Key Takeaways

- •Marathon Digital CEO Fred Thiel has stated that Bitcoin miners need to transition from asset-light models to owning their power infrastructure to remain profitable.

- •The recent Bitcoin halving event, which reduces miner rewards, is driving out less efficient operations, making access to low-cost energy the critical factor for survival.

- •The industry is shifting its focus from raw hash rate to controlling megawatt capacity.

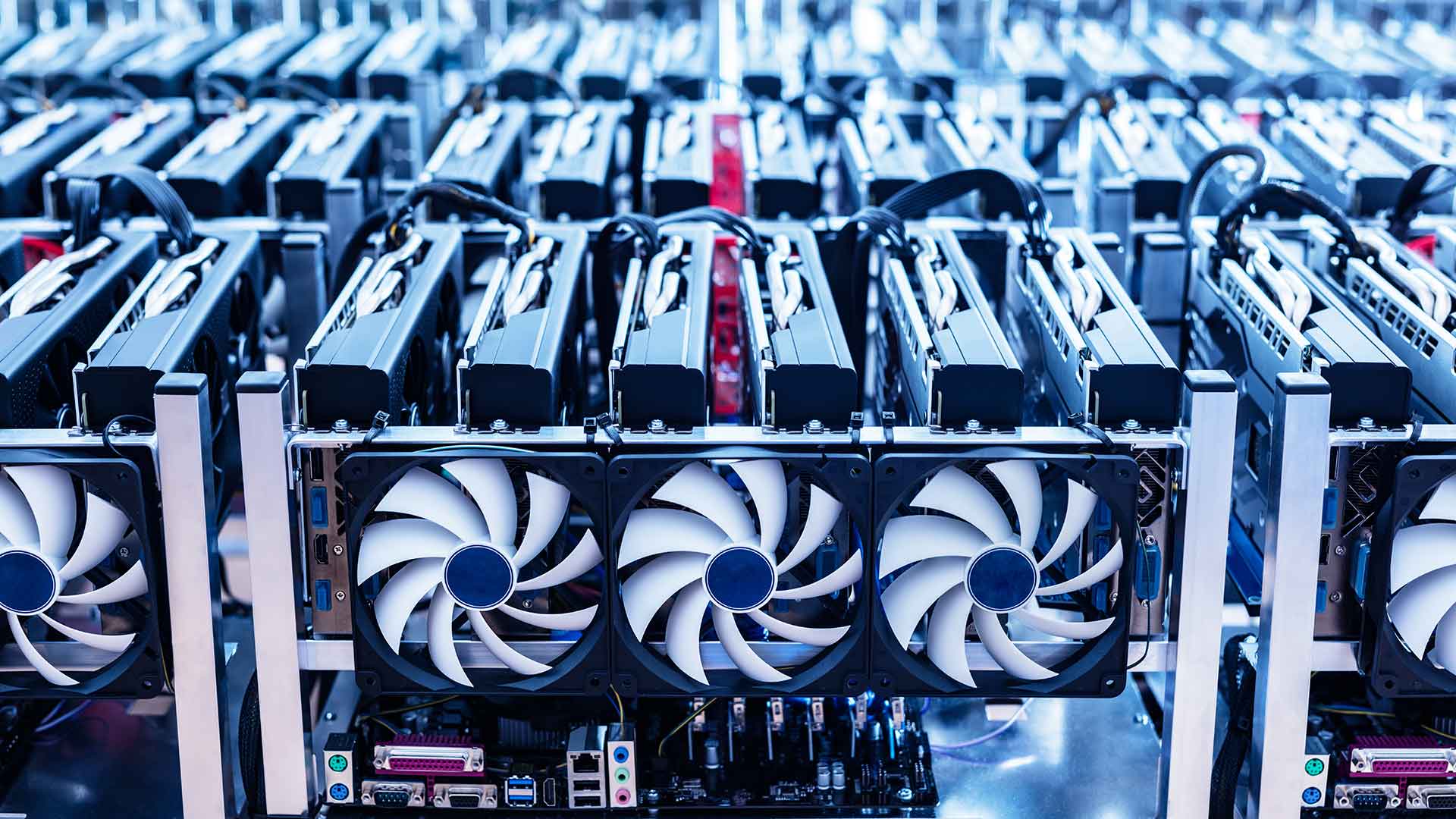

Fred Thiel, Chief Executive Officer of Marathon Digital Holdings, has issued a warning that cryptocurrency mining firms must gain control of their energy sources to navigate the ongoing consolidation wave in the industry following the recent Bitcoin halving. Thiel's remarks highlight the increasing importance of operational efficiency, where power access, rather than just hash rate, is becoming the primary determinant of a miner's viability.

Electricity represents the single most significant operating expense for miners, typically accounting for 75% to 85% of a company's total cash costs. The halving event, which reduces the block reward by half (most recently to 3.125 BTC), makes securing ultra-low-cost power an existential necessity for mining operations.

Marathon Digital has been actively pursuing a strategy of direct site acquisition, investing substantial capital to move away from an asset-light hosting model. This transition to owning and operating its own facilities, which now represents over half of its total capacity, aims to significantly lower its cost per coin and provide greater insulation from market volatility.

Consolidation Accelerates as Low-Cost Energy Becomes King

Thiel's perspective reflects a significant industry shift where the traditional boom-and-bust cycle associated with the halving is being superseded by a focus on monetizing megawatts. Companies like Cango are increasingly exploring ways to stabilize revenue by diversifying the use of their power capacity, including pursuing opportunities in the Artificial Intelligence (AI) and data center sectors.

Mining companies that are unable to secure low-cost power contracts or own their facilities are facing difficulties in generating sufficient revenue to cover their operational costs. This pressure is accelerating a trend of mergers and acquisitions (M&A) within the industry, enabling larger, well-capitalized firms like Marathon to expand their market share, while smaller, less efficient operators are compelled to declare bankruptcy or exit the market.

Prior Halving Events Dictated Efficiency

Historically, the Bitcoin halving has served as a catalyst for innovation and efficiency improvements within the mining sector. Following each of the three previous halvings, a period of consolidation occurred where the network hash rate temporarily dipped before recovering, as more efficient miners absorbed the market share of those who ceased operations.

The current trend toward vertical integration and power ownership suggests that future profitability will depend less on acquiring the latest mining hardware and more on effectively managing complex energy infrastructure. This strategic pivot indicates that Bitcoin mining is evolving from a pure cryptocurrency operation into a sophisticated energy and data management business.