Bitcoin is entering a crucial phase, with its price currently holding above $90,000 as traders await the Federal Reserve's final meeting of the year. The market structure is tightening, and investors are closely watching the $89,000 to $95,000 zone for directional signals. Despite a cautious sentiment, seasonal patterns and robust underlying demand are keeping the possibility of a "Santa rally" alive. Reduced leverage and subdued activity in the derivatives market are also contributing factors to this week's trading setup.

In brief

- •Bitcoin has maintained its position above $90,000 following a volatile weekend, keeping the $89,000–$95,000 range as a key focus area.

- •Traders are observing critical price levels as the Federal Reserve prepares to announce its final interest rate decision of the year, with a 25 basis point cut widely anticipated by the market.

- •Low leverage, a decrease in open interest, and historical seasonal patterns suggest that a year-end rally remains achievable if Fed Chair Jerome Powell conveys a message of economic stability.

Bitcoin Tests Key Levels Ahead of Fed Week

Bitcoin continues to exhibit significant volatility, having reclaimed the $90,000 level on Sunday and successfully defending it thus far. This weekend rebound underscores the rapid shifts in market momentum, with traders reacting intensely to price movements within the broad $87,000 to $90,000 range. Several prominent analysts are closely monitoring this price structure, as highlighted in recent market analysis that detailed key expectations for the current trading range.

Trader CrypNuevo anticipates a potential move towards the 50-day Exponential Moving Average (EMA) located near $95,500, which represents a significant liquidity cluster. However, this analyst still does not see a clear long setup, acknowledging that a retest of the lower $80,000s remains a possibility if Bitcoin fails to establish a stronger support base. Michaël van de Poppe, on the other hand, observes strong buying pressure near recent lows and believes that a sustained move above $92,000 would provide support for a bullish continuation trend.

Daan Crypto Trades emphasizes the significance of the $84,000 Fibonacci retracement level. This area previously acted as support earlier in the month, and a failure to hold this level would disrupt the higher-timeframe market structure, potentially exposing the April lows as the next downside target.

Fed Decision Takes Center Stage This Week

With a limited number of macroeconomic data releases scheduled for this week, the Federal Open Market Committee (FOMC) meeting is set to dominate market attention. Financial markets widely expect a 0.25 percent interest rate cut, a move supported by recent weakening in U.S. labor data. The Nonfarm Payrolls report has shown declines in five of the last seven months, a trend described as the weakest streak in at least five years.

Despite this, Mosaic Asset Company views the overall economic backdrop as constructive. While inflation remains above the Federal Reserve's target, the broader economy appears stable, and the S&P 500 is trading near all-time highs. According to Mosaic, this combination of factors creates a favorable environment for risk assets if the Fed continues its easing policy. Jerome Powell's press conference following the rate decision will be particularly crucial, as markets will be scrutinizing his remarks for any indications regarding the future path of monetary policy into 2026. His communication could significantly influence the reaction of both equity markets and Bitcoin to the FOMC's decision.

Bitcoin Santa Rally Depends on Market Reaction and Seasonality

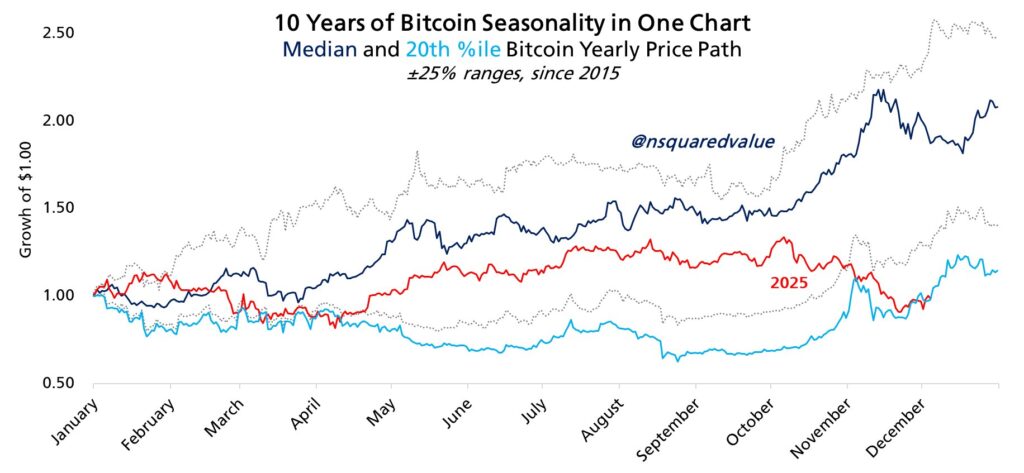

Bitcoin has underperformed traditional stock markets throughout the fourth quarter, while major stock indices have been trading near new record highs. Nevertheless, historical seasonal patterns have sustained the narrative of a potential "Santa rally." Analyst Timothy Peterson has identified strong similarities between the current market cycle and the period observed between 2022 and 2023.

