dedicated user base contribute to ADA being considered one of the best cryptocurrency picks for November, especially for investors seeking diversification beyond Bitcoin and XRP.

Chainlink Positioned for Institutional Growth

Chainlink (LINK) is currently trading around $17.52 after a minor pullback. However, increased institutional activity suggests potential for larger price movements in the near future. Grayscale and Bitwise have submitted applications to launch Chainlink ETFs on NYSE Arca, a move that could create new avenues for traditional investors to gain exposure to the asset.

Whales have also been actively accumulating LINK tokens, purchasing over 54 million tokens in October around the $16 price zone. This accumulation area may serve as a base for the next upward movement, particularly as exchange reserves have decreased by 33 million LINK since July.

Chainlink continues to lead in the integration of real-world assets (RWA), collaborating with major entities such as S&P Global, SWIFT, and ICE. Its increasing importance in decentralized data systems solidifies its position among the best cryptocurrencies to buy for November, appealing to investors seeking steady, utility-driven growth.

MAGACOIN FINANCE: Whale Interest Surges Before Q4 Breakout

As traders strategically reallocate capital into emerging altcoins, MAGACOIN FINANCE is capturing significant attention. The project has seen over 21,000 new investors join its community following the team's confirmation of listings on both a major decentralized exchange (DEX) and a centralized exchange (CEX). Market observers note that whales are discreetly accumulating positions below $0.0006, anticipating what could be the most significant Q4 breakout among low-priced cryptocurrencies.

The potential for substantial gains is evident, with projections suggesting a possibility of holding a token that could surge to $0.1, representing a 1000x return from its current price. Many view this as an opportunity to diversify portfolios beyond established large-cap cryptocurrencies while still aiming for significant upside potential.

Why MAGACOIN FINANCE?

- •Whale accumulation preceding exchange listings.

- •An early-stage altcoin currently priced under $0.0006.

- •A transparent, community-driven development model.

With growing market buzz, MAGACOIN FINANCE is now being considered alongside Bitcoin, XRP, ADA, and LINK as one of the best cryptocurrencies to acquire for November.

How Traders Can Position Now

Traders are transitioning from a state of apprehension to active preparation. The market correction experienced in October has created new entry points for prominent cryptocurrencies. Investors who diversify into emerging projects like MAGACOIN FINANCE may position themselves early in the next wave of market breakouts.