Bitcoin is flashing a powerful combination of on-chain signals that suggest the worst of the recent sell-off may be behind the market. Fresh data from CryptoQuant and Glassnode shows that almost all selling pressure is coming from short-term traders, while long-term holders and large whale wallets continue to accumulate aggressively into weakness, a dynamic often seen at major cycle turning points.

Short-Term Capitulation Dominates Bitcoin’s Sell-Off

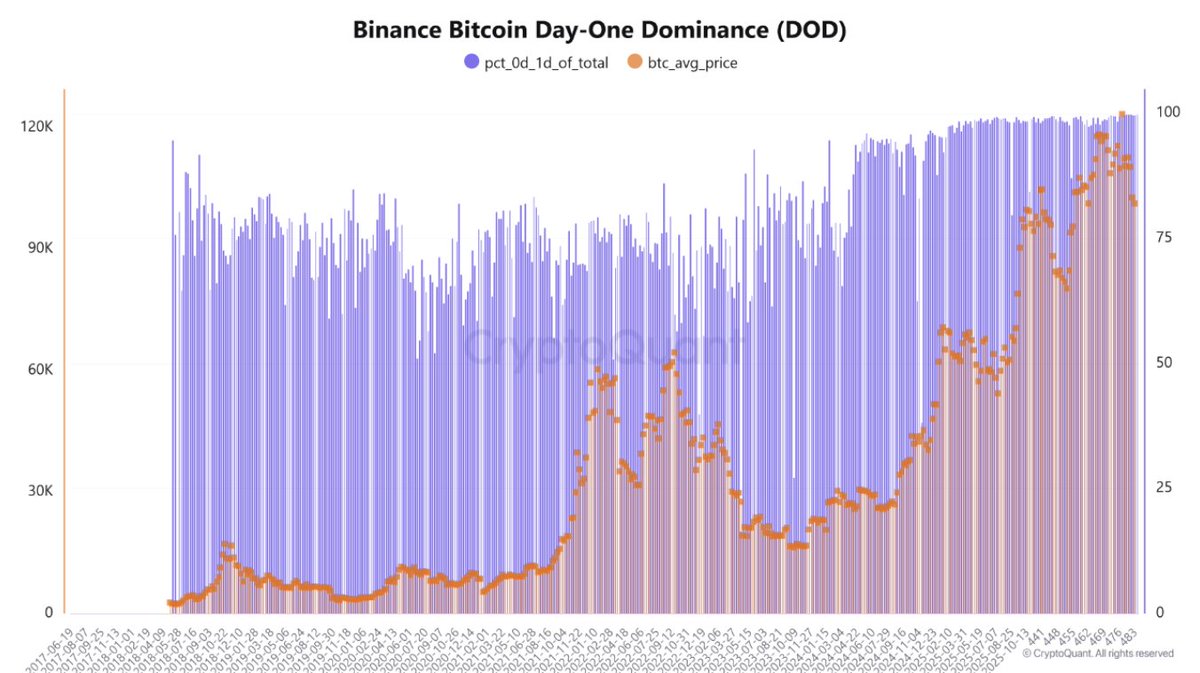

According to CryptoQuant’s Day-One Dominance (DOD) metric, Bitcoin’s selling pressure is now coming almost exclusively from short-term holders.

The DOD indicator, which measures how much of Bitcoin’s supply was deposited to exchanges within 24 hours of being acquired, has reached an unprecedented 99.9%.

This marks a dramatic rise from 70% in 2022 and signals that the latest decline was driven overwhelmingly by fast-moving, speculative capital rather than seasoned long-term holders.

Historically, spikes of short-term capitulation like this tend to occur near local bottoms, as weak hands exit during volatility while long-term investor conviction stays intact.

CryptoQuant summarizes it clearly: Long-term holders are still holding strong, a bullish indicator of investor confidence.