His assertion that "$89,000 is the new $16,000" reflects the perspective that Bitcoin may be in the process of forming a longer-term bottom or consolidation floor.

Timothy Peterson

Analyst Joao Wedson anticipates that Bitcoin will likely trade sideways to end the year, noting that the cryptocurrency has already experienced more negative trading days than its historical average for this period. In his view, any significant correction is more probable in 2026 rather than occurring in the final weeks of the current year. These differing outlooks highlight the extent to which the next significant price movement for Bitcoin is contingent upon macroeconomic events, particularly the Federal Reserve's upcoming interest rate decision.

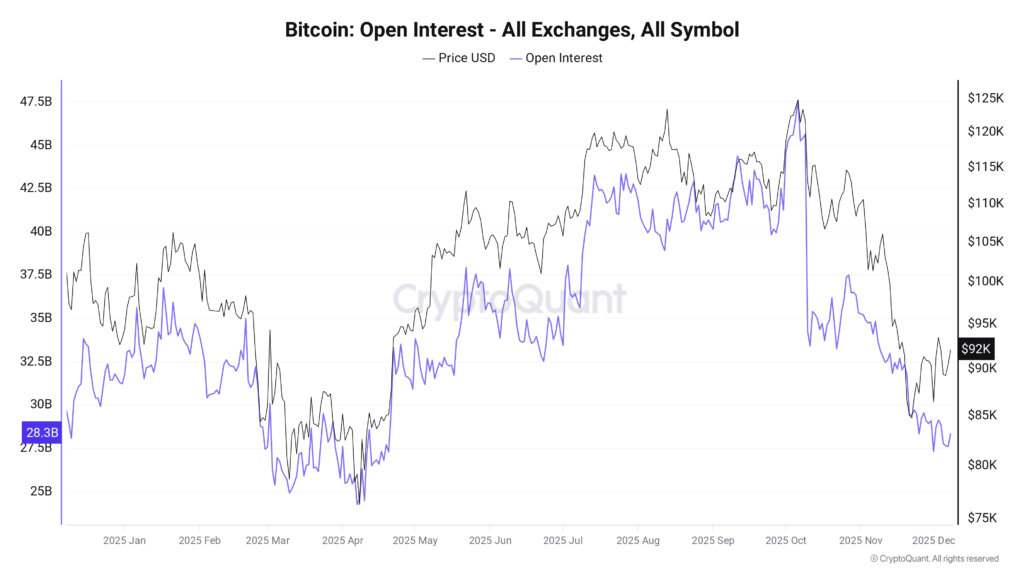

Market signals derived from the derivatives market further support this cautious outlook. Recent data from CryptoQuant indicates that open interest across major cryptocurrency exchanges has fallen to its lowest point since April. Analyst Coindream explains that such declines often signify investor apathy or a mild form of capitulation, both of which have historically presented opportunities for buying on dips. Leverage ratios have also decreased substantially since mid-November, which has reduced structural pressure on the market and contributed to a healthier trading environment.

Even after the recent rebound from the $80,500 level, traders have not significantly increased their leverage. This suggests that the market has already absorbed its recent correction and is now awaiting a macroeconomic catalyst to determine the direction of its next move. The combination of seasonal tendencies, reduced leverage, and a tightening market structure creates the potential conditions for a "Santa rally." However, the ultimate outcome will likely depend on the market's interpretation of the Federal Reserve's policy announcement and whether buyers can successfully reclaim control above key resistance levels.

Bitcoin Outlook for the Coming Weeks

Bitcoin is entering a pivotal period, with its price holding above $90,000 amidst persistent volatility. The price range between $89,000 and $95,000 is considered the critical zone to watch ahead of the Federal Reserve's final interest rate decision of the year. If the Fed proceeds with a rate cut and Fed Chair Jerome Powell conveys a stable economic outlook, Bitcoin could gather sufficient momentum to break through the upper boundary of this range. Existing supportive factors, including seasonal patterns, reduced leverage, and steady demand, bolster the possibility of a year-end rally. The next significant price movement will be determined by how financial markets interpret the Fed's communication and whether buyers can regain dominance above crucial resistance levels.