Market Correction and Short-Term Holder Behavior

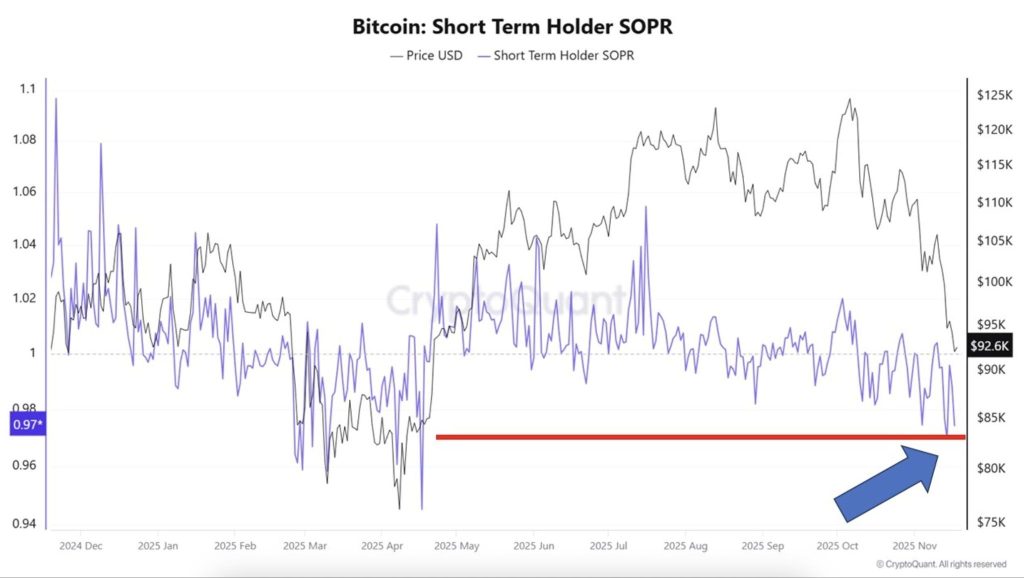

Bitcoin’s price has been experiencing significant volatility, sparking concerns over the future of its four-year market cycle. On-chain data shows that short-term holders (STHs) are capitulating, as evidenced by the Short-Term Holder Spent Output Profit Ratio (STH-SOPR) falling below 1.0. This indicates that many traders are selling at a loss, a behaviour typically associated with panic and fear. Historically, such periods of capitulation mark the later stages of a market correction rather than the beginning.

