Record Inflows Despite Geopolitical Headwinds

Digital asset investment products recorded $2.17 billion in net inflows last week, marking the largest weekly inflow since October 2025, according to data published by CoinShares. The surge came despite a late-week deterioration in sentiment tied to geopolitical tension, tariff threats, and policy uncertainty.

Regional Performance

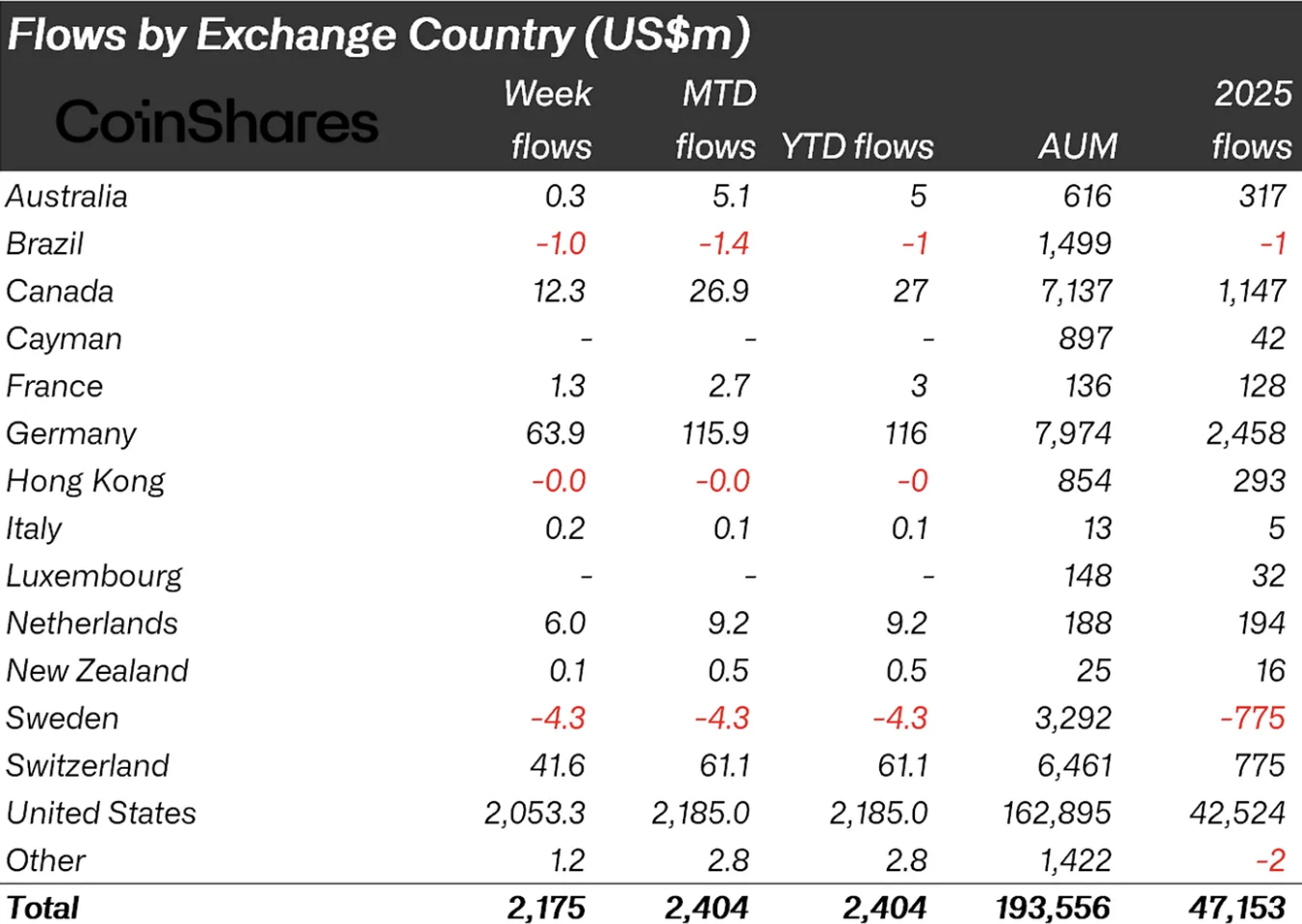

The inflows were broad-based across regions, with the United States contributing $2.05 billion of the weekly total. Europe also posted notable strength, led by Germany ($63.9 million) and Switzerland ($41.6 million). Canada added $12.3 million, while the Netherlands recorded $6.0 million.

