Key Market Developments

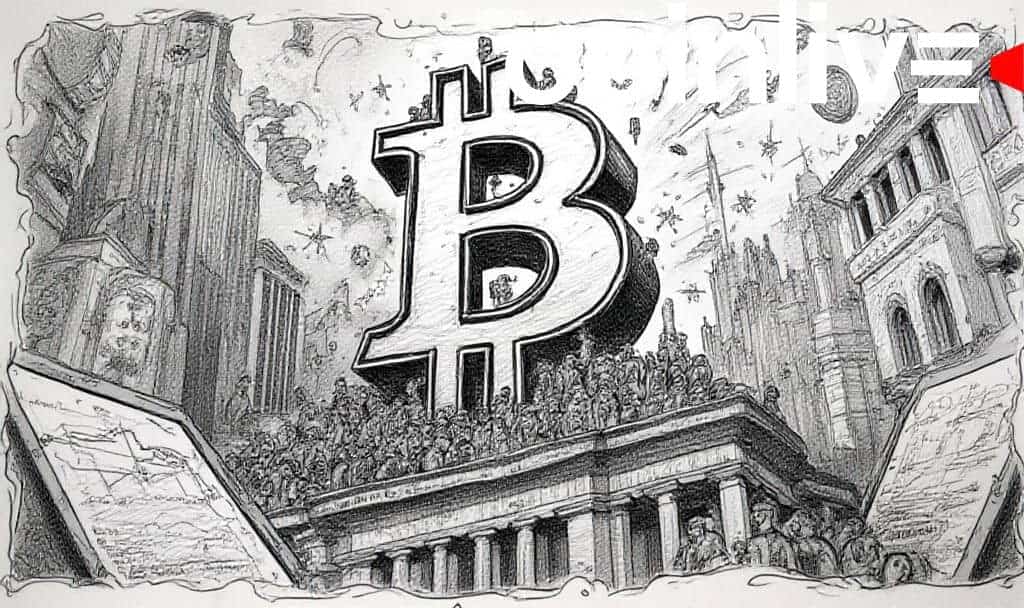

In early 2025, Bitcoin achieved an all-time high of $108,786, fueled by new ETF listings from BlackRock and others, signaling significant institutional adoption.

This milestone showcases the cryptocurrency's growing mainstream credibility and financial potential, drawing increased regulatory interest and reshaping market dynamics.

Bitcoin achieved an all-time high following the approval of a Bitcoin ETF and the recent halving event. This significant milestone is attracting increased investor interest and strategic shifts in corporate asset management.

Institutional Adoption and Regulatory Support

Key figures like Michael Saylor and Larry Fink advocate for Bitcoin's inclusion in corporate balance sheets. Saylor emphasizes Bitcoin as a strategic asset, while regulatory support has pivoted under President Trump's administration. The administration's stance is to "Support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy."

"Support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy."

Market Confidence and Financial Strategy Shifts

The market rally reflects growing confidence in the crypto sector, emphasizing the importance of regulatory clarity. Institutional investors are increasingly considering Bitcoin as a core asset in investment portfolios amid global market fluctuations.

The financial implications are profound, with Bitcoin's status evolving from speculative asset to a stable investment. The impact of regulation fosters trust and supports sustained digital asset growth across various sectors.

Future Outlook and Sector Expansion

Regulatory approvals have led to a marked increase in market participation, stimulating broader sector confidence. Institutional inflows into Bitcoin-related assets are anticipated to grow further, potentially reshaping traditional financial systems.

With historical market cycles as a reference, analysts predict continued sector expansion given the regulatory advancements. Data supports the view that sustained institutional engagement could ensure lasting growth in digital asset markets.