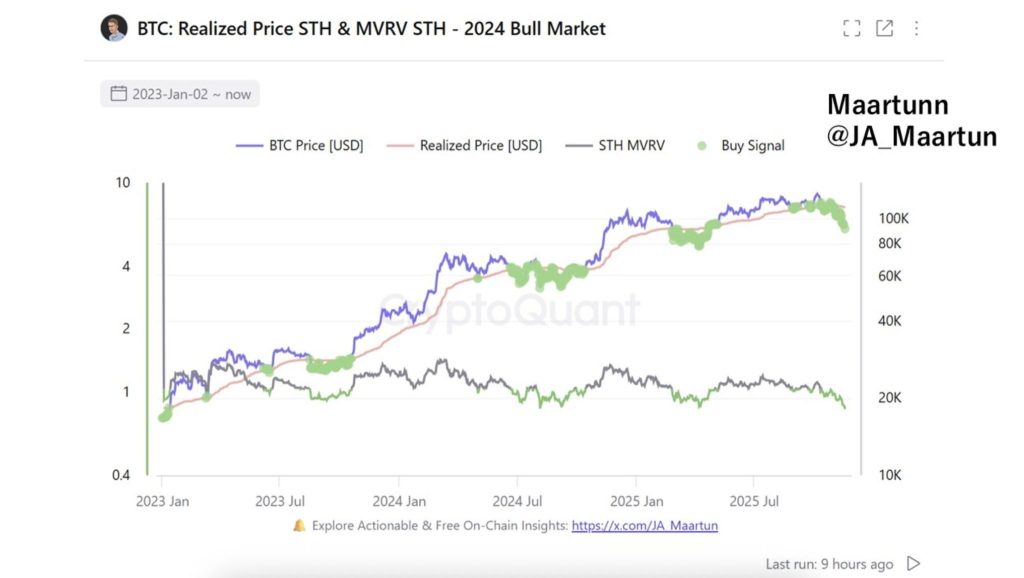

Moreover, the Short-Term Holder Market Value to Realized Value (STH-MVRV) is also showing distress, dropping below 1.0, which suggests that the most recent buyers are underwater. This scenario points to a market under heavy selling pressure.

As a result, the market is undergoing a "cleansing" phase, where weak hands are gradually exhausted, a process commonly seen in the final stages of a correction. Additionally, the transfer of 65,200 BTC to exchanges at a loss confirms that fear is not just theoretical, but actively driving market behaviour. Although volatility is likely to persist, this pattern historically signals that the conditions necessary for a market turnaround are beginning to align.

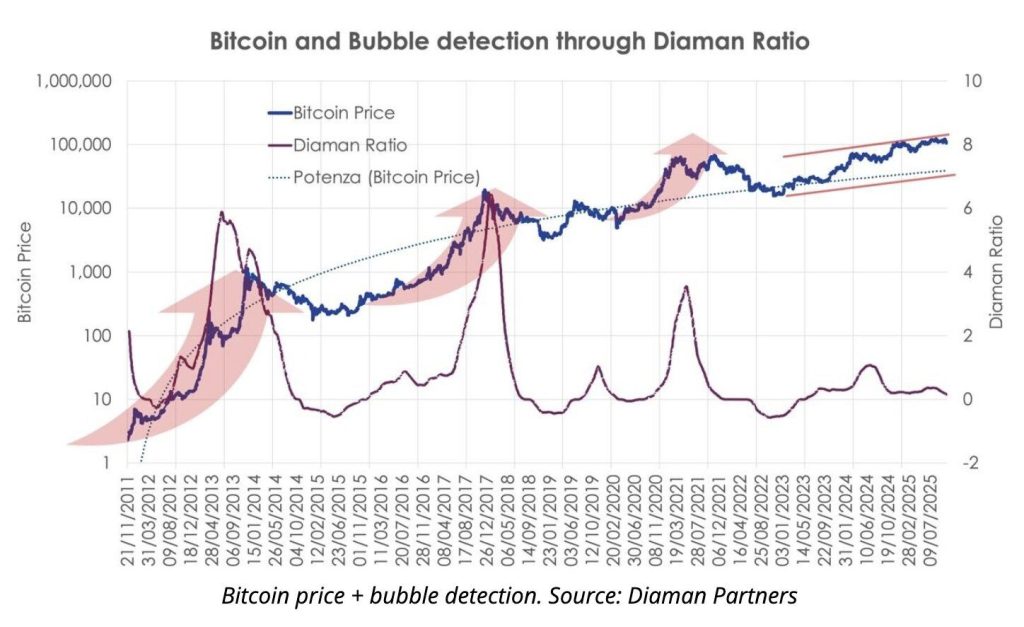

Analysts Divided on the Four-Year Cycle's Validity

The ongoing market pullback has brought into question the validity of Bitcoin’s four-year cycle. Analysts are divided, with some arguing that the current downturn is merely a part of the cycle, while others suggest that the model may no longer apply as the market matures.

Some experts believe this could be the largest pullback of the current bull market cycle, based on the extent of recent price drops. Meanwhile, on-chain data shows that small retail wallets are dumping Bitcoin, which some analysts view as a positive signal for a rebound. As small holders panic-sell, prices tend to move in the opposite direction, hinting at a potential recovery. The increasing number of small wallets liquidating their positions could signal that the worst of the market correction is nearing its end.

However, with continued uncertainty, many remain cautious about the future direction of Bitcoin's price. While the long-term outlook for Bitcoin remains optimistic, the debate over whether the four-year cycle is still relevant in today’s market continues.