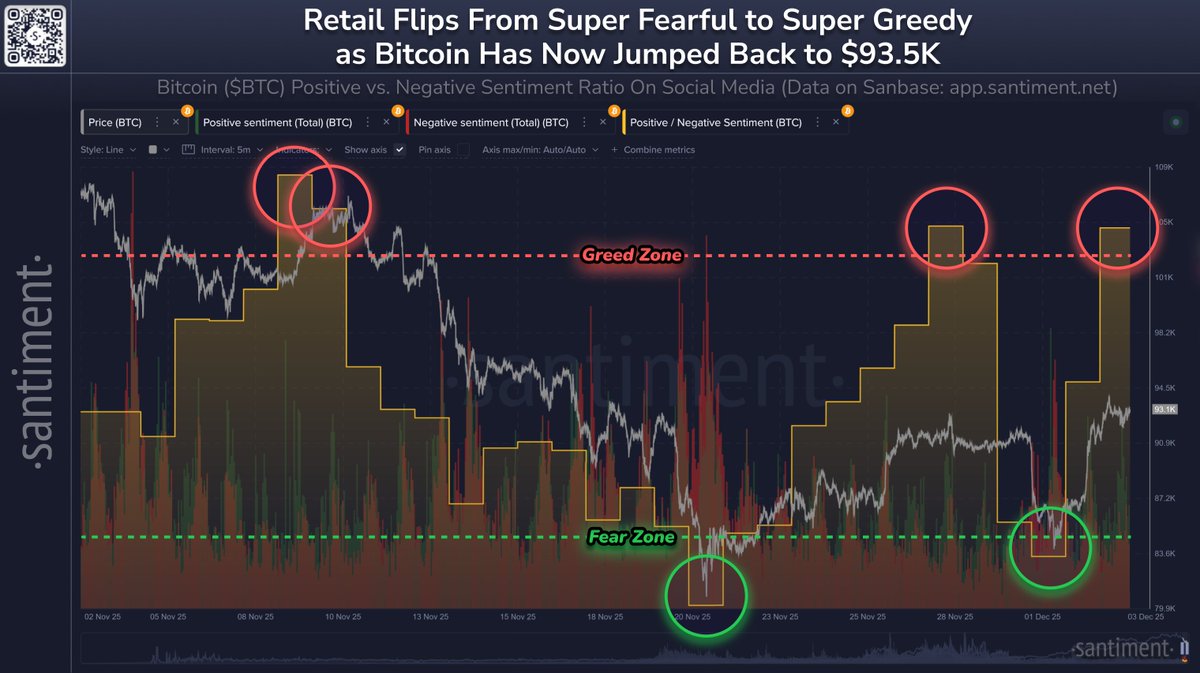

Bitcoin has reclaimed the $93,000 level, and the latest sentiment analytics from Santiment show a dramatic emotional swing among retail traders. According to data collected across major platforms, the crowd has moved from panic to renewed confidence in just days, a pattern that has closely shadowed Bitcoin’s price throughout November and early December.

Fear Marked the Bottom

Santiment’s model compares bullish versus bearish comments about Bitcoin, highlighting moments when sentiment becomes abnormally skewed. The chart shows that each time social media entered the Fear Zone, Bitcoin was forming a local bottom. This happened repeatedly through late November, including during the sharp dip toward the low $80,000s. Negative sentiment spiked far beyond bullish commentary, and that emotional capitulation coincided with the exact period when Bitcoin began its latest rebound.

Greed Has Repeatedly Signaled Short-Term Tops

The opposite conditions have been just as reliable. When retail traders shifted aggressively into the Greed Zone, Bitcoin’s price briefly overheated and stalled. These greed spikes appeared at three separate moments in November, all of which were followed by pullbacks or periods of consolidation. Now, with Bitcoin back near $93.5K, the sentiment gauge has surged into greed once again. Historically, this level of enthusiasm tends to signal a short-term cooling period ahead.

What the Current Shift Means

Markets often move against crowd expectations at emotional extremes, and the past month’s behavior reinforces that tendency. The latest push into the Greed Zone suggests that the rally may pause or soften as overly optimistic traders dominate the conversation. If momentum slows, sentiment could reset organically, a process that has previously helped Bitcoin build support for the next uptrend.

Looking Ahead

While the sentiment surge shows growing confidence, it also raises the possibility of a near-term slowdown before Bitcoin attempts a stronger move. A brief consolidation would bring social sentiment back to a more neutral zone and relieve the emotional pressure seen during these peaks.

For now, traders are watching whether Bitcoin can maintain its grip on $93,000 or whether this round of greed marks another temporary high, just as it has throughout the past several weeks.