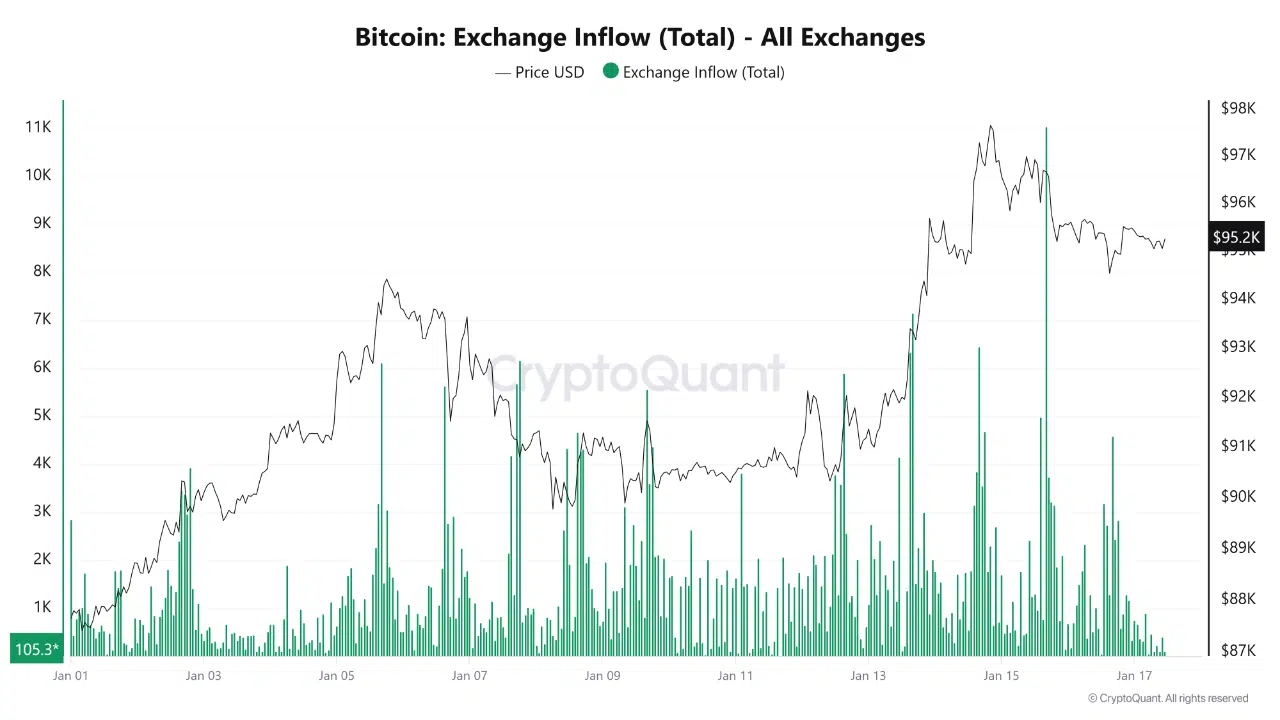

According to a report shared by CryptoQuant, Bitcoin is entering a more fragile on-chain phase as exchange inflows surge to some of the highest levels seen so far this month.

The data shows a clear increase in BTC moving onto exchanges, a pattern that typically reflects distribution behavior rather than long-term accumulation, particularly after an extended price advance.

The total exchange inflow chart highlights several high-magnitude inflow spikes that align closely with local price highs. Historically, this behavior suggests that market participants are using periods of strength to transfer coins into liquid venues.

While elevated inflows do not automatically signal an immediate reversal, they have often preceded volatility expansions or corrective phases, as sell-side availability increases.

