Bitcoin’s market cycle remains one of the most debated frameworks in crypto. For years, investors anchored their expectations to the familiar four-year halving rhythm.

But according to analyst Michaël van de Poppe, the current environment shows that while Bitcoin still moves in cycles, those cycles no longer rhyme with fixed timelines. Today’s dynamics are shaped by new forces, institutional flows, macro liquidity, and global economic cycles, that are far more influential than the traditional supply-driven model.

Why the Old Four-Year Model No Longer Fits

Van de Poppe argues that both bulls and bears are partially correct, and partially wrong. Bears insist the four-year cycle dictates a deeper correction, while bulls assume the pattern guarantees another explosive rally. But Bitcoin just experienced a standard 35% pullback, not a structural breakdown. As Raoul Pal once noted, markets can drop sharply without ending the broader cycle.

The halving remains part of Bitcoin’s fabric, but the price’s relationship to the halving is weakening. ETF flows, institutional positioning, global liquidity, fiscal conditions, and even currency dynamics now exert greater influence than simple supply reduction.

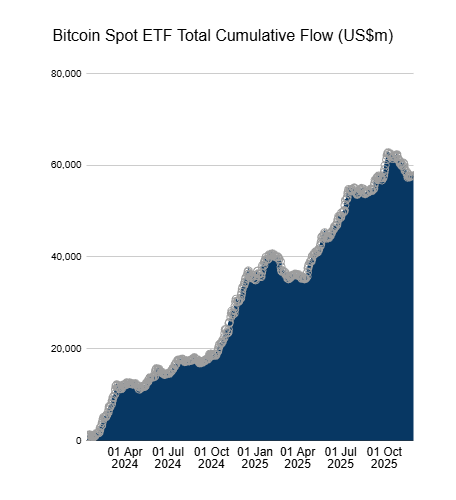

The ETF Effect Has Completely Redrawn the Floor

The biggest shift this cycle: spot Bitcoin ETFs.

Van de Poppe highlights that nearly 60,000 BTC in demand came directly from ETF issuers acquiring spot Bitcoin as collateral. This institutional buy pressure pushed Bitcoin from the $30,000–$40,000 region toward $80,000–$120,000, effectively establishing a new floor more than 100% above the previous one.

In other words, the cycle changed because the buyer base changed.

Yet despite this massive structural shift, macro conditions have not improved. QT persists, interest rates remain high, and global headwinds haven’t vanished. The ETF opened a new door, but the underlying market structure and economic backdrop continue to exert pressure.

Gold Strength Signals Bitcoin’s Macro Position

One of the most important charts, van de Poppe says, is Gold.

Bitcoin thrives during strong economic growth, rising PMI, and risk-on cycles. It lags when gold accelerates, a classic sign of uncertainty. The relationship is consistent across past cycles.

Today’s backdrop mirrors those earlier periods when gold strength suppressed risk assets. And without the ETF-driven bid, Bitcoin would likely be celebrating a breakout above $40,000, not debating whether a correction to $80,000 is catastrophic.

The Cycle May Now Be Longer – Like Pre-2008 Liquidity Cycles

From 2013 through 2021, Bitcoin aligned with four-year liquidity waves following the 2008 financial crisis. But before 2008, liquidity cycles typically spanned 8–10 years.

Van de Poppe suggests the current Bitcoin cycle may now resemble those longer macro cycles, meaning 2025 may be the middle, not the end, of a multi-year bull phase.

A maturing asset class often delivers lower annual volatility, smaller drawdowns, and less dramatic four-year rotations. Bitcoin may be entering that stage now.

The CNY/USD–ETH/BTC Signal Points To Mid-Cycle Positioning

A rarely discussed dataset strengthens this argument: the correlation between Chinese Yuan strength and ETH/BTC bottoms.

Historically, when the Yuan bottoms:

- •ETH/BTC bottoms

- •macro conditions improve

- •risk-on cycles begin

This occurred in 2016, 2019, and again in April 2025, strongly suggesting Bitcoin is positioned similarly to the early-mid phases of previous cycles.

