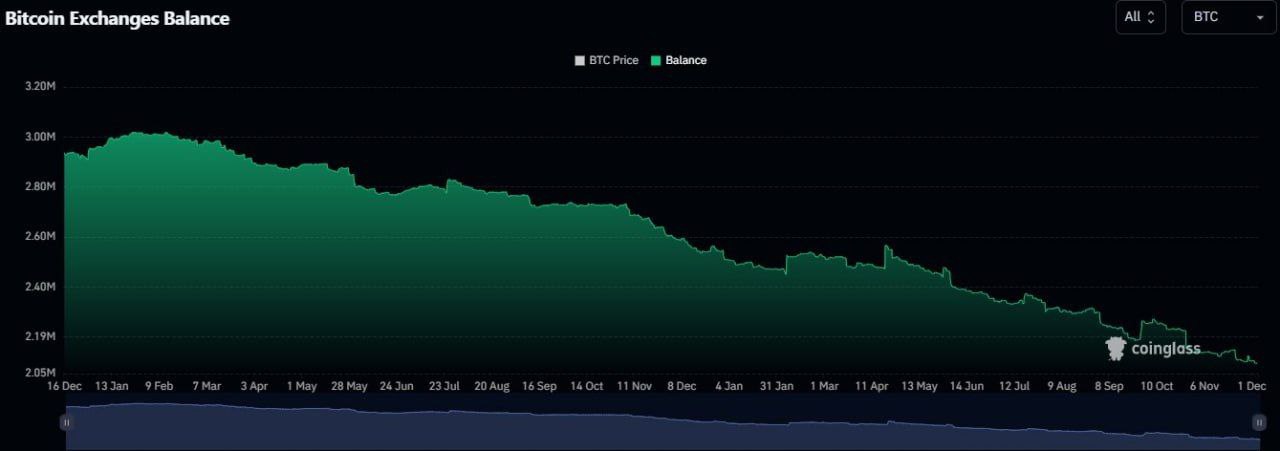

Bitcoin exchange reserves have continued to fall at an accelerated pace, with more than 25,000 BTC leaving centralized exchanges during the past two weeks. The latest data from Coinglass shows that the total on-exchange balance has dropped toward levels not seen in months, extending a multi-month downtrend that has gradually intensified through 2024 and into late 2025.

The chart illustrates a steady decline from early-year balances near 3 million BTC to levels approaching 2.1 million BTC, highlighting persistent withdrawal pressure across the market. Each leg lower reflects growing preference for self-custody, long-term holding, or institutional cold-storage accumulation.

Continuous Outflows Signal Strengthening Long-Term Holder Behavior

The gradual but unbroken downtrend visible on the chart signals a consistent pattern: coins are leaving exchanges faster than they are returning. As the balance moved lower through February, April, August, and into November, the market repeatedly showed the same behavior, with holders withdrawing Bitcoin during both rallies and dips.

The additional 25,000 BTC outflow over just fourteen days reinforces this structural trend. Such rapid withdrawals often appear when investors expect higher future prices, when long-term conviction rises, or when institutional desks build positions away from public trading venues.

Implications of Exchange Outflows for Market Dynamics

Bitcoin’s liquid supply tends to tighten when exchange reserves fall, reducing the amount of BTC immediately available for trading. Historically, extended periods of declining exchange balances have preceded strong market expansions because reduced liquidity amplifies price reactions to renewed demand.

Although the chart does not show short-term price volatility in detail, the long green slope fading downward across the entire year captures a clear message: fewer coins remain in circulation on spot markets. That creates conditions where even moderate inflows of buying interest can generate stronger volatility and potential upside momentum.

Market Entering a Supply Squeeze Phase

With balances now hovering near multi-year lows and the latest two-week outflow accelerating the trend, Bitcoin appears to be entering a deeper supply-squeeze stage. If demand continues to build, whether from retail investors, institutions, or ETF inflows, the reduced exchange liquidity could significantly shape market behavior heading into 2026.

The past two weeks’ withdrawal wave strengthens the broader narrative that long-term holders remain firmly in control, and the circulating supply available for trading continues to shrink at one of the fastest paces of the year.