Key Takeaways

- •Institutional accumulation intensifies: Binance on-chain data shows 86,400 BTC in large internal transfers followed by mass withdrawals to private wallets, a classic signal of institutional repositioning.

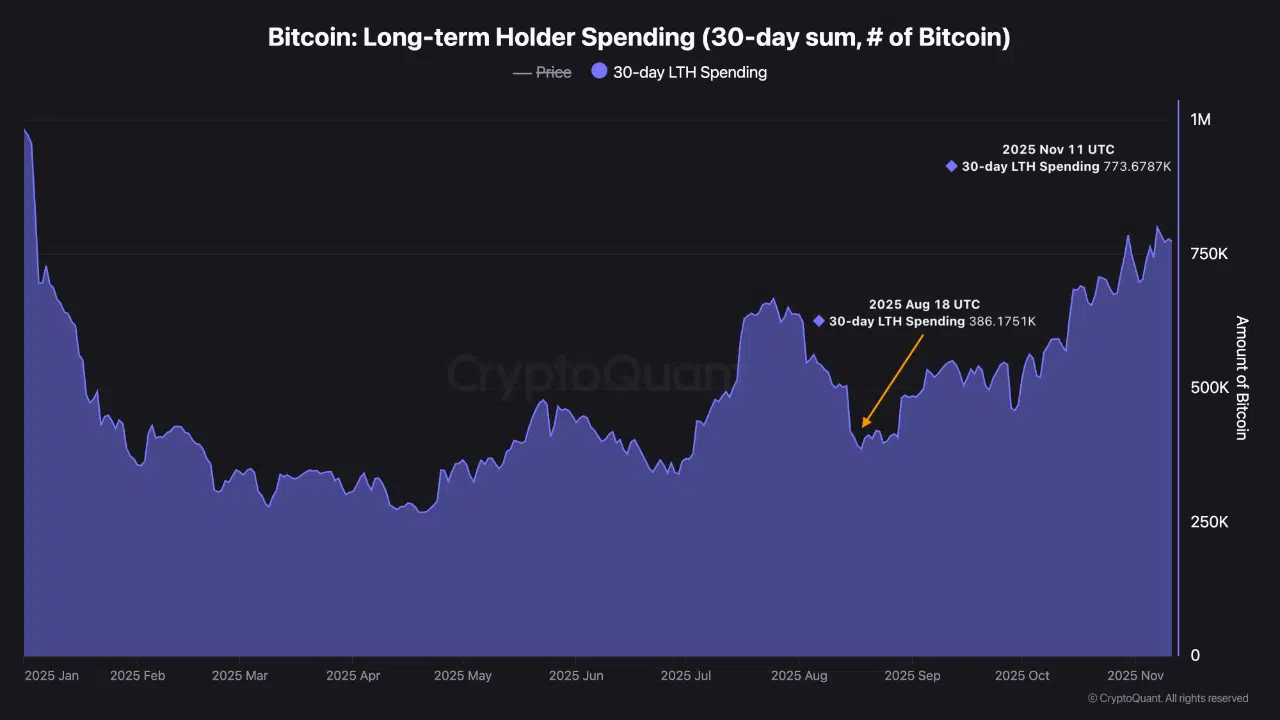

- •Long-term holders rotate supply: 30-day long-term holder spending doubled to 770K BTC, marking structural rotation rather than panic selling.

