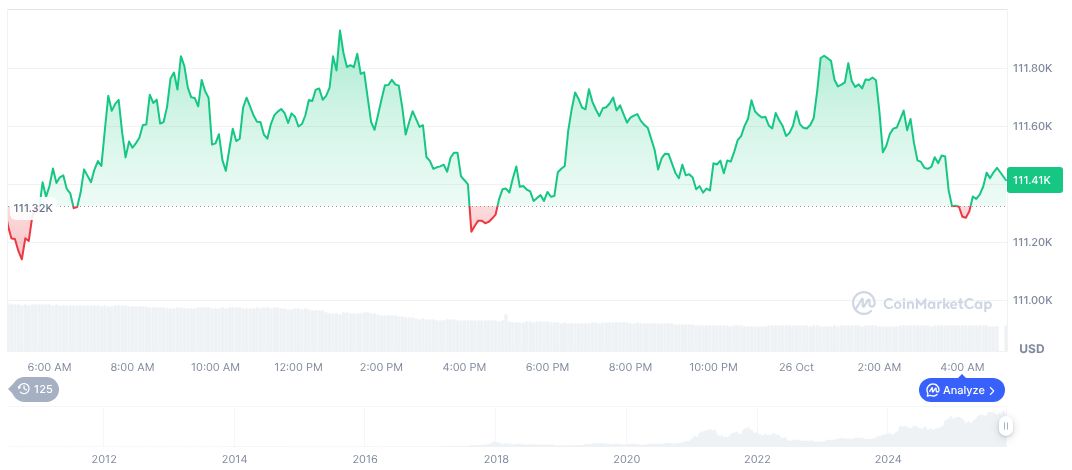

On October 26, Bitcoin (BTC) broke through the $113,000 mark, a significant price threshold. On-chain analyst Aunt Ai reported this development, noting a 100% winning rate and substantial profits for whale investors since October 14.

This surge in BTC price reflects strong institutional involvement and impacts overall market dynamics. The floating profits for Bitcoin and Ethereum long orders have exceeded $7.67 million.

Bitcoin Surge Boosts Institutional Investments

The recent surge in Bitcoin's price to over $113,000 represents a significant milestone in the cryptocurrency market. On-chain analyst Aunt Ai observed this increase, emphasizing the activity of 'whales.' Aunt Ai stated, "Whales have made significant profits since October 14, with total profits exceeding $20.04 million." These major market participants accumulated profits surpassing $20.04 million since mid-October, largely due to substantial buying actions.

Key stakeholders in the industry have reacted cautiously yet positively, acknowledging the bullish behavior demonstrated in recent weeks. Prominent figures, such as Arthur Hayes, have commented on Bitcoin's resilience, suggesting this optimism could set a precedent for future investments and market strategies. This sentiment was further discussed in Bitfinex Alpha reports.

As of October 26, Bitcoin (BTC) holds a substantial market capitalization of $2.26 trillion, commanding a dominant 59.05% share of the cryptocurrency sphere. While its trading volume has seen a decline of 34.11%, it still shows a weekly increase of 5.07%, continuing positive momentum over the past month.

Whale Activity Drives Regulatory Interest

Historical parallels can be drawn to the 2017 Bitcoin rally, where similar whale-driven events led to considerable market volatility and a notable influx of new participants into the crypto space.

Coincu's research team anticipates potential financial flux as whale activity amplifies market liquidity. Ali Charts has discussed significant technical developments for Bitcoin. On the technological front, ongoing advancements and innovations in blockchain technology may prompt regulatory bodies to establish clearer guidelines in response to these developments, aiming to stabilize the volatile environment.

Market implications suggest a heightened institutional interest in digital currencies, which could lead to increased participation and liquidity.