By contrast, Sweden saw outflows of $4.3 million, and Brazil recorded modest weekly outflows of $1.0 million. In aggregate, total assets under management across digital asset products now stand at $193.6 billion, with year-to-date inflows reaching $2.4 billion.

Asset Allocation Breakdown

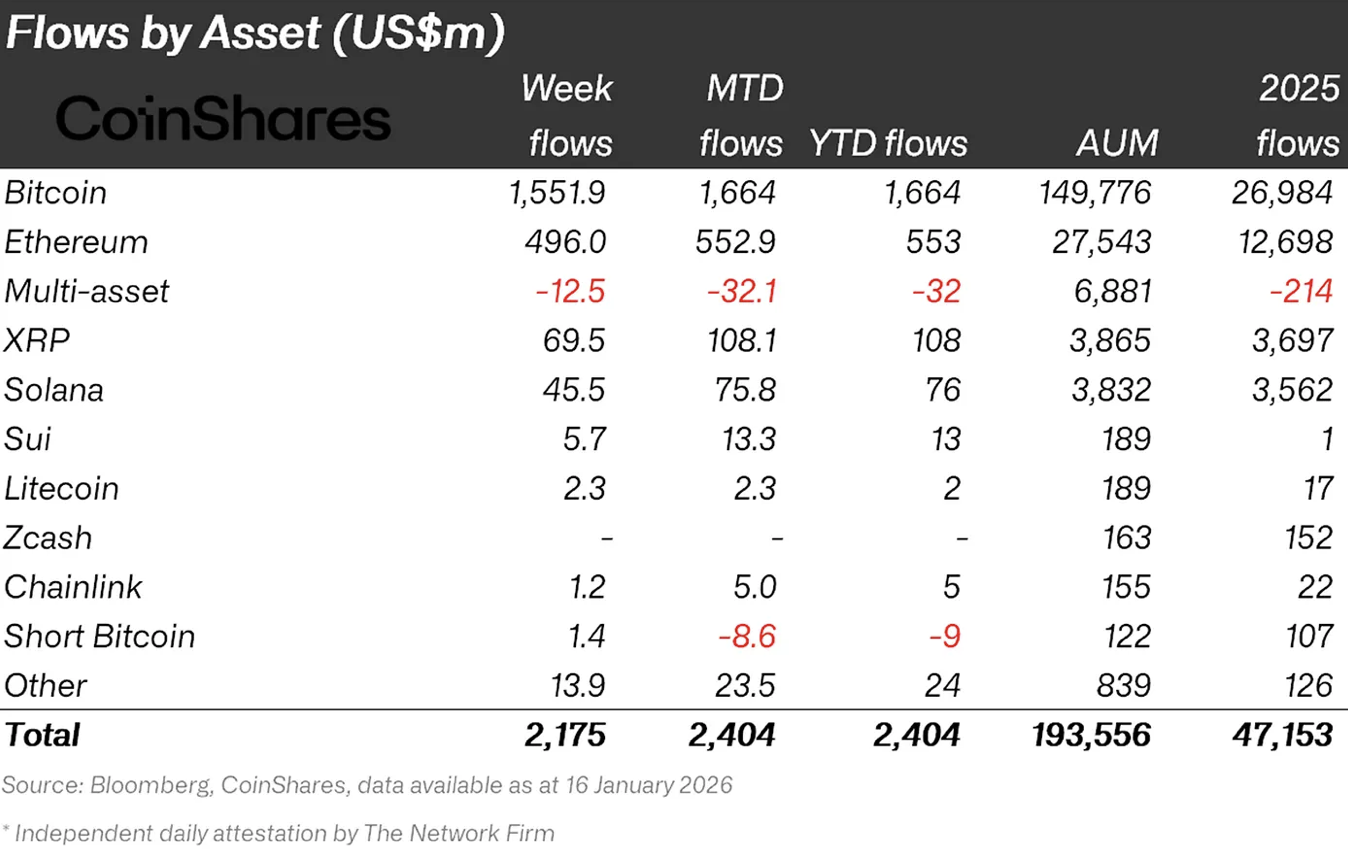

At the asset level, Bitcoin captured $1.55 billion of the weekly inflows, reinforcing its dominant position among institutional investors. Year-to-date, Bitcoin products have attracted $1.66 billion, with total AUM near $149.8 billion.

