Bitcoin experienced a significant recovery, surpassing the $115,000 mark on Sunday night, injecting renewed optimism into the cryptocurrency market. Currently, Bitcoin is trading around $115,218, with daily trading volume reaching $47.6 billion, reflecting a 3.41% increase in the last 24 hours.

The broader cryptocurrency market capitalization has also seen growth, now standing at $3.9 trillion, a 3.68% increase for the day. Overall trading volumes have surged by 68.41% to $139.39 billion.

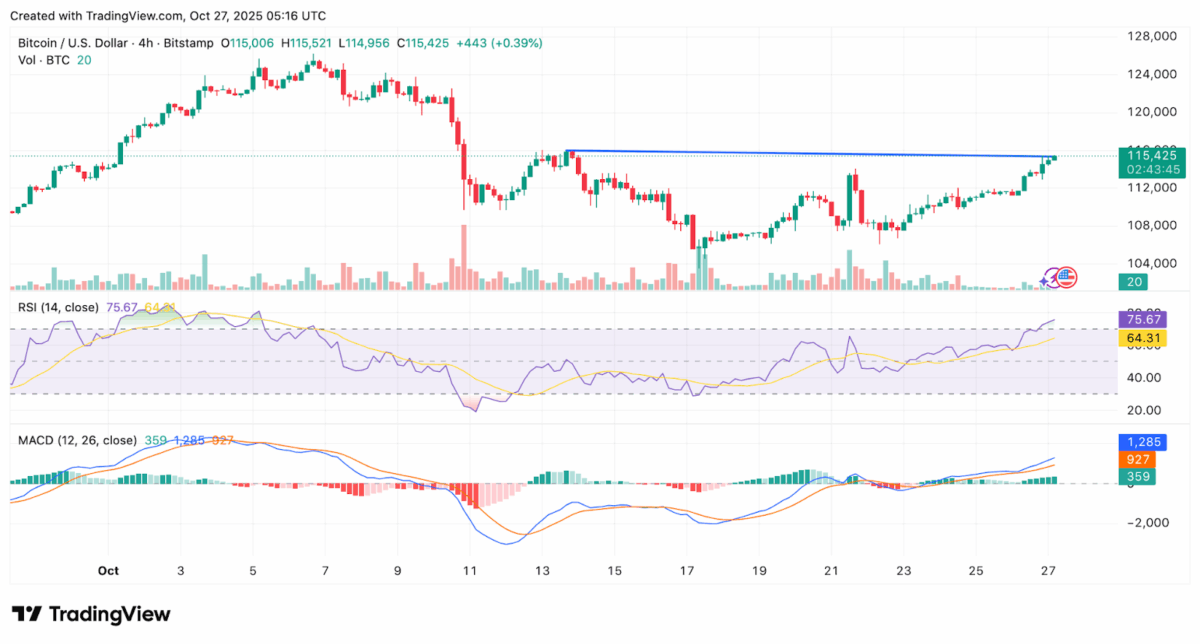

According to TradingView data, Bitcoin's 4-hour chart indicates that the price is approaching a resistance level near $115,400. This level has previously acted as a ceiling multiple times, creating anticipation for a potential price breakout.

Furthermore, the Relative Strength Index (RSI) value of 75.67 suggests that Bitcoin may be slightly overbought, indicating strong demand. The Moving Average Convergence Divergence (MACD) indicator remains positive, signaling that short-term momentum is currently in favor of the bulls.

Analysts Anticipate Increased Volatility

Market analyst Daan Crypto Trades observed, "Sentiment was bearish going into September which ended up green. Sentiment was bullish going into October which is red as we speak. Meanwhile, Bitcoin’s price has opened & closed within a small 8% price range during the past 4 months. A bigger move is coming at some point." He forecasts stronger volatility as the year 2025 concludes.

$BTC This is shaping up to be an interesting monthly candle.

— Daan Crypto Trades (@DaanCrypto) October 26, 2025

Sentiment was bearish going into September which ended up green.

Sentiment was bullish going into October which is red as we speak.

Meanwhile, Bitcoin's price has opened & closed within a small 8% price range during… pic.twitter.com/QvWxZEhyDF

In a similar vein, analyst Crypto Caesar stated, "$BTC – bitcoinbuilder is testing a key resistance around $112K. A CLEAN break and close above it could confirm a bullish continuation toward $123K."

Additionally, trader Astronomer noted that Bitcoin longs initiated around $107K remain open with targets set near $118K. However, he pointed out the potential for a CME gap to be closed before further upward price movement occurs.

$BTC longs

— Astronomer (@astronomer_zero) October 26, 2025

112k hit, getting closer to the above-midrange area.

Alright, price indeed moving higher nicely and push has the health factor we have been looking for.

Of course, we have the developing CME gap to deal with and during periods of ranging (you already know I called… https://t.co/Qc5GoodQJnpic.twitter.com/vsRA0t2hR7

Market Overview

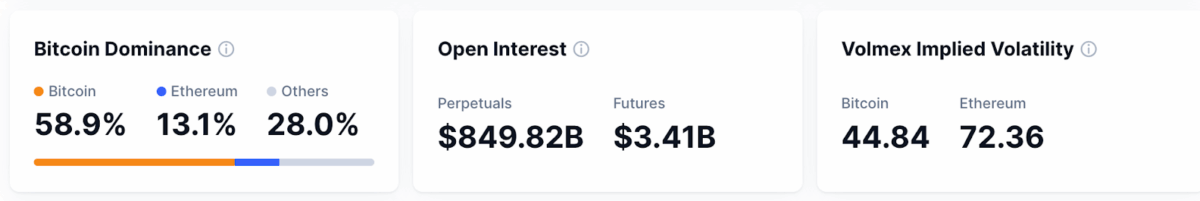

According to CoinMarketCap data, the Fear and Greed Index is currently at 42, indicating a neutral market sentiment. Bitcoin continues to dominate the market with a 58.9% share, followed by Ethereum at 13.1%. The Altcoin Season Index stands at 30, suggesting that it remains a favorable period for Bitcoin.

Trading activity in cryptocurrency derivatives remains robust, with perpetual contracts valued at $849.82 billion and unsettled futures totaling $3.41 billion. Several leading altcoins, including Bitcoin Cash (BCH), Zcash (ZEC), and Uniswap (UNI), have also experienced gains exceeding 10% in the past 24 hours.

Bitcoin's ascent above $115,000 signifies a resurgence in buyer confidence and a renewed energy in the market. Nevertheless, traders are maintaining a cautious stance, anticipating potentially larger price fluctuations before the end of the year.