Bitcoin's recent descent below the $90,000 mark has reignited a significant divergence within financial markets, as proponents of the cryptocurrency regroup and its critics intensify their opposition. This movement occurs during a phase where Bitcoin continues to be one of Wall Street's most debated assets. The prevailing sentiment driving the current discussion suggests that this decline might represent a seasonal retreat preceding another upward surge, with Cameron Winklevoss asserting that Bitcoin is well-prepared for future challenges.

Concurrently, Peter Schiff is signaling a different outlook from the sidelines. Bitcoin's drop has attracted renewed scrutiny, prompting critical questions about its narrative as a store of value and compelling both camps to defend their respective positions.

Schiff Renews Criticism as Bitcoin Falls Toward Key Levels

Peter Schiff contends that Bitcoin's recent weakness signifies more than a transient correction. He observed on X that Bitcoin has depreciated by 28.5% from its peak value. Furthermore, he stated that the asset has lost nearly 40% when measured against gold. Schiff highlighted that gold has maintained its value above $4,000, while Bitcoin is struggling to hold its position near $93,000. He asserted that this disparity directly challenges Bitcoin's long-standing narrative as "digital gold."

Schiff further elaborated that this divergence raises doubts about its reliability as a hedge against deflation. He recently criticized a particular strategy, asserting that its foundation relies on volatile gains rather than stable operational performance. He characterized such a model as a "fraud" and cautioned that it could face significant pressure during more profound market downturns. His assessment pointed to inherent risks associated with liquidity, regulatory frameworks, and broader macroeconomic conditions. These warnings contributed to a heightened sense of caution among traders who were already monitoring their relative strength indicators.

Despite these criticisms, the commentary has prompted a renewed wave of pushback from Bitcoin supporters who have framed the current decline as an anticipated event. The central question remains whether Bitcoin's present weakness should be interpreted as a structural decline or if it is merely another reset phase before new demand emerges.

Winklevoss Twins Counter With Long-Term Bullish Outlook

The Winklevoss twins continue to be prominent advocates for Bitcoin's long-term potential, having previously predicted that Bitcoin could reach $1,000,000 within the next decade. Cameron Winklevoss suggested that the current dip below $90,000 might represent the final opportunity to acquire the asset at this price level. He argued that this market movement is indicative of consolidation rather than an outright failure of the asset.

He posted that Bitcoin is positioning itself for another supply-driven advance. Technical charts indicate that the asset is undergoing a pullback following a period of issuance compression, a pattern observed in previous market cycles. These types of movements have often preceded significant recoveries in earlier market phases. His comments directly contrasted with Schiff's warnings, framing the current decline as a strategic maneuver.

These remarks followed the public debut of Gemini on the Nasdaq stock exchange, trading under the ticker symbol GEMI. Gemini Space Station priced its initial public offering at $28 per share and opened for trading at $37.01, valuing the company at approximately $4.4 billion. This listing has brought renewed visibility to the twins' extensive involvement in the cryptocurrency sector.

Accumulation Data Points to Deep-Pocketed Support

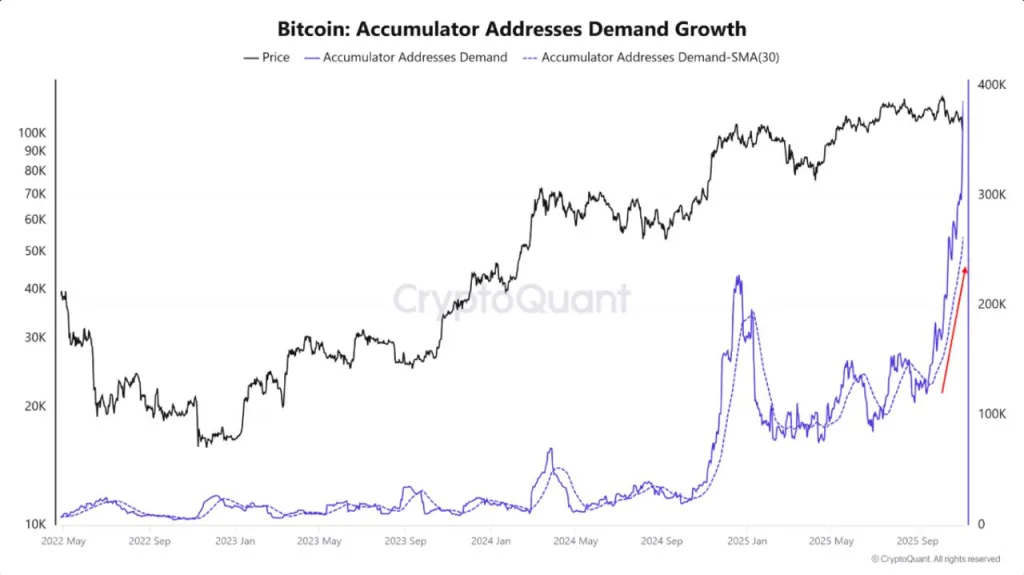

On-chain analyst CryptoSeth shared a chart illustrating a significant increase in demand from accumulator addresses. The data, sourced from CryptoQuant, recorded a robust rise in long-term buying activity. These accumulation trends became apparent as Bitcoin was trading below the $90,000 threshold.

CryptoSeth commented that whales and exchange-traded funds (ETFs) are actively absorbing substantial selling pressure. He stated that Bitcoin "would be much lower if there were no takers." His observation highlights the consistent demand originating from large wallet holders and institutional investment products during the recent downturn.

The trend depicted in the chart aligns with patterns observed in earlier market cycles, where accumulation surged during periods of pullback. These phases have frequently served as foundational bases for subsequent rallies. Investor activity continued to increase throughout the recent decline, suggesting that long-term interest remains robust despite short-term volatility. As buying activity strengthens, the data supports the perspective that the current pullback is more reflective of consolidation rather than a fundamental breakdown.