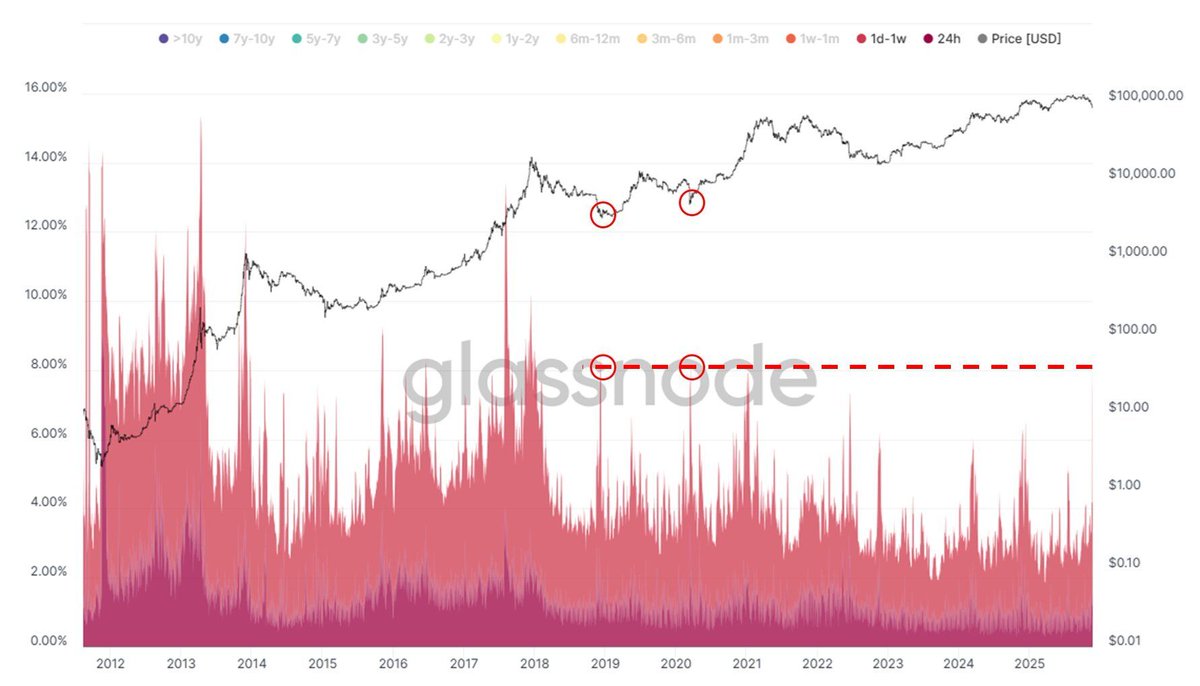

More than 8% of Bitcoin’s total supply has moved in the past week, according to new Glassnode data. This represents an extremely rare network event that has historically appeared only during deep market stress. The last two times this phenomenon occurred were in December 2018, when Bitcoin bottomed near $3,500, and in March 2020, during the COVID crash when the price was around $5,000.

The accompanying chart illustrates a dramatic surge in recently spent outputs, pushing above the red 8% threshold. This threshold has historically served as a marker of capitulation. In both prior instances, this significant movement reflected intense fear, heavy repositioning by long-term holders, and a rapid transfer of supply from weaker to stronger hands. Each of these episodes preceded a major cyclical reversal in the market.

Today’s spike falls into that same historical zone. A large portion of older coins has suddenly moved, implying that the market is undergoing a high-pressure transition phase. This type of phase typically arrives at the end of a selloff rather than at its beginning. The price chart positioned above the activity bars reinforces this pattern, showing how past supply surges aligned with structural turning points in the market.

While this does not guarantee a market bottom, such large-scale movement almost always signals a moment of extreme stress followed by renewed accumulation. Traders are now watching closely to see whether Bitcoin is setting up for another major shift in its trend.