Two newly-activated whale wallets have initiated significant leveraged trades in opposing directions, creating a dynamic "Bitcoin Whales Showdown" that is capturing trader attention. With over $64 million at risk, this battle between long and short positions is influencing short-term market sentiment and setting the stage for potential volatility.

Whale Wallets Enter High-Leverage Long and Short Positions

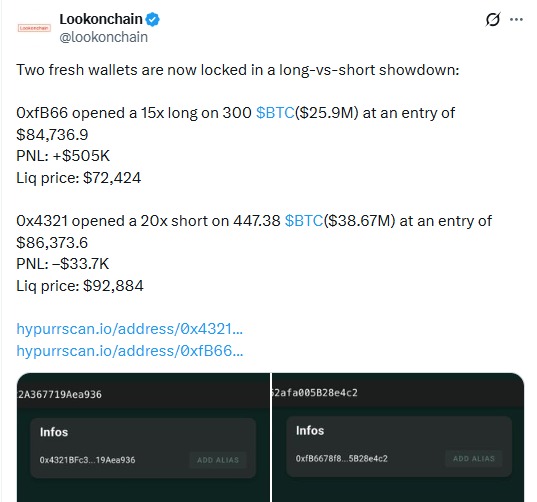

On-chain data reveals that two new wallets have made aggressive positions within hours of each other. One wallet initiated a 15x long position on 300 BTC, valued at nearly $25.9 million, with an entry price of $84,736.9. This position is currently showing a profit of approximately $505,000 and has a liquidation level at $72,424, indicating it is stable as long as Bitcoin remains near current price levels.

Conversely, another wallet established a 20x short position on 447.38 BTC, valued at over $38.6 million, with an entry price of $86,373.6. This trade is currently experiencing a loss of about $33,700, and its liquidation price is higher at $92,884, making the short position vulnerable to further price increases.

This direct confrontation has become a focal point in the market. A rising price benefits the long whale while pressuring the short whale; conversely, a sharp pullback would reverse this dynamic. Consequently, traders are closely monitoring this Bitcoin Whales Showdown, which has seen a 125% increase in derivatives open interest over the past month.

Bitcoin Tries a Bounce After Heavy Selling

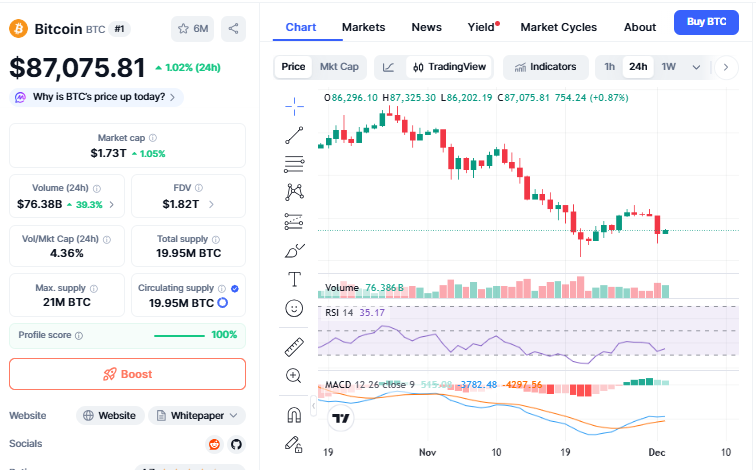

Following the activity of these whale wallets, the Bitcoin price has seen a modest recovery, moving to $87,075, an increase of about 1.02% in the last 24 hours. While the daily chart indicates a mild upturn, the broader market sentiment still reflects notable weakness, with 30-day and 90-day declines around 20.95% and 21.71%, respectively.

A contributing factor to the current rebound is Bitcoin's oversold condition. The seven-day Relative Strength Index (RSI) has fallen to 35.17, creating an opportunity for a potential short-term recovery. Historically, RSI readings below 40 have frequently preceded bounce attempts, and this instance appears to be no different.

Bitcoin has also managed to maintain its position above the 100-week Simple Moving Average (SMA) at $84,000, a support level that has historically absorbed losses during previous market downturns.

Momentum indicators further support a bullish outlook. The Moving Average Convergence Divergence (MACD) histogram has turned positive, reaching +754.24, which could signal a reduction in selling pressure. Traders are now observing $88,000 as the next significant area of interest, aligning with the 50% Fibonacci retracement level from the recent price decline.

Macro Environment Adds Caution to Market Sentiment

Despite the current short-term relief, global economic conditions continue to present uncertainty. U.S. 10-year Treasury yields remain above 4%, which limits Bitcoin's effectiveness as a hedge against the U.S. dollar. Additionally, rising bond yields in Japan and ongoing concerns about the Bank of Japan's tightening policies are exerting pressure on risk assets.

Furthermore, U.S. Bitcoin Exchange-Traded Funds (ETFs) experienced outflows totaling $3.4 billion in November, which has diminished the impact of technical support levels.

Bitcoin Price Prediction

If the current bullish momentum persists, Bitcoin may advance towards the $88,000-$89,200 range, potentially driven by the long whale's position. However, if macroeconomic pressures re-emerge, the price could retest the $85,000 zone. The outcome of the Bitcoin Whales Showdown and the short whale's ability to withstand further price increases will be critical factors.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please conduct your own research before investing in cryptocurrencies.