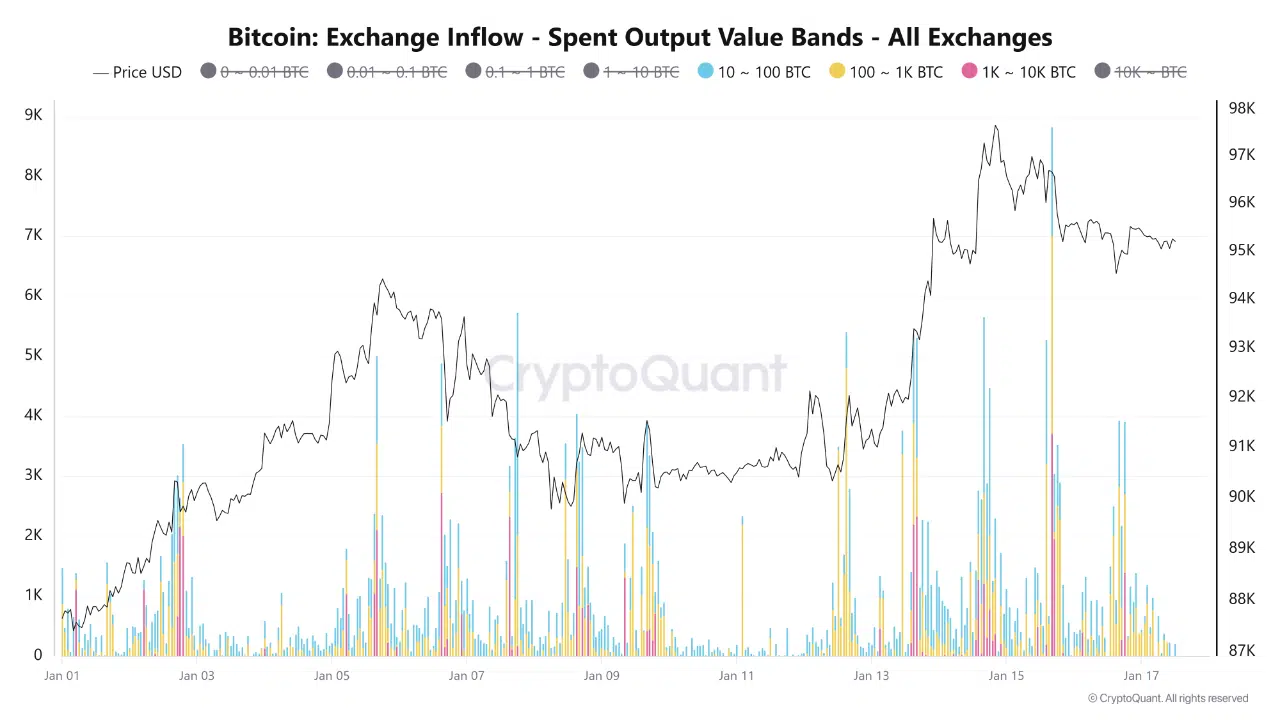

Larger Holders Drive Recent Inflows

A closer look at exchange inflows by spent output value bands adds important context. The latest spikes are not driven by small retail-sized transfers. Instead, activity is concentrated in the 10–100 BTC and 100–1,000 BTC cohorts, categories commonly associated with whales, funds, and long-term holders adjusting exposure.

CryptoQuant notes that flows from these size bands tend to be more informative than fragmented retail movements. Their behavior usually reflects strategic portfolio decisions, such as profit realization or risk reduction, rather than short-term noise.

Market Structure Turns More Delicate

From a broader on-chain perspective, the combination of elevated exchange inflows and distribution from larger cohorts points to a shift in market structure. Momentum can still persist in the near term, but the balance of risk is changing. If Bitcoin struggles to establish sustained new highs while inflows remain elevated, it would strengthen the view that supply is beginning to outpace demand.

This setup does not imply that a downturn is imminent. Instead, it signals that the market is becoming more sensitive to negative catalysts and liquidity shifts.

Why Exchange Inflows Matter Now

CryptoQuant emphasizes that persistent large inflows are more consistent with late-cycle behavior than with aggressive accumulation phases. In such environments, capital preservation and profit-taking tend to play a larger role in decision-making, increasing the likelihood of choppy price action.

As a result, exchange inflow dynamics are emerging as a key metric to watch. Continued strength in these flows would suggest growing distribution risk, while a clear cooling would be needed to restore confidence that accumulation remains dominant.