Market Overview

Bitcoin's price extended its decline on Monday, falling to $90,075 and approaching the $87,500 support zone. This movement occurred within a persistent downward channel that began after a rejection near $126,000. The market structure shifted as the asset failed to reclaim key resistance levels at R1 ($115,000) and R2 ($125,000), with sellers dominating the market since early October.

Despite the dip below $90,000, a sharp rise in permanent holder demand signals that long-term capital continues to accumulate aggressively. This trend persists even as short-term sentiment weakens. This creates a rare setup where heavy selloff pressure meets record conviction, suggesting that underlying demand may offer a stabilizing force if market conditions begin to shift.

Down-Channel Pressures Bitcoin

Bitcoin has been trading inside a clear parallel down-channel. Each lower high has aligned along the descending trendline, tightening pressure on buyers. The price experienced rejections at mid-channel levels of $107,500, $102,500, and $97,500 before sliding towards the channel's base.

The Relative Strength Index (RSI) for Bitcoin is currently at 26.70, marking its lowest reading since mid-year. The indicator has moved along a clear downward trendline from early October's peak near 65, indicating sustained weakening momentum throughout the decline.

Bitcoin Sees Record Holder Demand as Accumulation Surges

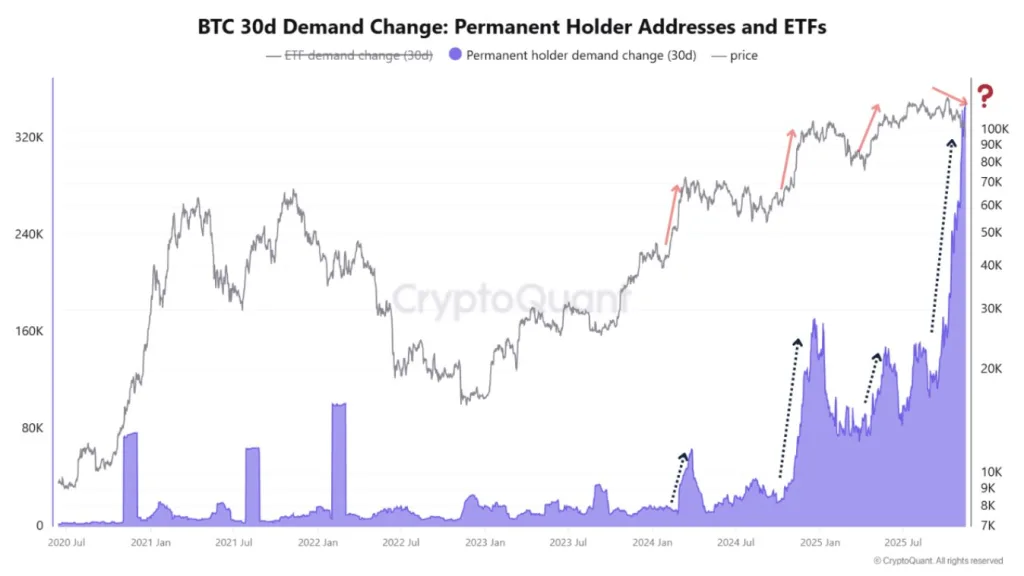

Bitcoin's 30-day permanent holder demand has surged to its highest level on record, even as the broader market faces a selloff. This data, posted by CryptoQuant, shows a sharp increase in permanent holder demand, climbing from the 11,000–15,000 zone to over 100,000.

Analyst @MorenoDV_ described this move as "the biggest BTC accumulation in the middle of a selloff," noting that long-term capital appears to be absorbing supply while short-term sentiment continues to deteriorate.

Throughout the entire dataset, every significant increase in demand has corresponded to notable price reactions in 2024 and 2025, marked by repeated red arrows on the price line. The ongoing decline around the $90,000–$100,000 level does not seem to have affected the buying activity of long-term holders, which now equals the levels seen during larger-scale accumulation periods.

Supply Ratios Fall to Levels Below Prior Bear-Market Bottoms

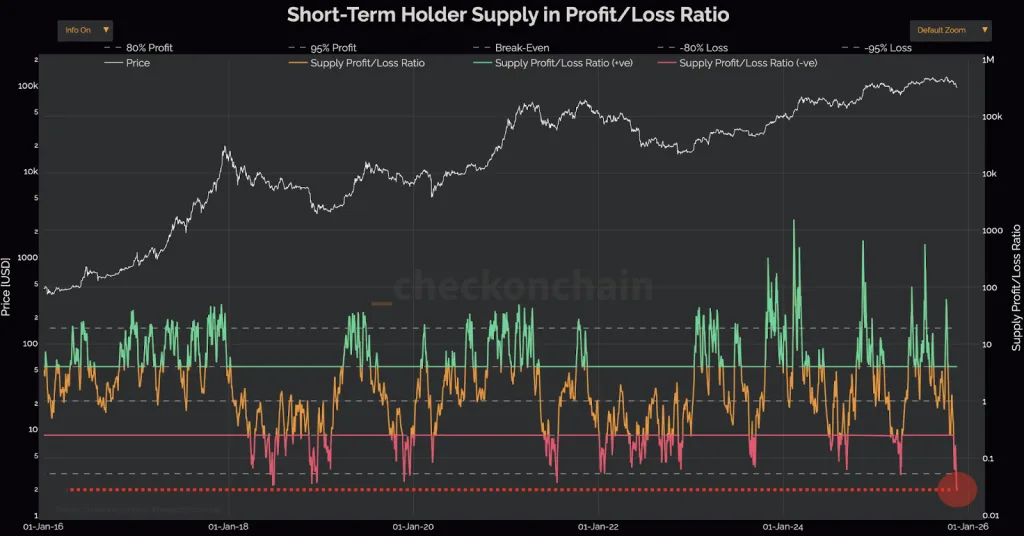

Analyst Onchain College noted that Short-Term Holder (STH) supply has fallen below the –95% loss band, pushing the STH Supply Profit/Loss Ratio towards 0.01. This level has only appeared during the bear market lows of 2018 and 2022.

The dataset showed that positive STH spikes frequently moved within the 10 to 100 ratio range, while extreme losses dropped below 0.1 during periods of deep stress. The latest reading, highlighted in red at the chart's edge, aligned with severe STH distress.

This decline raises a question for market observers: Could severe STH losses near record lows signal an approaching structural shift? Onchain College stated that these loss levels have reached points lower than the last two bear-market bottoms, challenging the belief that recent bearish sentiment across X correctly captured the cycle top.

Moreover, in the long term, the accumulation of Bitcoin during deep market stress has been a forerunner of significant trend shifts. The present demand situation indicates that, in spite of the fierce short-term volatility, Bitcoin might still have a stabilizing floor.