Whale Accumulation Surges to Highest Level in Four Months

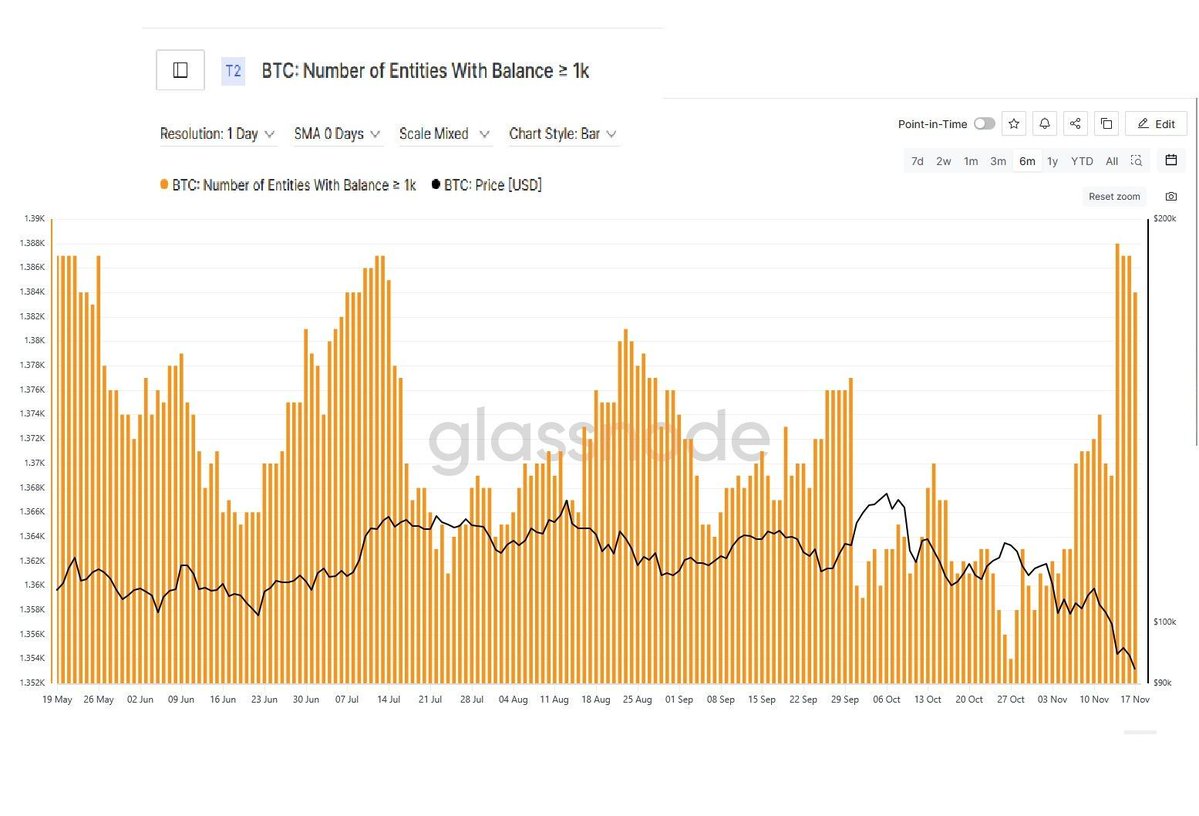

While retail traders panic sold into the correction, large Bitcoin holders have been buying aggressively.

Glassnode data shows that wallets holding 1,000 BTC or more just jumped 2.2% to 1,384 addresses, the highest reading in four months. This surge in accumulation happened at the same time that Bitcoin’s price fell sharply, a classic signature of “smart money” behavior.

Whales have historically accumulated during fear-driven dips and distributed during euphoria.

The current trend suggests whales view the recent correction as a buying opportunity, not the start of a prolonged downtrend.

As one analyst framed it: “While retail panic sells, big players are quietly loading up. Dips are gifts.”

Long-Term Holders Signal Stability Despite Market Turbulence

Combined with short-term capitulation data, the resilience of long-term holders paints a supportive long-cycle outlook.

Even as Bitcoin dropped below key psychological levels, old-hand investors did not contribute meaningfully to the sell-off.

This divergence, weak-hand selling versus strong-hand holding, typically reinforces the structural strength of the broader bull cycle.

Market sentiment collapsed into fear, with indicators reaching their lowest levels in months, but long-term holders continue to anchor the market with high conviction.

Conclusion

Bitcoin’s price may still be volatile in the short term, but the underlying on-chain trends show a very different picture beneath the surface:

- •Short-term speculators have already capitulated.

- •Long-term holders remain unfazed.

- •Whales are aggressively accumulating at multi-month highs.

When these signals align, Bitcoin has historically been closer to a rebound than a deeper collapse.