Bitcoin has fallen below $90,000 for the first time since April, with Ethereum and XRP also experiencing declines as "extreme fear" permeates the cryptocurrency market.

As of 3:12 a.m. EST, BTC is trading at $89,730.57, marking a drop of over 5% in the last 24 hours and more than 14% over the past week.

Other major cryptocurrencies have also seen significant downturns. Ethereum (ETH), the leading altcoin, has slumped 6%, falling below the crucial $3,000 level. XRP has shed over 5%, moving closer to the $2 mark.

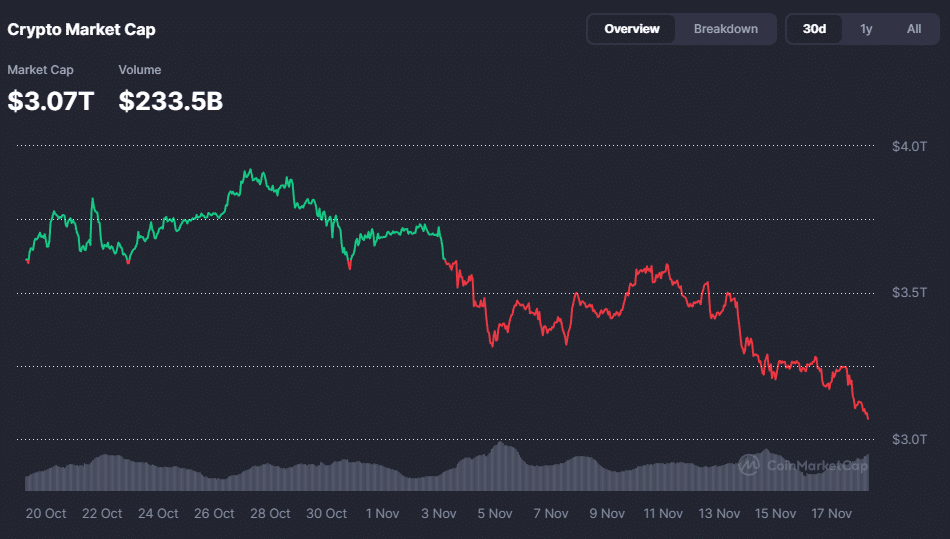

Crypto Market Cap Nears $3 Trillion Amid Widespread Declines

Most of the top ten cryptocurrencies by market capitalization have succumbed to the selling pressure. Cardano (ADA) has lost 6%, while BNB and Solana (SOL) have tumbled more than 3%. Tron (TRX) has fallen 1%, and the meme coin Dogecoin (DOGE) is down 4%.

The overall cryptocurrency market capitalization has plunged 5% to $3.07 trillion, according to CoinMarketCap data.

"Extreme Fear" Prevails as Liquidations Exceed $1 Billion

Amid the market-wide pullback, investor sentiment has shifted towards bearish territory. The Crypto Fear & Greed Index, a widely used indicator of market sentiment, has fallen three points to an "extreme fear" level of 11. This represents a decline of 18 points over the past month.

CoinGlass data indicates that liquidations have surpassed $1.02 billion in the past day, with long positions accounting for $724.2 million of that total.

The ratio of short to long liquidations has increased significantly in the last four hours, with $100.74 million liquidated from long positions compared to only $17.90 million from shorts during this period.

Before the recent sell-off, The Kobeissi Letter informed its extensive following on X that the crypto market had experienced three days with over $1 billion in liquidations within the last 16 days.

Over the last 16 days alone, we have seen 3 days with liquidations exceeding $1 billion.

Daily liquidations of $500+ million have become a normal occurrence.

Particularly in periods of thin volume, this results in violent crypto swings.

And, it goes in both directions.

— The Kobeissi Letter (@KobeissiLetter) November 16, 2025

The firm also noted that daily liquidations exceeding $500 million have become a regular occurrence, attributing these volatile swings to excessive leverage.

Industry Executives Anticipate Market Bottom This Week

Despite the current market downturn, executives from Bitwise and BitMine express optimism that the market could reach a bottom this week.

In a recent interview with CNBC, Bitmine Chairman Tom Lee stated that the crypto market has been under pressure since the liquidation event on October 10th. He also highlighted ongoing uncertainty among traders regarding a potential interest rate cut in December.