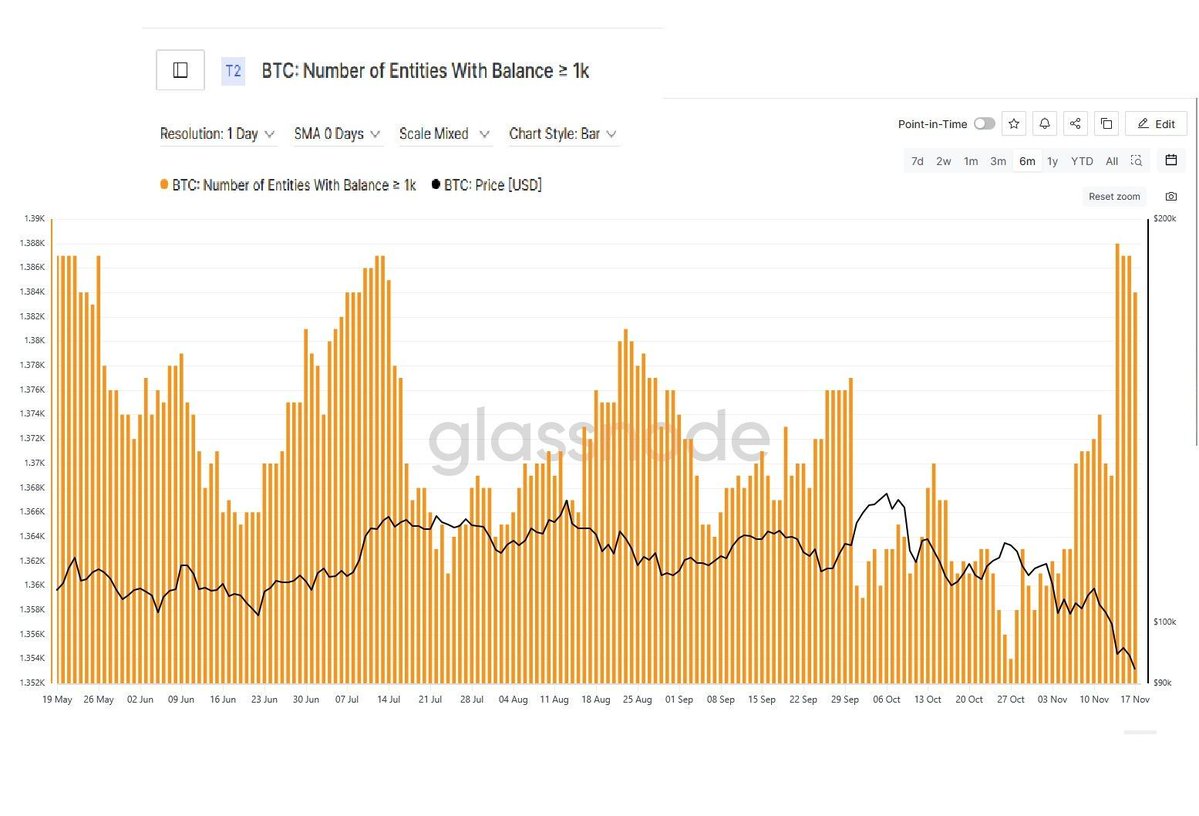

Bitcoin’s latest market downturn is being met with aggressive accumulation from large holders, with new on-chain data showing a sharp rise in wallets holding 1,000 BTC or more. According to Glassnode, the number of these so-called whale wallets jumped 2.2% to 1,384, marking the highest level in four months.

This increase in deep-pocket accumulation stands in stark contrast to the panic-driven selling seen across retail markets over the past week. While smaller investors offload coins into weakness, larger entities are steadily adding to their positions, a pattern historically associated with early-stage bottom formation.

The chart shows a clear upward break in whale holdings even as Bitcoin’s price accelerated downward, falling below the key $90,000 level for the first time since April. Analysts note that such divergence has often signaled long-term confidence among institutional or high-net-worth buyers.

Market commentators describe this behavior as “smart money accumulation,” where experienced players treat market corrections as strategic buying opportunities rather than signals to exit.

Market Implications

With whale ownership rising at the fastest pace in months, traders will be watching to see whether large inflows from this cohort help stabilize Bitcoin’s price in the days ahead.