Bitcoin (BTC) has fallen below the $100,000 mark, triggering a significant wave of forced liquidations across the cryptocurrency market. In a 24-hour period, over $1.78 billion in leveraged positions were wiped out, according to data from Coinglass on Wednesday. This event represents one of the largest single-day liquidation events of the quarter, pushing market sentiment into a risk-off territory. A total of over 441,069 traders were impacted as major positions in both BTC and Ethereum (ETH) triggered margin calls and subsequent liquidations.

Bitcoin's Price Action and Market Sentiment

Currently, BTC is trading around $101,551, showing a slight recovery from an intraday low of $98,966. This minor recovery accounts for approximately 0.05%. The market's direction is heavily influenced by a descending wedge pattern that formed during the sharp decline from $116,400.

A key resistance level for the ongoing struggle between bulls and bears is situated at $105,561, which corresponds to the 0.382 Fibonacci retracement level. The primary support area is located near $98,861, representing the local low.

The Relative Strength Index (RSI) for the 14-day period is currently at 32.39, indicating that the market is oversold. However, the moving average is hovering around 44.74, which suggests weak buyer interest. The broader market view reveals a significant resistance zone between $116,000 and $123,600, alongside a strong support base ranging from $98,800 to $101,000. These levels have been in place since August and have been tested multiple times. A decisive close below $98,800 could lead to further price declines, potentially reaching $96,000. Conversely, a breakout above $107,000 might restore short-term confidence.

Traders are exhibiting increased caution during the current brief rally due to reduced liquidity and heightened volatility. The market is still processing the impact of heavy derivatives trading, where leveraged participants are finding it challenging to maintain their positions as market momentum continues to shift.

Record Liquidations Across the Crypto Market

Data compiled by CoinGlass indicates that Ethereum (ETH) led the liquidation list with $590.72 million, followed closely by Bitcoin (BTC) with $519.73 million. These two cryptocurrencies accounted for over 60% of the total liquidations, reflecting substantial financial losses. MMT ranked third with $129.59 million, XRP followed with $40.84 million, and a group of smaller altcoins contributed a combined $107.32 million, also experiencing significant losses.

Within shorter timeframes, liquidations totaled $37.69 million over a 4-hour period and reached $1.09 billion over 12 hours, demonstrating persistent pressure across global exchanges. The largest single liquidation event was recorded on Hyperliquid's ETH-USD pair, valued at $26.06 million, highlighting the inherent risks of employing high leverage in volatile markets.

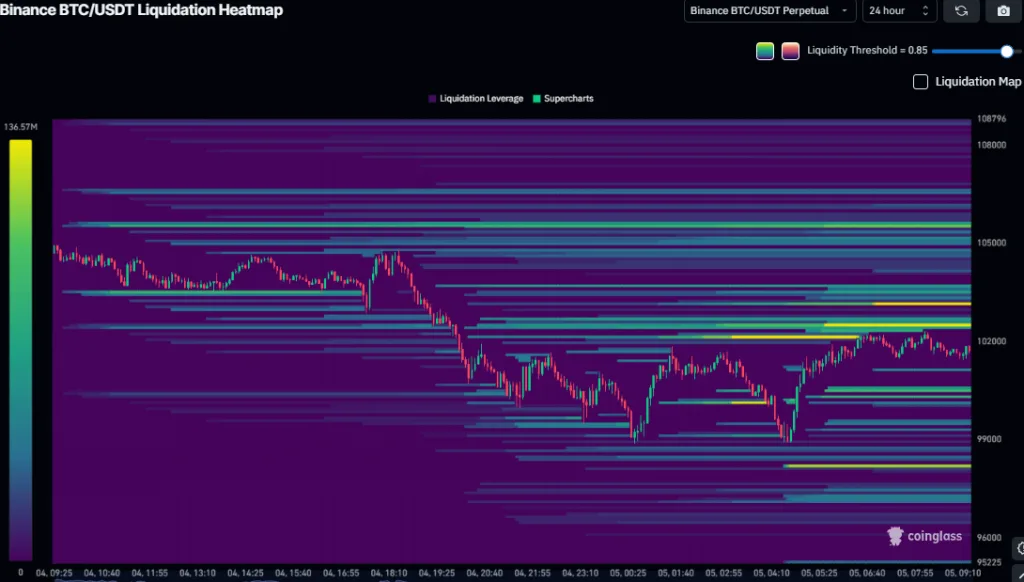

Simultaneously, BTC/USDT liquidation heatmaps revealed concentrated clusters around the $101,500 and $99,800 price points, where forced selling activity was accelerating. Liquidity levels remained around 0.85, indicating thin order books and weak market depth. The significant liquidation bands observed between $98,500 and $99,000 underscore the market's substantial long exposure, which was severely impacted by the price compression experienced from $105,000 down to $96,000.

Market Volatility and the Potential for a Bullish Reversal

Bitcoin is presently trading at approximately $101,800, holding just above critical support levels. Market participants are scrutinizing this price action for signs of a potential reversal, which would be confirmed by a sustained close above $105,000. Until then, the market situation remains precarious, presenting significant challenges for traders navigating the prevailing uncertainty.

The market fluctuations affecting ETH, BTC, and other altcoins continue to be considerable, leading to a series of margin calls. Coinglass's liquidation map visually represents over-leveraged clients, identified by yellow bands, who have been liquidated due to rapid price movements. The entire cryptocurrency industry, still recovering from recent impacts, is now undergoing a test of its resilience.