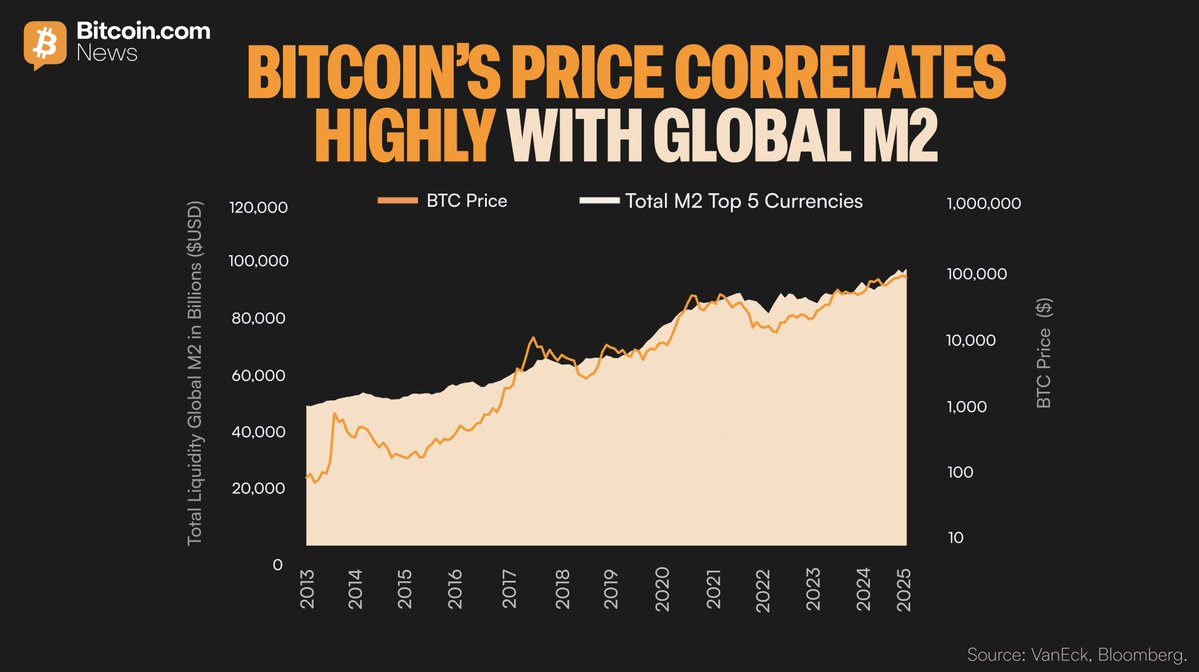

Bitcoin's long-term price cycles continue to track global liquidity conditions, according to new research highlighted by VanEck. The asset manager reports that more than 50% of Bitcoin’s price movements since 2014 are directly tied to global M2 liquidity trends, a measure of broad money supply across major economies.

The data shows that Bitcoin behaves less like an isolated “digital commodity” and more like a macro-sensitive asset that responds to changes in global monetary expansion and contraction.

Euro-Area Money Supply Plays the Biggest Role

While global M2 aggregates include the U.S., China, Japan, the U.K., and the Eurozone, VanEck’s analysis points to one unexpected driver:

Euro-area money supply has been the largest contributor to Bitcoin’s liquidity correlation.

This suggests that shifts in European monetary policy, especially during periods of easing or tightening by the European Central Bank, may exert more influence on Bitcoin’s long-term behavior than many investors assume.

Why Liquidity Matters for Bitcoin

M2 liquidity represents the amount of money circulating in the financial system. When money supply expands, investors typically take on more risk, benefiting assets like Bitcoin. When liquidity contracts, risk appetite falls, often leading to drawdowns.

VanEck’s findings reinforce a familiar pattern:

- •Liquidity up → Bitcoin strengthens

- •Liquidity down → Bitcoin weakens

The chart shared by Bitcoin.com News shows Bitcoin’s price climbing in near-parallel with global M2 growth over the past decade, especially during stimulus periods such as 2020–2021.

What This Means for Investors

Bitcoin’s strong correlation with global liquidity cycles highlights an important dynamic: Macro forces, not just crypto-specific news, drive the majority of its market behavior.

For long-term investors, monitoring central bank policies, money supply trends, and global financial conditions may be just as critical as watching on-chain indicators or ETF flows.

With major economies shifting between tightening and easing cycles heading into 2025, liquidity conditions could again dictate the direction of Bitcoin’s next major move.