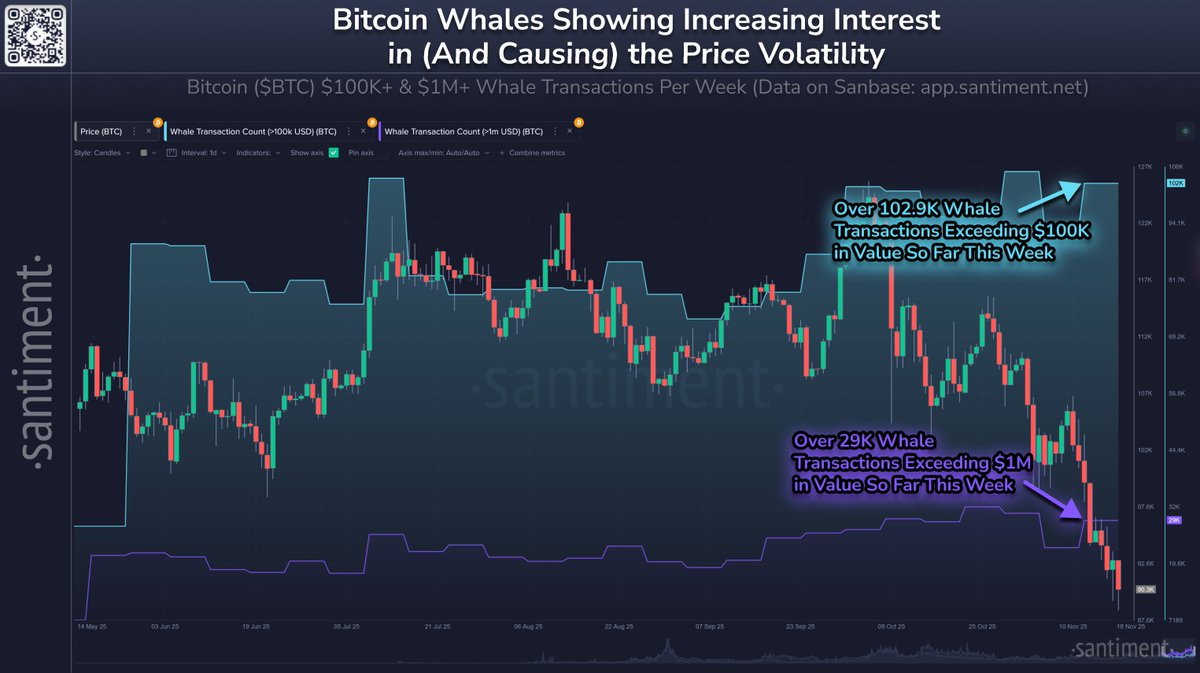

Bitcoin’s price may still be under pressure, but its largest investors are waking up fast. New Santiment data shows a sharp spike in whale activity this week, signaling that the past six weeks of heavy selling could be transitioning into a new phase of accumulation. With volatility rising and liquidity thinning across major exchanges, whale behavior is becoming one of the most important indicators to watch.

Whales Ramp Up Activity as Bitcoin Struggles

According to Santiment, whale wallets have steadily increased their activity as Bitcoin’s price extended its six-week decline. Rather than stepping back during the drawdown, large holders appear to be re-entering the market, a pattern historically linked to bottom-formation periods.

More than 102.9K transactions above $100,000 have been recorded so far this week. Even more notable: 29,000+ transfers above $1 million, indicating that institutional desks, funds, and long-term high-net-worth holders are reshuffling positions despite the market uncertainty.

This level of activity has not been seen since earlier in the year, when Bitcoin was preparing for major directional moves.

Why This Week Stands Out

Santiment analysts highlight that the combination of elevated whale activity and declining prices suggests whales may be shifting from distribution back toward accumulation. If this trend continues through the weekend, the platform expects this to be the most active whale week of 2025.

Historically, Bitcoin tends to make sharp pivot moves when whale transactions cluster heavily after extended downturns. Market bottoms often occur during periods of aggressive whale re-entry, especially when retail sentiment is at its lowest.

What Comes Next for Bitcoin

While whale activity alone doesn’t guarantee an immediate reversal, it does indicate rising volatility ahead. Traders should watch for:

- •Stabilization in whale flows, shifting from high outflows to balanced inflows.

- •A slowdown in exchange inflow spikes, which typically accompany sell-offs.

- •Price reactions around key support zones, especially near psychological levels such as $90K and $85K.

If whales continue accumulating at this pace, Bitcoin may soon see the conditions for a meaningful bounce, especially if macro liquidity begins to stabilize.

For now, the data is clear: the biggest players in the market are active again, and history shows that when they move, the market often follows.