Bitcoin continued its upward momentum, reaching $93,330 after a 7.4% rise in 24 hours, according to CoinGecko. During this price movement, one wallet identified as 0x4321 closed a 20x short position on 447.38 BTC worth $38.67 million. According to Lookonchain, the exit led to a realized loss of $3.2 million.

The long-vs-short battle has its winner.

— Lookonchain (@lookonchain) December 3, 2025

0x4321 has surrendered — closing his $BTC short for a $3.2M loss.

Meanwhile, 0xfB66 is still holding his $BTC long, now sitting on over $2.5M in unrealized profit.https://t.co/Retrri2wOfpic.twitter.com/gZxPwhogeY

The opposing wallet, 0xfB66, had opened a 15x long position on 300 BTC valued at $25.9 million. This position remains active with over $2.5 million in unrealized profit. The long was entered at $84,736.90, with a liquidation price of $72,424, showing resilience as BTC pushed past $93K.

Liquidation Zones and Exchange Activity

According to Glassnode, "Bitcoin faced a strong rejection at $93,000 last week, but as price attempts to break through this level again today, we’re seeing large short-liquidation clusters forming." These liquidation zones often indicate stress among short sellers, especially in high-leverage environments.

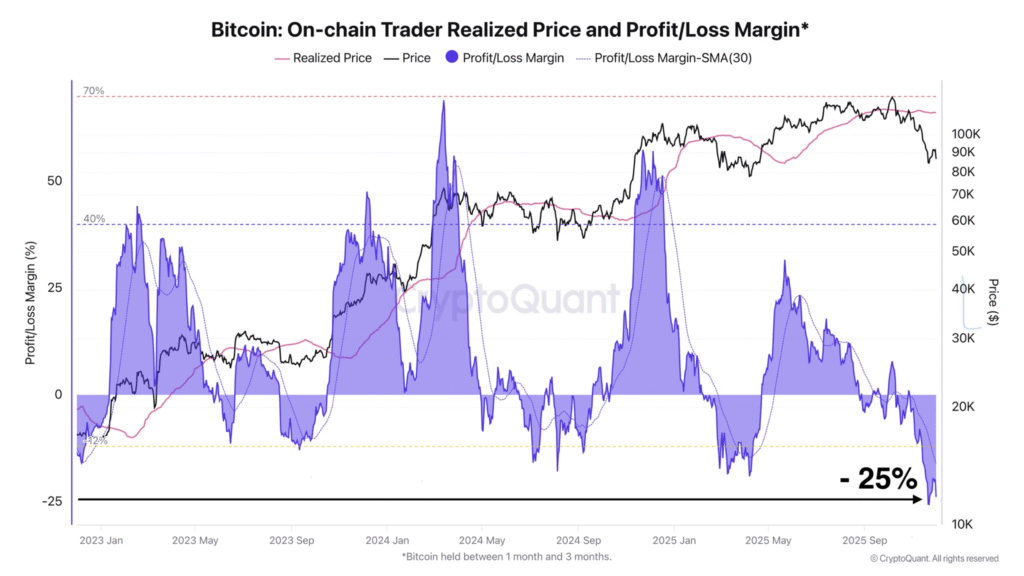

On-chain data supports the bullish trend. CryptoQuant analyst DarkFrost noted that trader capitulation during this cycle often coincides with market bottoms.

“Once a large portion has capitulated, that is usually when the opportunity to accumulate becomes interesting,” he added in a recent post.

Exchange Reserves Drop as Holders Withdraw BTC

Bitcoin held on centralized exchanges has dropped to its lowest level in several years. This decline in reserves indicates more users are withdrawing BTC, possibly into cold storage.

Historically, falling exchange reserves during a price rally suggest accumulation. As Bitcoin tests the $93,000 level again, trading behavior continues to reflect high volatility, with leverage playing a central role in current market dynamics.