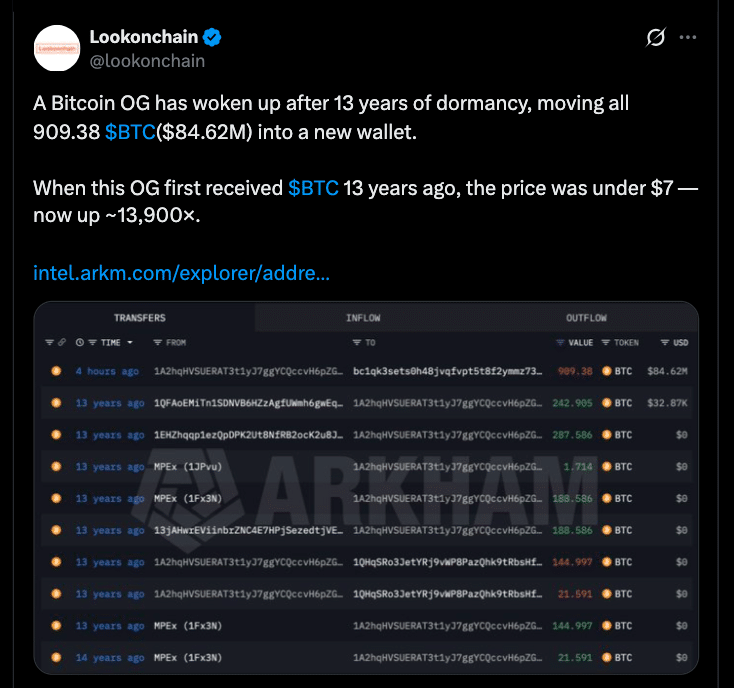

A significant Bitcoin whale has reawakened, with an address dormant for over 13 years moving approximately 909.38 BTC, valued at around $84.6 million, to a new wallet.

Blockchain monitoring services Lookonchain and Whale Alert tracked the movements, revealing that these coins were originally purchased when Bitcoin's value was below $7. This transaction represents an unrealized profit of nearly 13,900 times the original cost.

BTC Stash Moves for the First Time in 13 Years

The Bitcoin whale reactivation involved an address that had been inactive since early 2013, a period when the cryptocurrency traded for a fraction of its current price. On-chain data confirmed that the address, identified in part as “1A2hq…ZGZm,” transferred the entire 909.38 BTC to a new wallet address, bc1qk…sxaeh.

At the time of the original purchase, BTC was trading below $7. The value of the transferred BTC, based on 2026 prices, was estimated at approximately $84 million.

Unlike some previous whale transfers, these coins have not been sent to an exchange. This suggests the owner is consolidating them into a more secure location rather than preparing to sell. Consolidation trades are common among long-term holders who are rebalancing portfolios or securing profits.

Bitcoin Price Action at Time of Reactivation

This Bitcoin whale reactivation occurred while BTC was trading around $92,000, a strong resistance level in early 2026. Following rallies in late 2025, BTC briefly surpassed $97,000 before settling back into the low $90,000s. This hesitation in the market is attributed to geopolitical and macroeconomic developments.

Despite some weak signals across various markets, Bitcoin maintains strength around the $90,000 level. This stability offers hope that significant on-chain movements can be absorbed without substantial price damage.

This resilience marks a change from earlier periods when whale actions frequently triggered volatility, indicating that the markets are maturing with increased liquidity.

Historical Perspective on Whale Reactivation

Movements from long-dormant whale wallets are rare but noteworthy events. In previous market cycles, large transfers from early Bitcoin addresses have served as market indicators.

For instance, wallets that had remained inactive for extended periods moved BTC between 2024 and 2025, drawing significant attention due to their impact on market sentiment and technicals.

In late 2025, Galaxy Digital facilitated the transaction of an 80,000 BTC position from a very early wallet, which temporarily influenced price action and market dynamics.

In contrast, the 909 BTC transferred in this latest Bitcoin whale reactivation, while not as large in volume, is still significant given its 13-year dormancy.

Comparison to Other Whale Movement

Although the moving whale did not directly deposit coins to exchanges, this activity highlights early holders returning to the market after long-term cold storage.

Other large movements have been documented in recent months, including coordinated buys by significant wallets and substantial outflows from exchanges. These patterns suggest that while some older holders are moving coins, the broader whale ecosystem remains bullish and actively participating.

For example, in mid-December 2025, on-chain data revealed that wallets holding between 10,000 and 12,000 BTC collectively acquired over 56,000 BTC. This trend indicates long-term accumulation rather than distribution.

Conclusion

The reactivation of a Bitcoin whale wallet holding 909.38 BTC after over 13 years is a noteworthy event as Bitcoin continues its growth trajectory.

While the coins have not yet been moved to an exchange, the size of the transfer and its long dormancy make it a significant data point for market observers.

Considering Bitcoin's price stability around the $92,000 level and other recent whale accumulation patterns, this event suggests that old hands are active but cautious on the chain.

Glossary

Bitcoin whale awakening: An inactive Bitcoin address holding a substantial amount of coins becomes active after many years.

On-chain analytics: The practice of observing blockchain data to track transactions, wallet activity, and significant transfers.

Dormant wallet: A cryptocurrency wallet that has not made any transactions for a prolonged period, often years.

Consolidation: Moving assets from one wallet to another, often for security or strategic repositioning, and not necessarily indicating a sale.

Exchange supply: The total amount of a cryptocurrency available on exchanges, influencing liquidity and potential sell pressure.

Frequently Asked Questions About Bitcoin Whale Awakening

What defines a Bitcoin whale reactivation?

A Bitcoin whale reactivation occurs when a dormant wallet with a high BTC balance becomes active after many years and sends its coins to another address, potentially due to new strategies or investment decisions.

What was the whale value in this instance?

The whale transferred 909.38 BTC, valued at approximately $84.6 million. This represents a profit of about 13,900 times the initial purchase price when Bitcoin was less than $7 per coin.

Does this mean the whale is selling?

Not necessarily. Since the BTC has not been deposited to exchanges yet, the movement appears to be for consolidation, security, or portfolio construction purposes.

What is the correlation between the price of Bitcoin and reactivation of whales?

Whale reactivations often coincide with elevated valuations of dormant holdings. However, the impact on price varies depending on whether the movement involves sales or transfers. Bitcoin's price has largely maintained near $92,000 during these movements.

Were other whales active recently?

Yes. Extensive blockchain data indicates that large wallets have been acquiring, rather than selling, Bitcoin in recent months.