On-Chain Metrics Suggest Underlying Strength Despite Price Drop

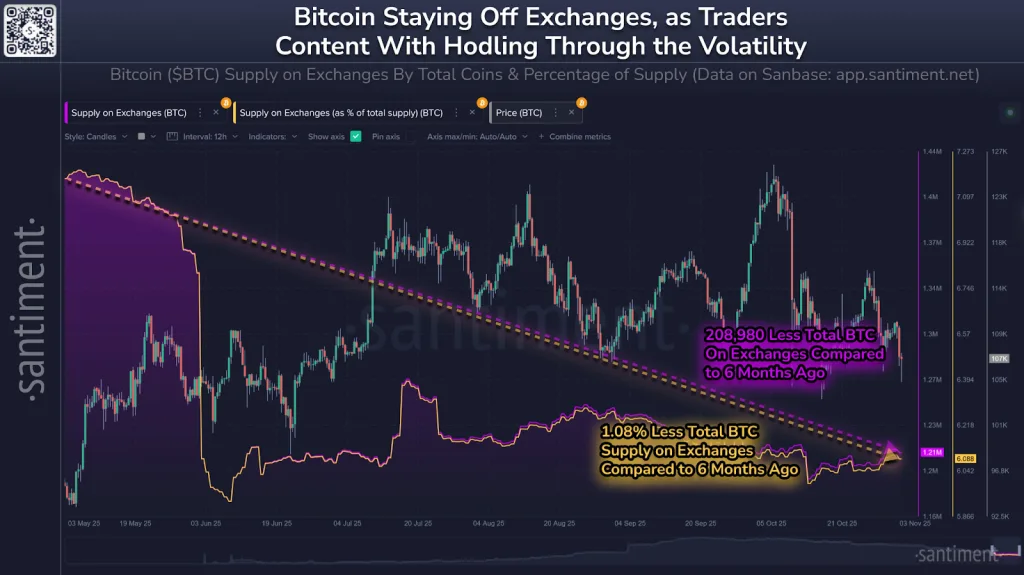

Bitcoin has experienced a sharp decline, dropping more than 14% since October 6. However, recent on-chain data reveals a contrasting trend. According to Santiment, nearly 209,000 BTC have been withdrawn from cryptocurrency exchanges over the past six months, reducing the available supply by approximately 1.08%.

This indicates that many holders are choosing to secure their assets rather than sell, even as prices fall. Market observers view this behavior as a positive sign, suggesting a reluctance to engage in panic selling. A lower supply of Bitcoin on exchanges is often associated with increased market stability and can precede a price recovery.

Santiment's data illustrates a downward trend in exchange balances while the price is retreating, creating a divergence between market sentiment and investor actions. Many traders are opting to hold their coins in self-custody wallets, choosing to wait out the current market conditions instead of reacting to short-term fear. The key question remains whether bulls can maintain support levels.

Selling Pressure Intensifies as Support Levels Break

At the time of reporting, Bitcoin's correction has deepened, with the cryptocurrency breaking below the $107,000–$105,000 range, which had previously served as strong support. This breach has paved the way for further losses, pushing BTC's price down to approximately $104,000. This represents a 3% daily drop, an 8% weekly decrease, and a 14% monthly decline from its recent peak. The broader cryptocurrency market has mirrored this trend, with its total value sliding 3.6% in 24 hours to around $3.47 trillion.

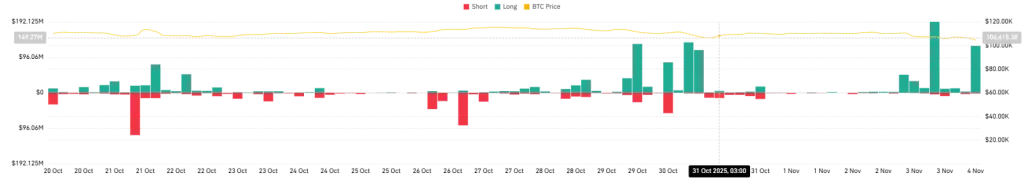

Analysts attribute a significant portion of this sell-off to the liquidation of leveraged positions. Data from CoinGlass indicates that approximately $436 million in long positions were liquidated within two days, while only $20 million in short positions faced a similar fate. This substantial imbalance highlights the impact of forced selling as traders attempt to mitigate losses.

The Fear and Greed Index further corroborates this sentiment, currently standing at around 24, firmly within the "Fear" zone. This indicates growing anxiety among both retail and institutional investors as they reassess their market exposure.

Key Price Levels to Watch for Future Movement

Technical indicators suggest that Bitcoin may test lower levels before finding a stable support base. Should the downward trend continue, the token could probe the $103,600 level, a price point last observed during October's "Black Friday" flash crash, when the crypto market experienced a $20 billion loss in a single day.

Below this level lies the psychologically significant $100,000 mark. A sustained move below this threshold could lead to prices reaching $98,000–$97,000, which aligns with the 127.20% Fibonacci retracement level. Concurrently, the Relative Strength Index (RSI) is hovering near 36, indicating that the market is not yet oversold and has room for further declines.

To regain market confidence, analysts suggest that Bitcoin would need to reclaim the $107,000–$105,000 corridor and establish it as a support level once more. This would be a crucial step in allowing buyers to regain control of the market.

Divergent Analyst Opinions on Market Outlook

Despite the negative price action, not all analysts believe this downturn signifies the beginning of a prolonged bear market. Analyst Altcoin Sherpa has drawn parallels to two previous significant corrections—one in mid-2024 when Bitcoin reached $54,000, and another early this year near $76,000. In both instances, periods of heavy selling were followed by substantial rallies.

Altcoin Sherpa further posits that market reversals often occur when fear reaches its peak. He commented, "It always looks the worst before reversal," suggesting that the current situation could be setting up for a recovery. This perspective is supported by Santiment's data, which indicates that a reduced supply of Bitcoin on exchanges could lead to tighter liquidity and potentially fuel the next rally when market optimism returns.

In essence, while short-term traders are cutting their losses, long-term investors appear to be accumulating more Bitcoin. This shrinking exchange supply might constrain liquidity, which could drive the next upward price movement once sentiment shifts positively.

The upcoming days are critical for determining the market's direction. If bulls can successfully defend the $100,000 level, market confidence may stabilize. Conversely, a failure to hold this level could trigger another downward price movement. Regardless of the short-term outcome, the conviction of long-term Bitcoin investors appears to remain strong.