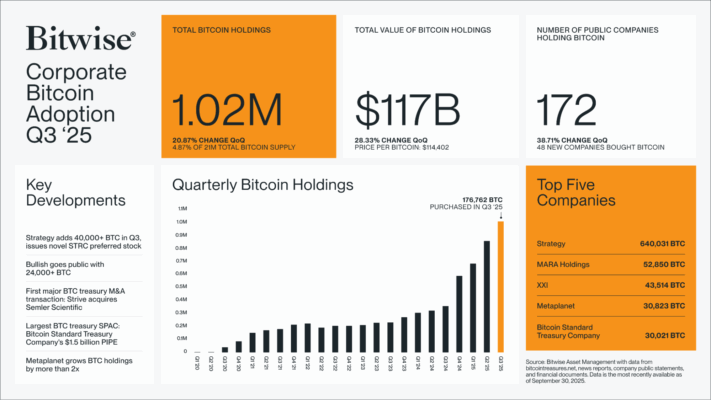

Bitcoin Treasuries Accumulate $117B in Bitcoin

Bitcoin treasuries are in full hoarding mode, surging to $117B in assets after accumulating north of 1.02M $BTC.

The number of public companies holding Bitcoin surged by 40% in the last three months and the accumulation rate only seems to increase.

Bitcoin Treasuries data goes even higher, showing over 1,046,291 $BTC trapped in corporate treasuries, the equivalent of almost $118B.

The bigger picture is even more impressive: 3.91M $BTC spread out between 349 entities, including public and private companies, governments, ETFs, and exchanges. That would be $440B-worth of Bitcoin sitting in treasuries across multiple sectors.

This hoarding trend suggests unbreakable confidence in Bitcoin’s ability to endure even the harshest market conditions, as Friday’s crash just showed.

Why is Everybody Hoarding Bitcoin?

It’s clear that everybody is hoarding Bitcoin at an accelerated rate, but why? The simplest answer is profit.

Bitcoin is more stable in 2025 than it’s ever been, according to the latest volatility chart. Deribit’s 2-year volatility index shows a smooth flatline between 2025’s July and October, indicating lower volatility on average.

While whales can still produce price swings, they are nowhere near as sudden or brutal anymore.

Another important catalyst would be the increasingly pro-crypto regulatory environment, with Trump’s GENIUS Act having the most impact. The Act seeks to protect consumers from crypto-related scams, contributing to a safer ecosystem.

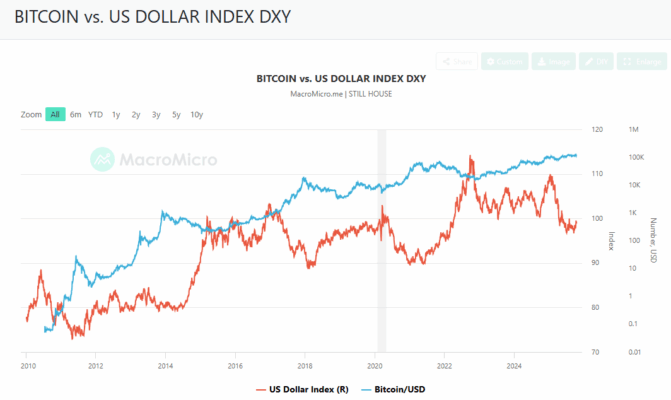

But perhaps the most relevant point is Bitcoin’s role as a hedge against inflation and the depreciating TradFi sector, which is increasingly vulnerable to politics-related changes and real-world events.

A quick glance at MacroMicro’s Bitcoin vs. US Dollar Index chart tells you everything you need to know. Bitcoin’s appreciating trend was almost unaffected by any of the events that caused the US dollar to cave, sometimes to abysmal lows.

We finally see current levels as attractive for increasing spot BTC exposure, as leverage has violently been cleared. Combined with a supportive backdrop, including expansionary policy expectations, high institutional demand, and pending ETF catalysts, the setup favors gradual accumulation.

—Vetle Lunde, head of research at K33.

In this context, between the historically low volatility, its role as hedge against inflation, and increase in profit-centric investments, it’s understandable why the market favors Bitcoin moving into 2026.

How Bitcoin Hyper Turns the Bitcoin Network Faster, Cheaper, and More Scalable

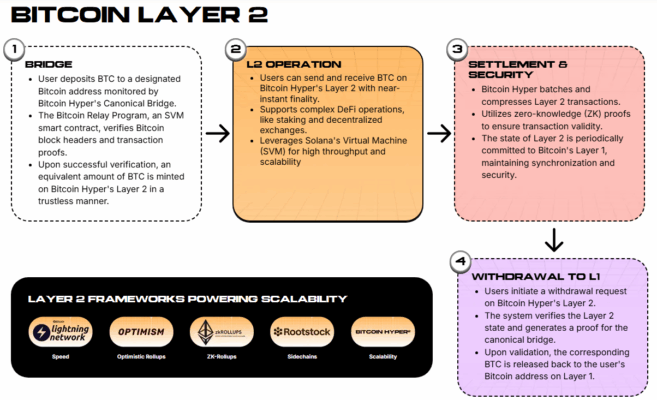

Bitcoin Hyper ($HYPER) is the Layer 2 solution to nearly all of Bitcoin’s problems, starting with the most impactful one: its performance limitation.

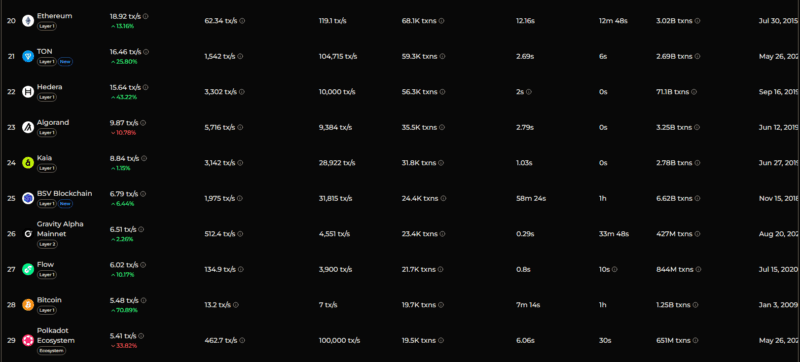

Bitcoin’s performance, currently capped at seven transactions per second (TPS), puts it at the 28th spot among the fastest blockchains by TPS.

For reference, Ethereum is the 18th, while Solana is second with a practical TPS of over 1,000 and a theoretical one of 65,000.

Bitcoin’s low TPS results in high network fees and exceedingly long confirmation times due to the fee-based priority system, which leaves small, low-fee transactions at the end of the queue line.

Hyper hopes to fix the problem with the help of tools like the Solana Virtual Machine (SVM) and the Canonical Bridge. SVM enables the ultra-fast and low-latency execution of smart contracts and DeFi apps, while the Canonical Bridge delivers shorter finality times and improved scalability.

The Canonical Bridge relies on the Bitcoin Relay Program to confirm incoming transactions nearly instantly, after which it mints your Bitcoins into the Hyper layer. You can then either use the wrapped bitcoins on Hyper’s Layer 2 or withdraw them to Bitcoin’s Layer 1 at any point.