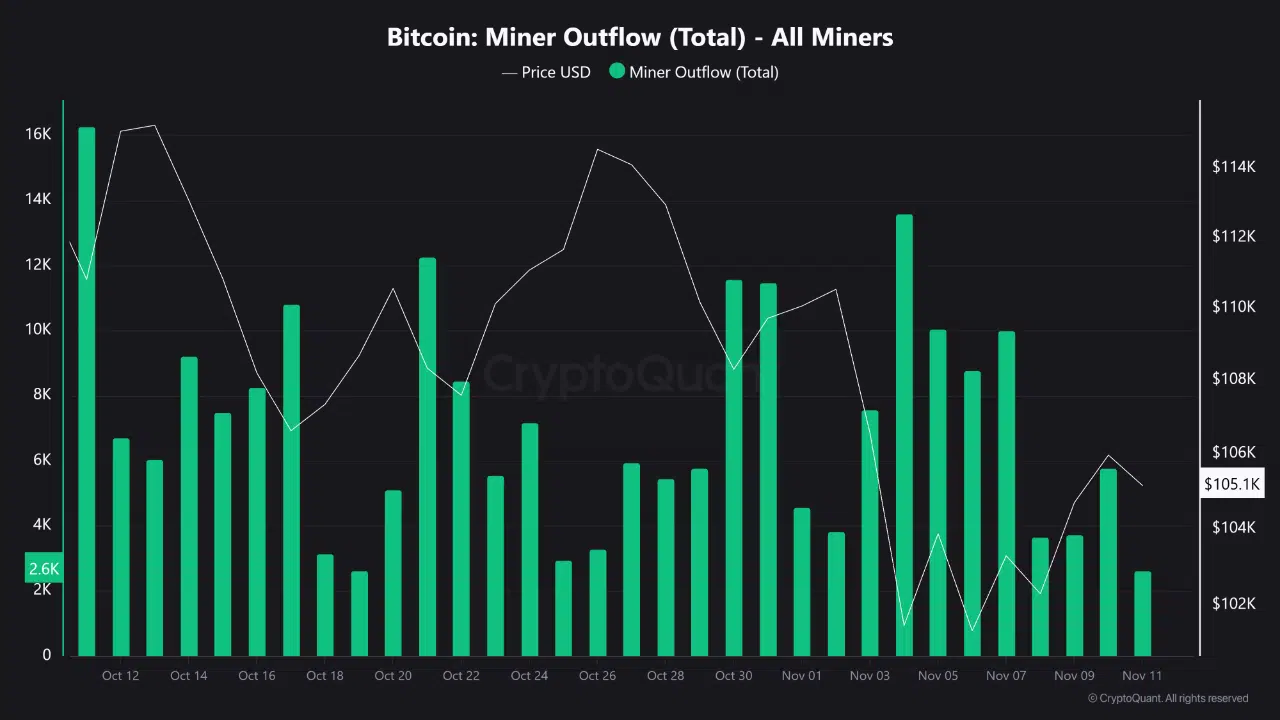

- •Miner outflows decline: Bitcoin miner transfers to exchanges have steadily dropped since late October, easing short-term sell pressure.

