Bitcoin's bearish momentum has intensified this week, leading to a breach of key support levels. The leading cryptocurrency fell below $95,000 earlier today and is now targeting the $94,000 mark as its next significant support level.

The $94,000 price level holds historical importance for Bitcoin. It has previously served as a consolidation zone, suggesting it could potentially act as a rebound area for the cryptocurrency.

At the $94,000 price point, Bitcoin's Relative Strength Index (RSI) is expected to enter oversold territory. This combination of support retesting and oversold conditions could ignite a renewed battle between bulls and bears, as some buyers might view this level as an opportune entry point.

In related news, recent reports indicate that BlackRock was among the significant Bitcoin sellers in the past 24 hours. The firm reportedly divested 2,310 BTC, valued at approximately $221 million, and 43,240 ETH, worth over $136 million.

Whale Activity Signals Rising Demand as Bitcoin Price Approaches $94,000

Despite the prevailing bearish market sentiment this week, key market data suggests that demand, particularly from whales, has been on the rise. This trend could signal a potential market pivot, possibly around the $94,000 level.

According to Coinglass, data on large order book flows revealed that whales acquired approximately $120 million in Bitcoin over the last 24 hours.

During the same period, this category of traders also executed liquidations totaling around $2.3 billion.

The increased net demand for BTC among whales in the past 24 hours significantly surpasses previous figures from Thursday, underscoring a growing conviction about a potential upcoming market shift.

This marks a notable resurgence for whales, as they had previously exhibited weaker demand at recently breached support levels.

Notwithstanding the growing demand from whales, market data continues to confirm substantial sell pressure. Bitcoin experienced net outflows amounting to roughly $830 million in the last 24 hours at the time of this report.

Potential Risk for Short Sellers as Long Positions Face Liquidation

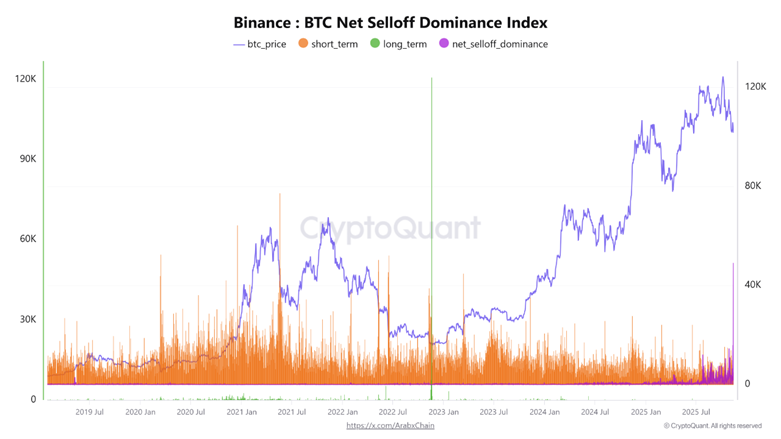

The Bitcoin net selloff dominance index indicates that short-term sellers have been the primary drivers of the current downward trend. The same indicator also shows that long-term holders have maintained their positions.

The observation that short-term sellers are dominating the bearish outcome this week offers insights into potential developments over the weekend.

This also necessitates an examination of other factors contributing to the sell pressure. Bitcoin's decline below critical support levels has triggered significant liquidations.

Over $634 million worth of Bitcoin long positions were liquidated in the past 24 hours. These liquidations may have initiated a long squeeze event and were likely a consequence of a liquidity sweep just below the $100,000 BTC price support level.

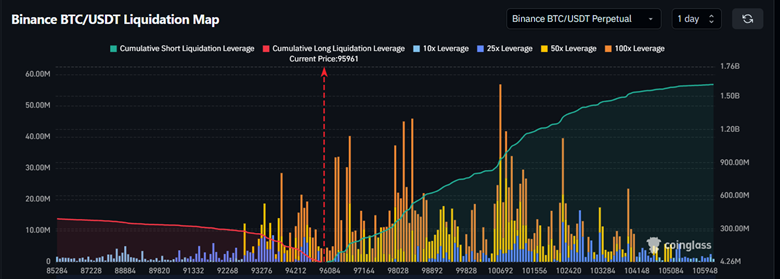

A detailed analysis of the Bitcoin liquidation heatmap suggests that a potential reversal could shift the advantage towards short sellers.

This possibility arises because the number of short positions has been increasing recently, aligning with a prevailing bearish market sentiment.

According to the Bitcoin liquidation map, approximately $929 million worth of liquidations are at risk should the BTC price rebound above $100,000.

Conversely, the cumulative long liquidation leverage for the cryptocurrency was less than $140 million at the $94,000 price level.

In essence, the current liquidation profile may encourage a resurgence in demand, driving the market towards the next liquidity sweep, which would likely target short sellers.