Bitcoin's Current Market Position

Bitcoin was up 3% for the day at one point yesterday and appeared to have reclaimed the $113K level. However, the token ended the day down 2% and is currently trading at $108K, leaving many investors uncertain about its future trajectory.

Currently, Bitcoin continues to trade around the 200-day exponential moving average (EMA). This level has historically served as a significant support in Bitcoin's recent price action.

Bitcoin's interaction with the 200-day EMA is particularly noteworthy. Past patterns from 2024 and March to April of 2025 indicate that Bitcoin often consolidates around the 200-day EMA for an extended period, building momentum before making its next upward move, rather than simply retracing and immediately skyrocketing.

For instance, in 2024, Bitcoin spent over three months hovering around the 200-day EMA before rallying more than 80%. Similarly, in early 2025, it consolidated for nearly two months before rallying over 30%.

If historical patterns hold true, the current consolidation phase could extend until at least the end of November before a decisive upward movement occurs.

Furthermore, Bitcoin is finding support at a major upward-sloping trendline. This trendline, in conjunction with the 200-day EMA, has supported Bitcoin's rallies in both 2024 and 2025, suggesting these two key support levels may be forming another Bitcoin bottom.

Patience is therefore advised as the market allows Bitcoin to establish its next move.

Bitcoin Price Prediction and Potential Targets

Regarding a Bitcoin price prediction, the initial level to monitor is the recent swing high, which represents the all-time high of $126K.

However, based on previous instances where Bitcoin comfortably surpassed its then all-time highs, it is plausible that the $150K level could be reached once the current consolidation phase concludes.

Overall, Bitcoin appears to be in a period of accumulation, requiring time to gather sufficient momentum for a clear upside rally. While price fluctuations of $10K are not unexpected, a significant 100% move might still take several months to materialize.

Exploring Bitcoin-Themed Altcoins: Bitcoin Hyper ($HYPER)

For investors seeking to generate substantial gains during this period, a strategy employed by savvy crypto investors involves identifying promising Bitcoin-themed altcoins that are currently undervalued, particularly those in presale.

Bitcoin Hyper ($HYPER) is presented as one such opportunity, potentially offering the next significant growth potential in the upcoming market cycle.

What Is Bitcoin Hyper?

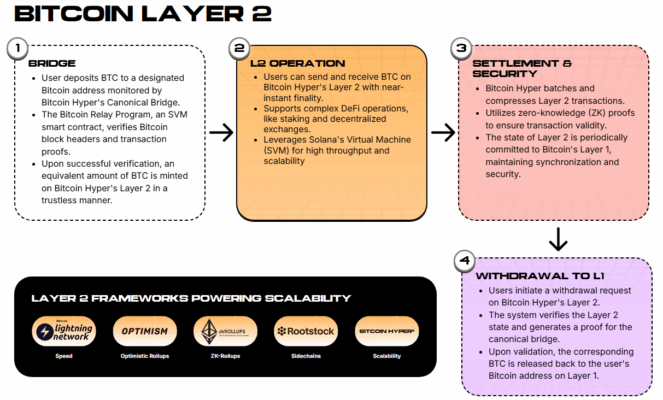

Bitcoin Hyper is positioned not as a typical meme coin, but as a project focused on developing a new Layer 2 solution for Bitcoin. Its objective is to enhance the Bitcoin blockchain with lightning-fast transactions, extremely low fees, and advanced Web3 compatibility.

This will be achieved through the integration of the Solana Virtual Machine (SVM), enabling $HYPER to process thousands of transactions per second, a significant improvement over Bitcoin's current main chain capacity of approximately 7 transactions per second (TPS).

Security is maintained as $HYPER processes transactions on a sidechain, summarizing them and anchoring them to Bitcoin's main chain, thus preserving the network's inherent security.

$HYPER Brings Web3 to Bitcoin

The integration of SVM into Bitcoin Hyper also empowers developers to create smart contracts and decentralized applications (dApps) on the network, a capability not currently available on Bitcoin.

This development is expected to foster a novel Web3 environment on Bitcoin, supporting high-speed DeFi trading applications, NFT marketplaces, DAOs and governance systems, lending, staking, swapping, gaming dApps, and more.

Bitcoin Hyper's non-custodial decentralized canonical bridge simplifies interaction with this emerging Web3 ecosystem on Bitcoin.

The process for utilizing the bridge involves:

- •Sending Layer 1 Bitcoin to a designated address monitored by the canonical bridge.

- •Upon verification, the bridge locks the Layer 1 Bitcoin and mints an equivalent amount of wrapped tokens on Bitcoin Hyper’s Layer 2 network.

- •After completing Web3 interactions, a withdrawal request can be submitted via the same bridge.

- •Following verification, the Layer 1 Bitcoin is released back to the native Bitcoin wallet address, ensuring a seamless and secure process.

Investment Potential of $HYPER

Investing in projects like Bitcoin Hyper at an early stage could yield significant returns, akin to investing in Bitcoin when it was valued at $10 in 2013.

Bitcoin Hyper is presented as having strong fundamentals, aiming to enhance Bitcoin's real-world utility and transform it from a purely investment vehicle into a functional blockchain ecosystem.

While Bitcoin remains a symbol of the crypto industry, the rise of utility-driven cryptocurrencies like Ethereum, Solana, and XRP could potentially diminish Bitcoin's relative appeal if investors seek projects with deeper functionality. Bitcoin Hyper aims to address this by injecting new utility into the Bitcoin ecosystem, potentially solidifying its dominance.

Beyond its fundamental strengths, $HYPER is also generating considerable interest. Currently in its presale phase, Bitcoin Hyper has already raised over $24.5 million, with each token priced at $0.013155. This level of investor confidence suggests significant potential for one of the notable crypto launches of this decade.

Early investors can acquire $HYPER tokens and benefit from a 48% staking APY.