Bitcoin’s on-chain trader cohort has moved back into profit, marking a shift in short-term market conditions.

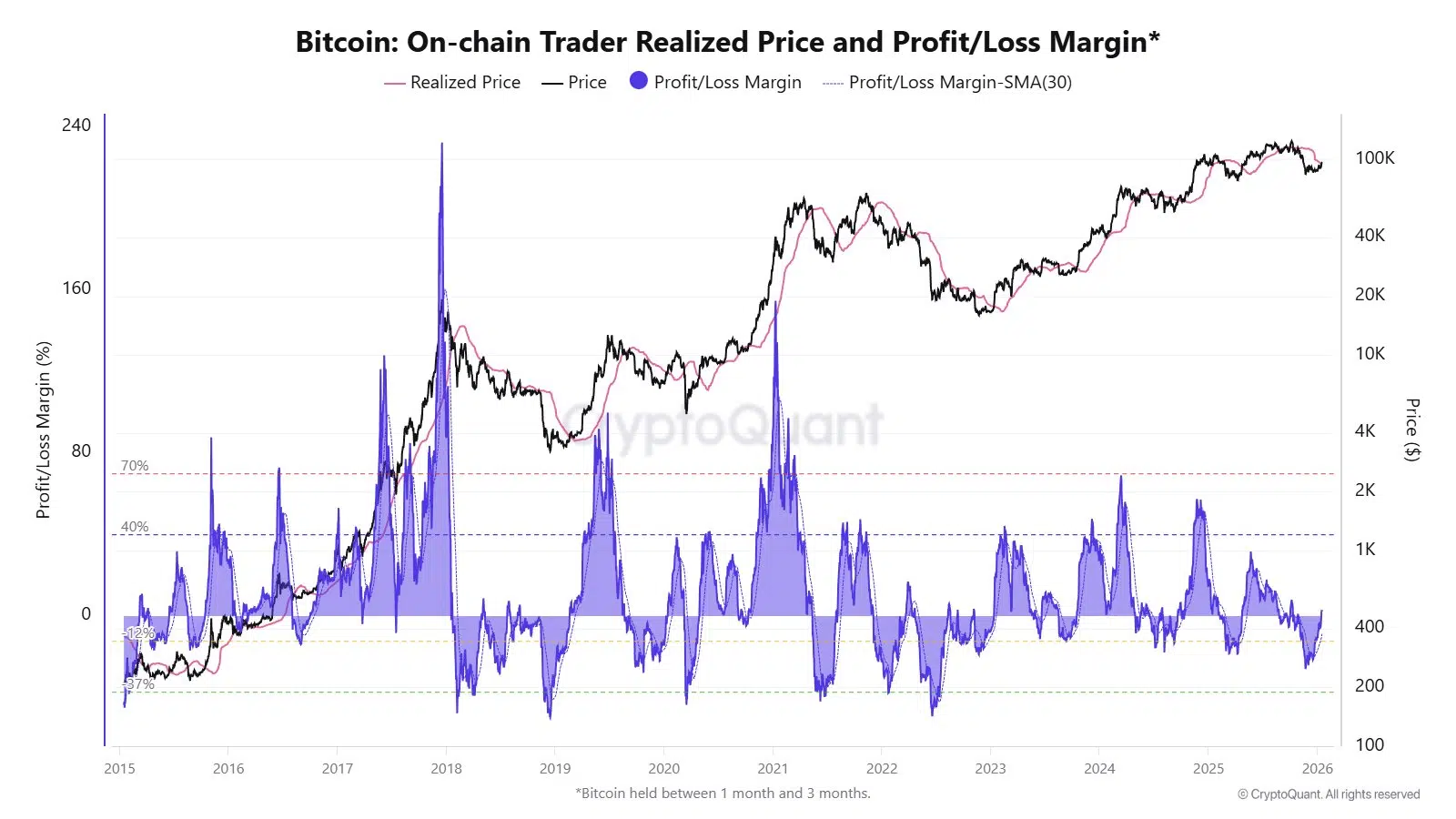

Data from CryptoQuant shows the profit and loss margin for traders holding Bitcoin between one and three months has turned positive again, aligning with Bitcoin trading near the $100,000 area.

The change matters because this group tends to reflect short-term positioning and market psychology. When these traders operate at a loss, selling pressure often dominates. When they return to profit, behavior typically shifts.

Traders Move Back Above Realized Price

The chart tracks Bitcoin’s spot price against the realized price for short-term holders, alongside the trader profit/loss margin. As price moved higher, it reclaimed levels above the realized price line, pulling the profit/loss margin out of negative territory.

Historically, deep negative readings coincided with periods of stress, while positive zones aligned with more constructive market phases. The current move places traders back in profit, though not near historical extremes seen during late-cycle peaks.

The profit/loss margin now sits comfortably above the loss thresholds highlighted on the chart, signaling that recent buyers are no longer underwater.

Psychological Shift Takes Hold

CryptoQuant notes that the return to profitability reflects a positive psychological state among on-chain traders. When positions flip back into profit, urgency to sell often fades, while willingness to add exposure increases.

The chart shows previous transitions from loss to profit frequently coincided with renewed buying activity, as traders regained confidence in near-term price action. While the margin remains well below overheated levels, the direction of change is notable.

Market Context Remains Balanced

Despite the improvement, the data does not show excessive profit-taking pressure. The profit/loss margin remains far from the elevated zones that historically preceded major corrections, suggesting positioning is constructive rather than euphoric.

For now, CryptoQuant’s data frames the market as stabilizing rather than stretched. Short-term holders are back in profit, sentiment has improved, and the structure points to a healthier psychological backdrop as Bitcoin holds higher price levels.