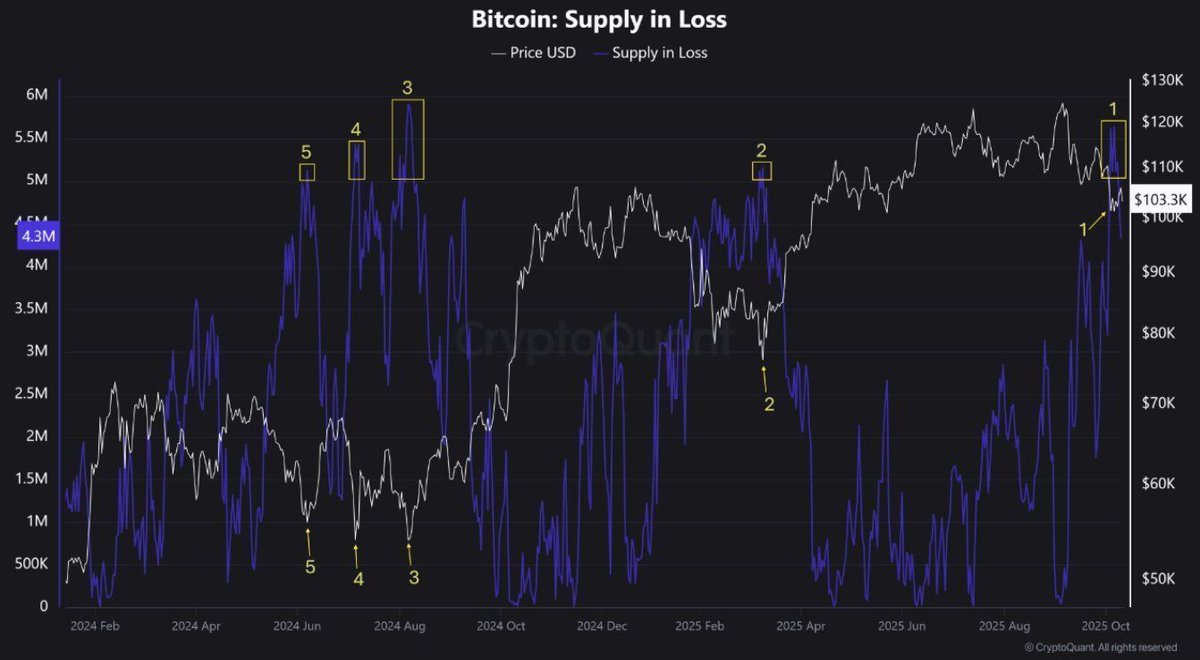

- •Supply in loss spikes to 30%: Over 5.5–6.5M BTC are now below cost basis, historically a zone linked to capitulation and market bottoms.

- •Market resetting, not collapsing: Combined signals indicate a late-stage correction phase with rising accumulation potential ahead of Q4–Q1 2026.

Bitcoin’s on-chain landscape is showing mixed but increasingly optimistic signs, as long-term holders rotate supply, miners ease selling pressure, and institutional accumulation patterns emerge on Binance. Despite short-term volatility, several key indicators now mirror conditions that historically preceded major recoveries.

Whales Move In While Binance Activity Surges

Fresh on-chain analysis from CryptoOnchain highlights a sharp rise in both internal and external Bitcoin movements on Binance. Over 86,400 BTC shifted internally through 3,400 transactions, with a massive average size of 37 BTC per transfer.

At the same time, withdrawal transactions skyrocketed, a sign that large entities and institutions are moving coins from exchanges to cold storage. Analysts interpret this as coordinated preparation by Binance to manage a wave of large-scale Bitcoin withdrawals, reflecting rising institutional confidence rather than routine “housekeeping.”

Long-Term Holders Rotate, Not Capitulate

Data from TeddyVision paints a deeper structural picture. Since mid-August, long-term holder (LTH) spending has doubled from 386K BTC to 770K BTC, showing widespread movement among veteran wallets.

However, this isn’t panic-driven selling. Instead, multiple holding cohorts, from 6 months up to 7 years, are actively repositioning. The 6–18 month segment leads with 460K BTC in movement, while even 7-year-plus holders are joining in.

According to analysts, this pattern marks a strategic rotation phase, where old coins re-enter circulation ahead of renewed accumulation, suggesting recalibration rather than capitulation.

Miner Outflows Decline, Signaling Reduced Sell Pressure

Meanwhile, miners appear to be stepping back from aggressive selling. KriptoCenneti’s data shows a steady decline in total miner outflows since late October, with levels now far below the peaks recorded during Bitcoin’s April–June 2025 rally.

Lower miner outflows typically align with accumulation and recovery phases, when miners opt to hold Bitcoin rather than send it to exchanges. If this trend persists, it could reinforce a neutral-to-bullish short-term structure, easing one of the main sources of supply pressure.

“Supply in Loss” Hits Capitulation Zone

A parallel dataset from CryptoQuant reveals that Bitcoin’s supply in loss, coins held below their cost basis, has surged to around 5.5–6.5 million BTC, or roughly 30% of total supply.

Historically, such levels coincide with market bottoms and emotional capitulation phases. Similar spikes occurred in mid-2024 and April 2025, both preceding multi-month recoveries.

The metric’s recent rise mirrors that pattern, indicating that many short-term holders have already realized losses, often a precursor to a rebound once selling pressure subsides.

As CryptosRUs noted, “High supply-in-loss readings tend to reflect fear and exhaustion among traders, setting the stage for the next upward cycle.”

Interconnected Signals Point Toward a Potential Reset

The combination of institutional withdrawals, miner restraint, and long-term rotation points to a synchronized transition phase across Bitcoin’s supply ecosystem. Each signal alone might seem neutral, but together they suggest the market is resetting its foundation before a possible Q4–Q1 2026 recovery.

If Bitcoin maintains support near the $100K–$105K region while these on-chain patterns persist, analysts expect renewed momentum driven by whale accumulation and easing supply stress.

Outlook

Short-term volatility remains likely, but structurally, the market appears to be in a late-stage correction rather than a full reversal. With nearly one-third of all Bitcoin now trading below cost basis, history suggests the next significant move could favor long-term bulls.

As on-chain analyst TeddyVision summarized:

This isn’t panic, it’s rotation. The system is rebalancing before the next major move.