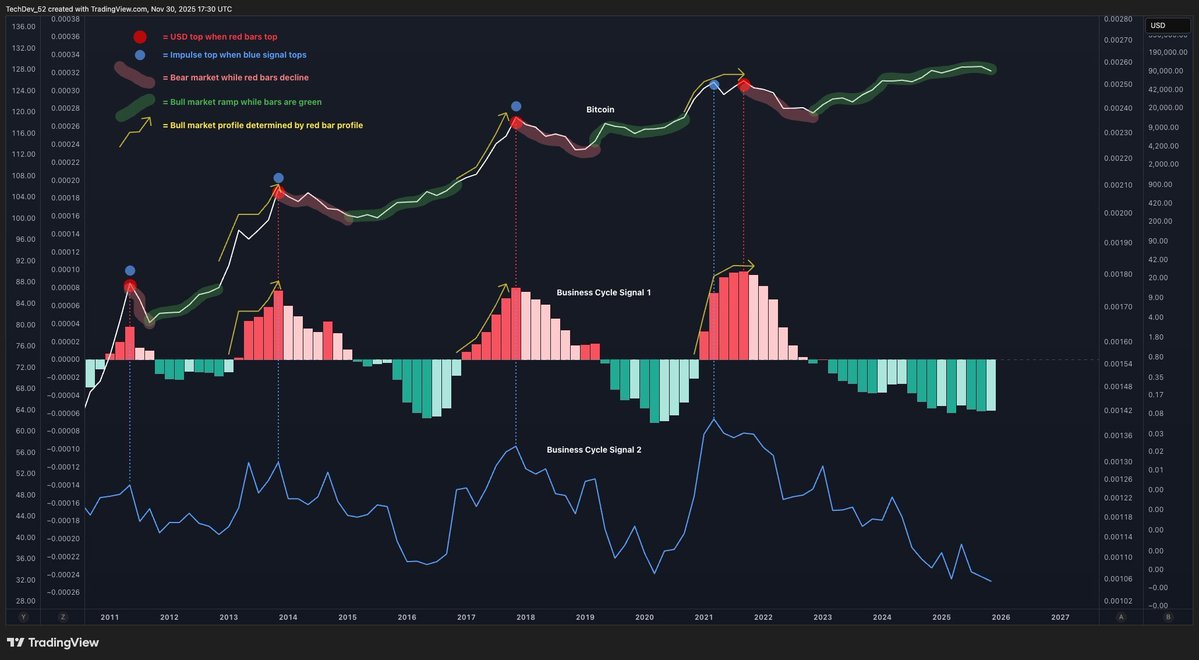

Business Cycle Data Points To “Peak Bear” Even With Bitcoin at $90K

Economic indicators also align with mid-cycle positioning:

- •PMI is improving

- •the Federal Reserve has begun overnight repo injections

- •the business cycle is climbing out of its trough

- •liquidity injections are expected in 2026–2027

Historically, those conditions have produced massive Bitcoin expansions — exactly as seen in 2016 and 2019.

It may seem surreal, van de Poppe notes, that we are “still in peak bear” while Bitcoin trades near $90,000, but structurally, the charts support that conclusion.

The Forward Outlook: A Much Bigger Cycle Than Expected

Looking ahead to 2026–2027, van de Poppe believes the macro setup strongly contradicts any bearish time-based assumption of a looming collapse.

Recent developments strengthen that case:

- •Bank of America is opening the door for clients to allocate 1–4% into spot BTC ETFs

- •the Clarity Act will enable institutional on-chain participation

- •the FED is preparing rate cuts and liquidity injections, historically the strongest fuel for Bitcoin bull markets

These are not conditions associated with a cycle top; they resemble the run-up to 2016–2017 and 2019–2020.

The Bigger Picture: Bitcoin’s Purpose Remains the Anchor

Ultimately, van de Poppe emphasizes that Bitcoin’s core value is not tied to its four-year performance pattern. The purpose of Bitcoin is long-term:

- •transparent

- •sound

- •predictable

- •resistant to inflation

- •a stable foundation for future financial planning

As inflation rises and traditional savings lose value, more capital is forced into risk just to maintain purchasing power. Bitcoin offers an alternative path, one grounded in scarcity and monetary certainty.

Conclusion

The traditional four-year halving cycle is no longer the prime driver of Bitcoin’s behavior. This cycle is shaped by institutional flows, global liquidity, currency dynamics, gold trends, and business-cycle conditions. And all those indicators suggest the same conclusion:

Bitcoin is not near the end of its cycle; it’s in the middle of a much larger one.

And the biggest wave of adoption, institutional and retail, has yet to arrive.