Towards the end of the year, a cyclical indicator highlights a potential $200,000 threshold for Bitcoin, driven by increasing demand since July. According to CryptoQuant, the visible demand is rising rapidly at approximately 62,000 BTC monthly. This increase mirrors the backdrop of growth seen in the fourth quarters of 2020, 2021, and anticipated in 2024. The trend in large‑wallet balances and spot ETF inflows supports this scenario. On the valuation side within the blockchain, the $116,000 level is recognized by traders as the Realized Price threshold.

Dynamics of Bitcoin Demand

With the latest data, the balances in large wallets reached an annual growth rate of 331,000 BTC. This presents a stronger picture compared to the trend of 255,000 BTC observed in the fourth quarter of 2024 and the 238,000 BTC increase in the same period of 2020. In 2021, a contraction of 197,000 BTC was recorded. The monthly demand increase of 62,000 BTC is considered essential ground for price movement.

In the ETF sector, a purchase of 213,000 BTC was made in the fourth quarter of 2024, and the total asset size under management of ETFs grew by 71 %. The strengthening of demand indicators through the institutional channel stands out prominently.

Crypto Sentiment Turns Bullish

CryptoQuant’s Bull‑Bear Market Cycle Indicator classifies the placement of spot price over realized price as the “Bull” phase. Conversely, descents below reflect the “Bear” phase. A sustained movement above $116,000 is marked as a prerequisite for a shift to the bull phase in the indicator. It is noteworthy that the valuation range is fundamentally between $160,000 and $200,000.

The Bull Score Index has been fluctuating in the range of 40‑50 in recent days. In 2024, after the index exceeded 50 at the start of the fourth quarter, the price had advanced from $70,000 to $100,000.

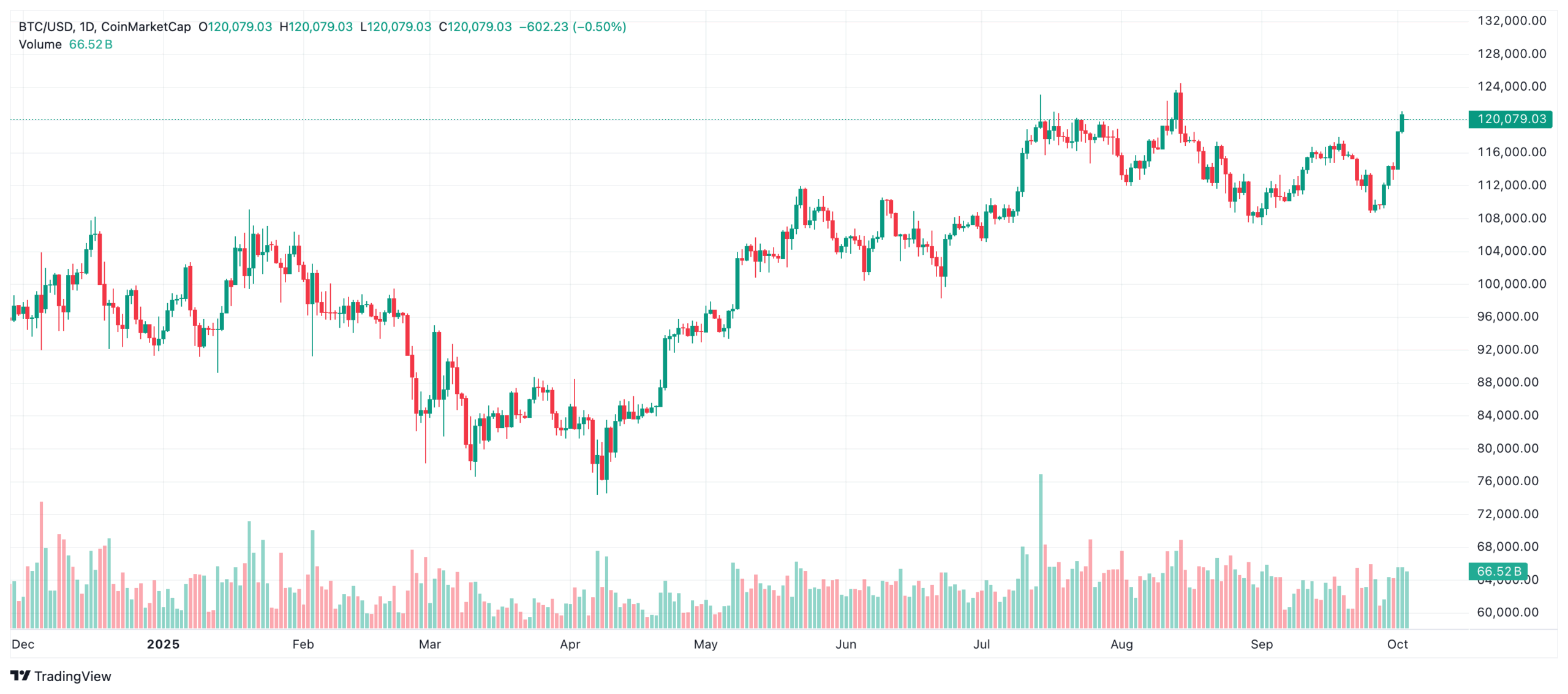

According to CryptoAppsy data, at the time of writing, Bitcoin is trading at $120,056, a rise of 1.35 % over the past 24 hours. On October 2, it briefly surpassed the $121,000 threshold. Currently, Bitcoin is valued only 3.53 % below its all‑time high of $124,457.