Ethereum followed with $496 million in weekly inflows, while Solana added $45.5 million. A wide range of altcoins also saw positive allocations. XRP recorded $69.5 million, Sui $5.7 million, Litecoin $2.3 million, and Chainlink $1.2 million. Multi-asset products were the main laggard, posting $12.5 million in weekly outflows.

Despite ongoing debate around U.S. legislation and potential yield restrictions for stablecoins, the data shows investors continued rotating into both major smart contract platforms and select altcoins.

Provider Performance

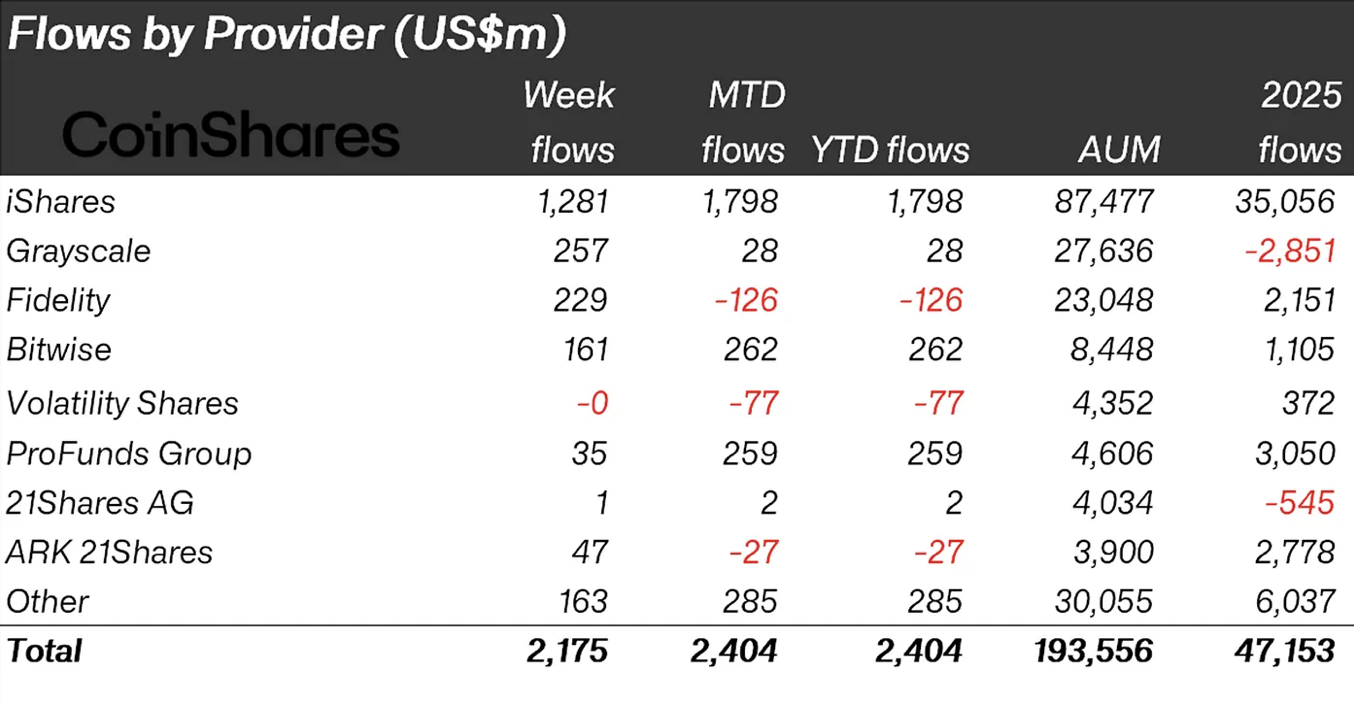

On the provider side, iShares accounted for $1.28 billion of weekly inflows, far ahead of peers. Bitwise followed with $161 million, while Fidelity added $229 million. Grayscale recorded $257 million of weekly inflows, though its 2025 net flows remain negative.

In total, digital asset investment products have accumulated $47.15 billion of inflows in 2025, underscoring sustained institutional engagement with the asset class.

Late-Week Sentiment Shift

While flows were strong earlier in the week, sentiment weakened sharply on Friday. CoinShares data shows $378 million in daily outflows, coinciding with renewed tariff threats, diplomatic escalation related to Greenland, and uncertainty around U.S. monetary policy leadership.

Even so, the overall picture remains constructive. The scale and breadth of inflows suggest investors continue to view digital assets, particularly Bitcoin, as core portfolio exposures rather than short-term speculative trades.