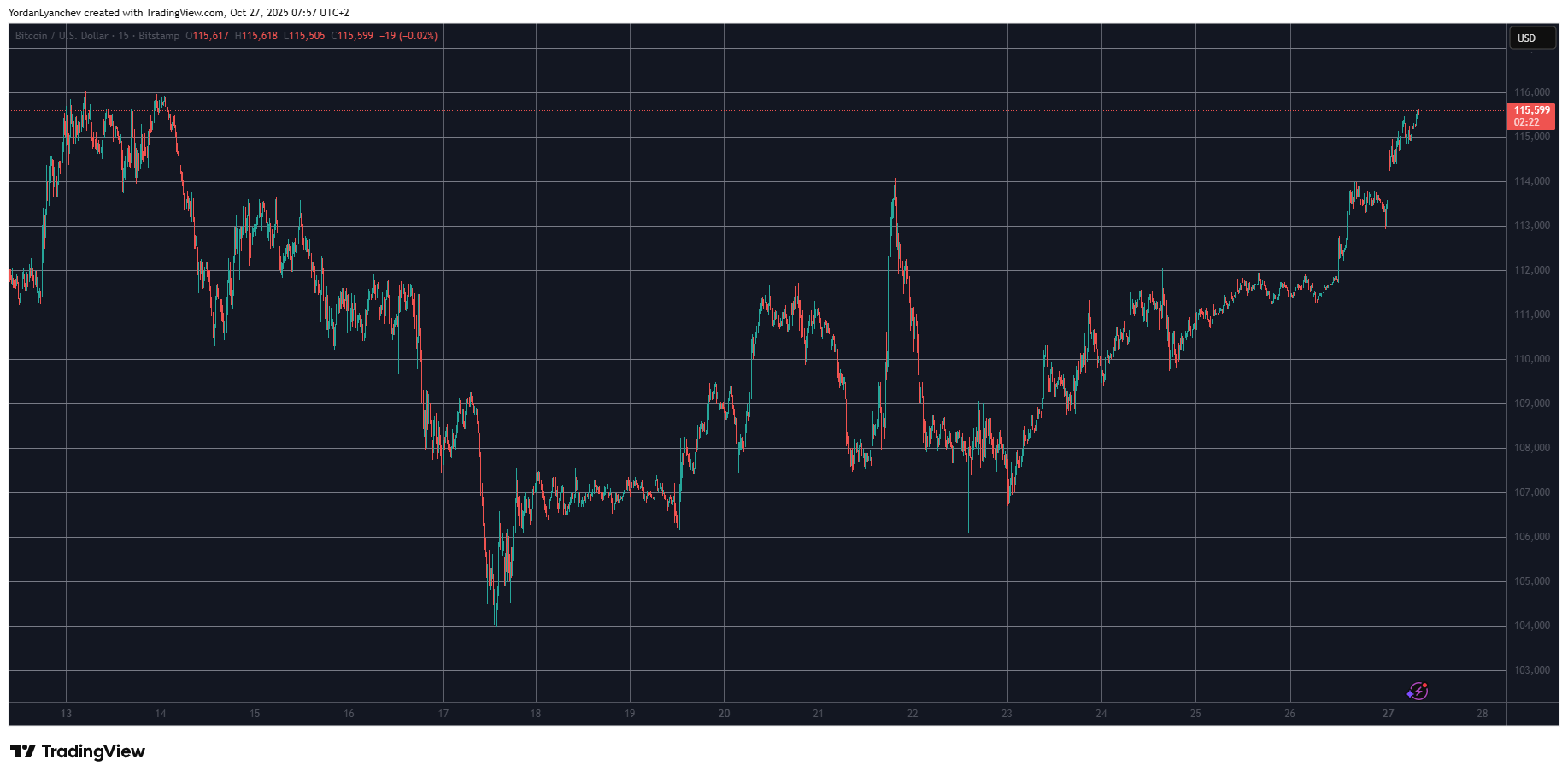

Bitcoin's rally, which began on Sunday following positive news regarding the US-China trade deal, intensified during Monday morning's Asian trading hours, pushing the asset to a two-week peak.

Many altcoins have followed suit impressively, leading to significant losses for over-leveraged short traders.

Previously, the primary cryptocurrency had stabilized on Saturday after a volatile week that saw several moves between $6,000 and $8,000. By the weekend's start, it had returned to its consolidation phase around $111,000, but initial signs of a potential breakout began to emerge.

On Sunday, US Secretary Bessent hinted at a potential deal between the United States and Beijing, which could be announced later this week after the presidents of the two superpowers meet in Europe.

This news had an immediate impact on Bitcoin's price, which surged past $112,000 and $113,000. Its gains paused for several hours, but the bulls returned as Asia began its trading day. Bitcoin resumed its upward movement, reclaiming $114,000 and $115,000. Its peak, for now, stands at $115,600, the highest it has traded since October 14.

Altcoin Performance

Most altcoins have joined Bitcoin's upward trend. Ethereum (ETH) has jumped by over 7% and is now trading above $4,200. Solana (SOL) has reclaimed the $200 mark after a 5.5% daily surge, while Cardano (ADA) is nearing $0.70 following a 4.7% increase. Zcash (ZEC) has seen a significant surge of over 24%, followed by notable gains in PI, IP, ENA, and HYPE.

Impact on Traders

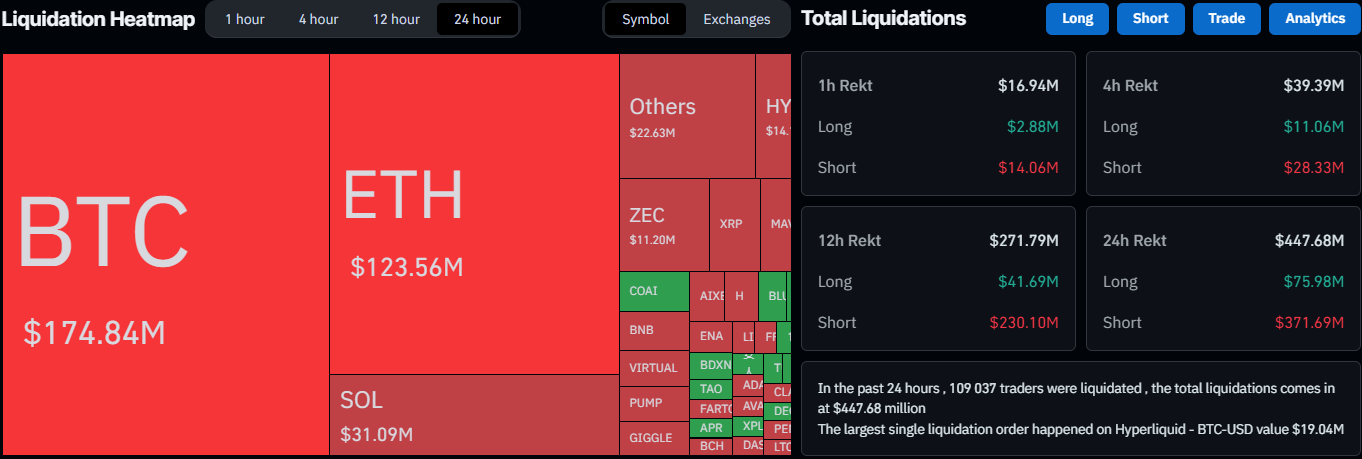

These impressive gains over the past day have had a substantial effect on short futures traders, with more than $370 million in such positions being liquidated daily. According to data from CoinGlass, nearly 110,000 traders have experienced liquidations since yesterday.